Stop and go – Rate hike pause remains conditional

EUR/USD holds as ECB to keep smaller hikes

The euro rallies as high price growth momentum warrants more tightening. The ECB projects an extended disinflation process as price pressures turned around after double-digit readings last year. Still, Chief economist Philip Lane expects price momentum fuelled by wage growth to hold inflation above the bank's 2% target for years. Other officials have echoed this viewpoint and led the market to believe that the ECB might carry on with 25 bp increments into the summer. This would allow the central bank to monitor economic data and tweak its policy accordingly. 1.1250 is the next resistance and 1.0800 a fresh support.

USD/CAD rebounds as Canada inflation in focus

The Canadian dollar clawed back losses after the Bank of Canada left the door open for more rate hikes. BoC Governor Tiff Macklem has stated that the central bank is ready to hike rates further if inflation remains persistently above the 2% target, which means that this week’s CPI will carry considerable weight. The March reading eased to 4.3%, nearly half of its peak of 8.1% last year, and if the downtrend goes on, the BoC could stay on the sidelines. However, an upside surprise would raise bets for more policy tightening, boosting demand for the loonie and sending the pair below 1.3300. 1.3650 is the closest resistance.

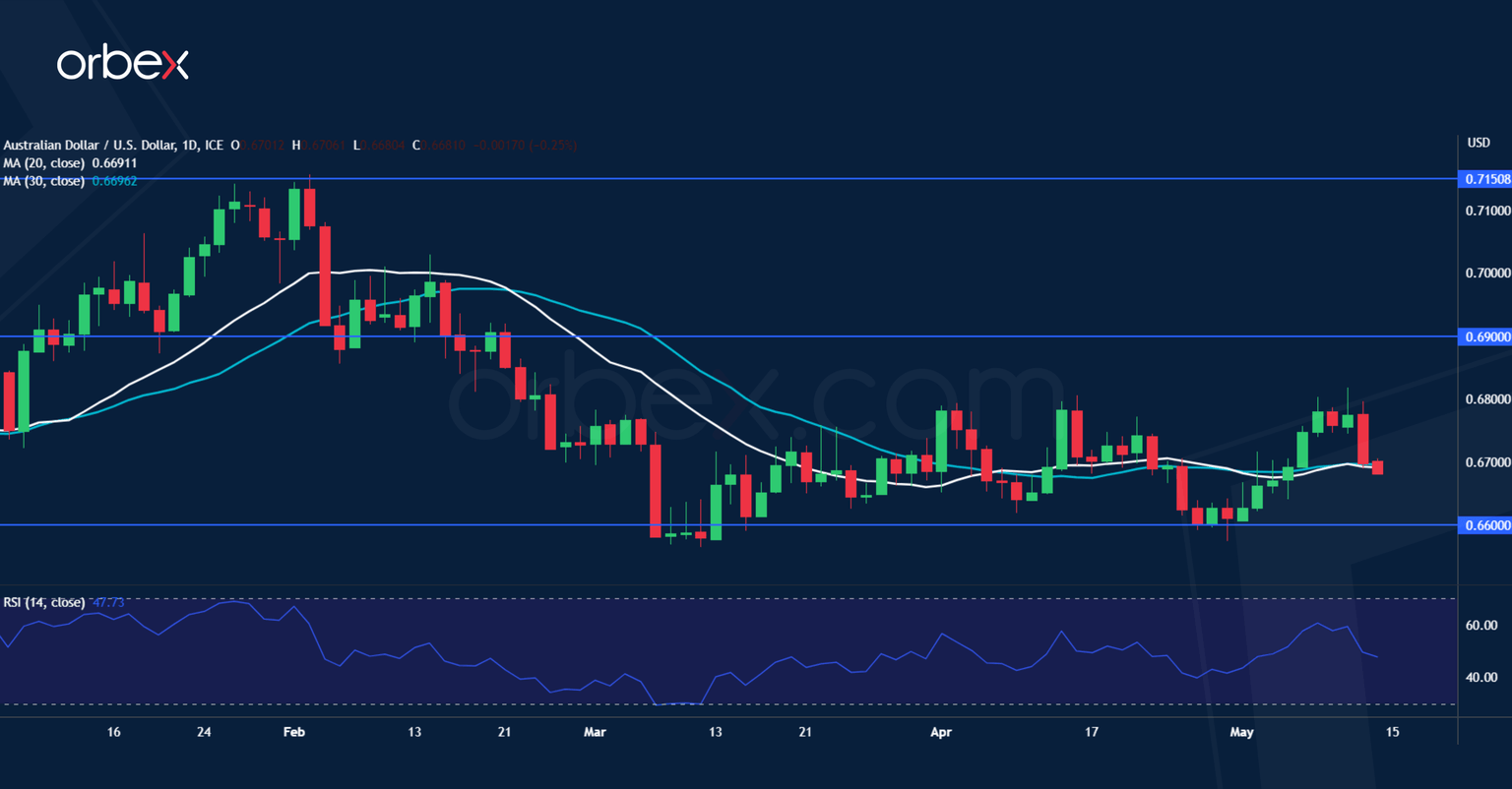

AUD/USD steadies as inflation may persist

The Australian dollar inches higher as the RBA may stay hawkish amid persistently high inflation. In its 2023 federal budget announcement, the government has pledged $10 billion as a cost-of-living relief. But with inflation still near its 30-year high of 7.0%, this feels like a double edged sword. The market frets that such a thinly veiled fiscal easing measure would be at odds with the central bank’s monetary tightening, putting more pressure on the latter to lift rates further. Assertive RBA meeting minutes after a surprise hike and resilient jobs data may offer support to the aussie. 0.6900 is a key resistance and 0.6600 the first support.

S&P 500 steadies as recession worries ease

The S&P 500 grinds higher as the US economy might achieve the ‘softlanding’. A string of weaker data could be a blessing for the risk asset class. The Fed wants to see the economy cooling down and slower consumer price growth and higher jobless benefit claims would go their way. However, the rebound might not be a smooth path. Investors may refrain from going overly zealous due to lingering concerns about the health of the regional banking industry. Meanwhile, the US debt standoff is unlikely to result in a default but may keep the price action choppy. 4300 is a major ceiling ahead and 4000 the closest support.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.