Slovakia: Strong economic start to 2024

-

Strong start for Slovak economy in 2024.

-

ECB decides on first interest rate cut.

-

More than 70% of financing needs are covered.

-

Weaker dollar expected.

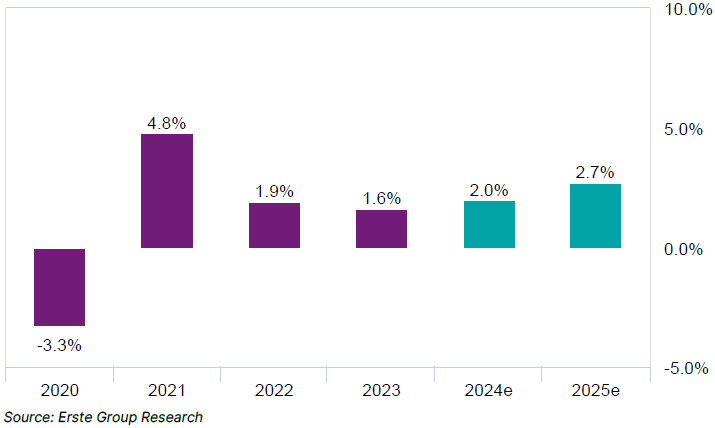

The Slovak economy experienced a strong start to 2024, with y/y GDP growth at 2.7%. The main drivers were household consumption, benefiting from rapid income growth and decreasing inflation, and government consumption. Investment activity showed a relatively weak performance in 1Q24. We anticipate that GDP growth will continue for the remainder of the year, driven primarily by ongoing robust household consumption and increased investment activity, due to NextGen funds. Towards the end of the year, we also expect some boost from foreign demand. Economic growth for this year could thus reach 2%, with slight upside risks.

The inflation rate dropped to two percent, but with the base effect fading out, it will rise again slightly in the coming months. The tight labor market is pushing up wage growth, which creates pressure for price increases. Inflation is expected to average around three percent this year. The Ministry of Finance announced fiscal consolidation in the amount of one percent of GDP annually. However, specific measures are yet to be revealed. For now, it seems that rating agencies have placed their trust in the credibility of this commitment. PM Robert Fico is gradually recovering after an assassination attempt.

GDP (real,y/y)

Author

Erste Bank Research Team

Erste Bank

At Erste Group we greatly value transparency. Our Investor Relations team strives to provide comprehensive information with frequent updates to ensure that the details on these pages are always current.