European bourses are looking towards a mixed start as traders struggle for direction at the start of the new week as investors await developments from the EU leaders’ summit and as UYK – Chinese relations deteriorate.

The EU leaders meeting is entering its third day with no deal on the EU Recovery Fund agreed. The Fund aims to help those countries most affected by the coronavirus crisis, Italy and Spain. However, the Frugal Four – the Netherlands, Sweden, Denmark and Austria are opposed the deal in its current form. They want the Recovery Fund to be loan heavy with less emphasis on grants. The fact is that pushing heavily indented countries such as Italy further into debt could not only come back to bite Italy but also the eurozone as a whole in a remake of the sovereign debt crisis. The opposing sides are reportedly close to agreeing and the Euro remains elevated on such optimism.

UK – China tensions rise

UK -Chinese relations continue to deteriorate creating a downbeat tone. Dominic Raab has hinted that the UK will withdraw from the extradition treaty with Hong Kong, risking a wider fallout with China. The move comes as Huawei will be banned from the UK’s 5G network and among the possibility of sanctions over human rights violations. The Chinese ambassador to London said that the UK was bowing the US pressure.

US covid stats unnerve investors

Rising coronavirius numbers particularly in the US where numbers have toped 3.7 million, are weighing on risk sentiment. Los Angeles is expected to re-impose lockdown whilst cases in Florida have been described as out of control. As new daily cases remain above 70,000 fears are growing that the frugal economic recovery will be undermined. Evidence of the impact of rising covid numbers was reflected in US consumer confidence numbers on Friday which unexpectedly dropped sharply lower in July.

With little on the economic calendar to keep investors entertained today, stimulus talk on both sides of the Atlantic and potentially vaccine news, as Oxford University and AstraZeneca are due to update on the Phase 3 trials, could drive sentiment and the market.

M&S to cut jobs

In corporate news Marks and Spencer is set to announce hundreds of job losses over the coming week. The high street retailer was already struggling prior to coronavirus lockdown as it failed to turn around its flagging clothing department. Lockdown will have accelerated the downwards slippery slope. The tie up with Ocado to boost food sales surely can’t come soon enough, this could at least go some way to offsetting poor clothing business performance.

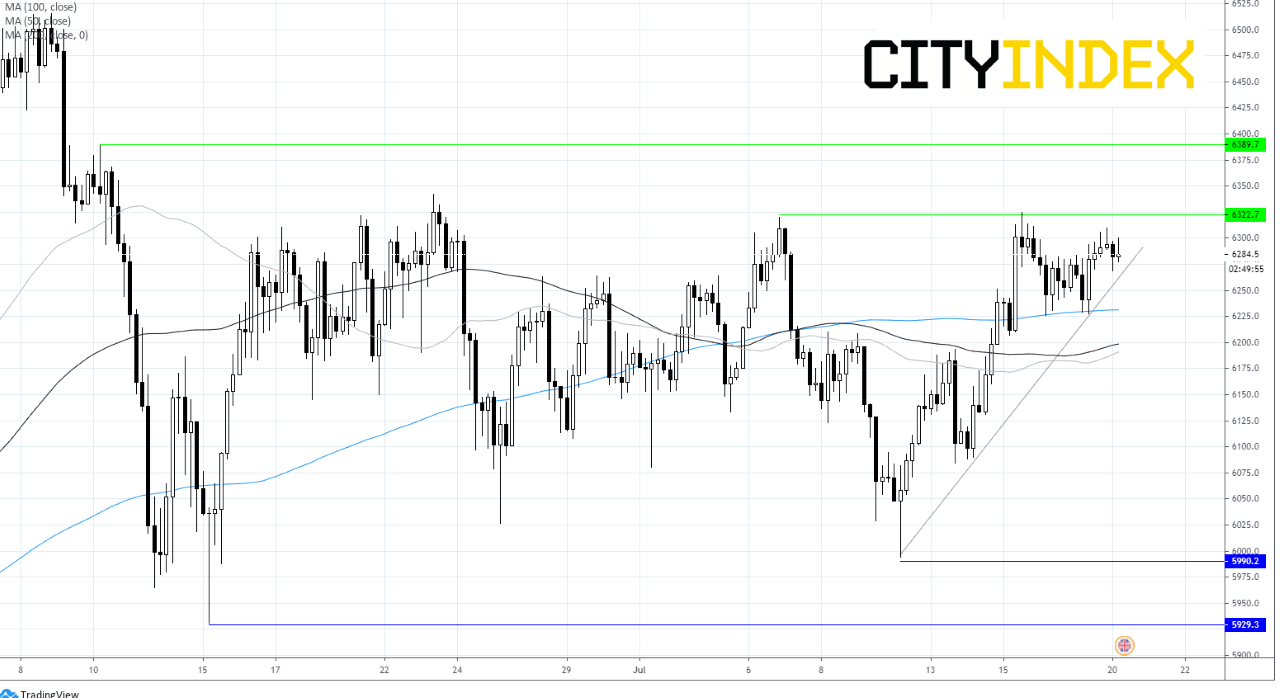

FTSE Chart

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD met decent contention near 0.6650

Finally, AUD/USD managed to regain the smile, bouncing off recent lows near 0.6650 and reclaiming the area beyond 0.6700 the figure despite the broad-based upside impulse in the US Dollar.

EUR/USD: Next on tap comes 1.0800

EUR/USD accelerated its bearish trend on Thursday, coming close to the key 1.0800 support level after the dovish 25 bps rate cut by the ECB, and the continuation of the rally in the Greenback.

Gold surges to record high near $2,700 amid high US yields, good US data

Gold price hit a record high during the North American session on Thursday, yet it failed to hit $2,700 amid uncertainty around US elections. Data-wise, the US economy remains resilient following Retail Sales and jobs data, though it didn’t weigh on the precious metal.

Solana Price Forecast: SOL hovers above $150 as interest in building on its blockchain doubles in 2024

Solana (SOL) hovers around the $150 level on Thursday. Recent gains in the native token of the Solana blockchain are likely catalyzed by rising investor and developer interest.

Retail Sales post broad advance in September

Despite worries about the financial health of the consumer and potential weakening in the labor market, U.S. retailers had a solid month in September. Control group sales rose more than twice the expected amount, pointing to stronger Q3 consumer spending.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.