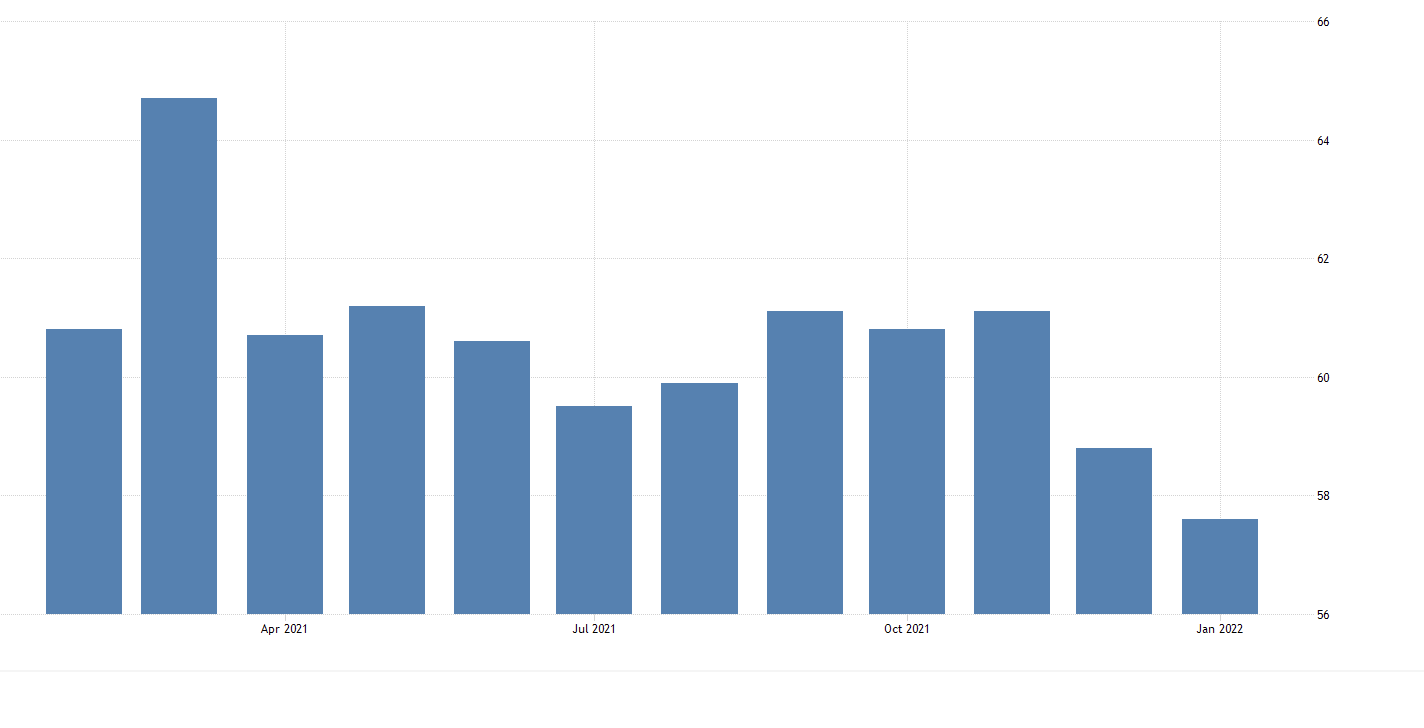

USA Factory PMI decline matters. Hints at something deeper.

US factory activity has been steadily slipping. It is still positive on the PMI, but what people may have missed is that it has now moved back below pre-pandemic levels again. All is not well in the manufacturing sector in the US.

We all know this is due to worker shortages and supply chain disruption. Which is why everyone keeps saying just look across the 'valley'.

However, I think we should consider that the pandemic is not just a two year economic aberration, but a long term historic level reset of how people go about their lives, earn a living and support and keep safe their families.

While the obvious reasons persist, there is also the case that more lasting damage could be taking place in the US manufacturing sector. And elsewhere in the world.

The USA long ago moved away from manufacturing toward service industries, and then re-discovered that in the end someone has to make the stuff we use in everyday life. If the balance between real production, goods and services we need for our daily lives, and consumer excess/indulgence moves too far toward the latter, then serious problems may arise. The extreme situation would see a collapse of society as everyone attempted to sell luxury non-essential goods and services only. The true wealth security of a nation will always depend on how efficiently it provides the necessary basics for the entire population.

If a society becomes too focussed on 'excessities', it may suddenly at some point find itself falling short of 'necessities'. Cute but true.

While the market enjoyed a tremendous rally, our Monday expectation being well surpassed in degree and duration through Tuesday, the economic data continued to point downward. This again highlights the on-going stretching of the elastic band between stock markets and Main Street economic activity. Of course, that did not stop the market previously, and we have to consider we may be returning to a 'just keep buying' regardless of what is going on in the world style of market.

My favoured outlook from here for US stocks is a further 1-2 weeks consolidation around current levels before resuming what could prove to be a very significant correction phase.

Right now, the rally is about any risk of Ukraine conflict having been re-scheduled until after the Olympics. Perhaps even until March, and that is simply too long a time frame to consider for most short term traders and for funds that are concerned they could miss an important low. Hence buying and consolidation are likely to dominate for the moment.

Suggest keep a watchful eye for any signs of this current buying becoming spent?

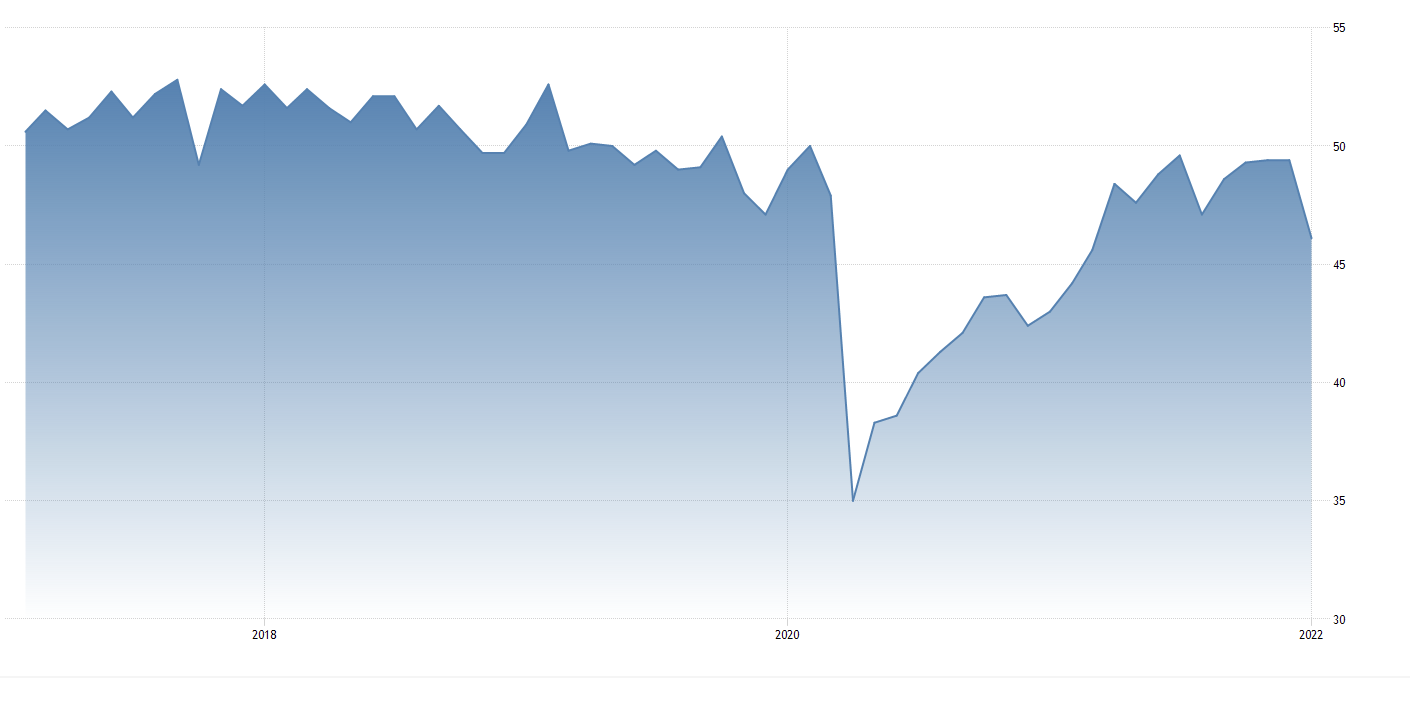

Mexico Manufacturing remains in contraction.

Yesterday's Video re RBA.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD trades sideways above 1.0850

EUR/USD is keeping its range above 1.0850 in the European session on Monday. The pair stays supported due to a subdued US Dollar and risk flows, as traders bide time heading into a critical week ahead.

GBP/USD holds range below 1.2900 amid a quiet start to Big week

GBP/USD is moving back and forth in a familiar range below 1.2900 in European trading on Monday. A softer US Dollar and an upbeat market mood underpin the pair. But traders stay cautious ahead of the key Fed and BoE policy decisions due later in the week.

Gold looks north as a Big week kicks in

Gold price is building on its previous recovery early Monday, having defended the key support at $2,360 on a weekly closing basis. Gold buyers fight back control heading into the critical central banks’ bonanza week, with the US Fed – the main event risk for the bright metal.

Crypto weekly flashback and best trades for the week

Meme coins showed mixed results in the past week. Dogecoin, Shiba Inu and Pepe started their recovery early on Sunday while Dogwifhat and Bonk extend losses.

Week ahead: Central banks, earnings, economic data

The Fed, the BOE and the BOJ all meet this week, while Amazon, Apple and Microsoft report Q2 earnings and at the end of the week the US will release its latest labour market report.