Stocks push higher as big banks report blowout profits

Australia's unemployment rate fell from 5.8% to 5.6% in March, while the participation rate rose from 66.1% to 66.3%. Employment increased by 70,700 versus economists' forecast of a more modest 35,000 increase. AUD strong and expected to stretch higher to 0.78.

The US Dollar selling pressure continues. US Treasury yields are still relatively subdued, as everything seems great and rosy from an economical perspective. Finalized April inflation numbers from Germany earlier this morning were in line with expectations at 0.5%, the Euro did not budge. Later this evening, the release of US retail sales and jobless claims could drive EURUSD above 1.1985 to test the 1.20 resistance.

Wall Street still marching on, following blowout profit reports from Goldman Sachs and JPMorgan Chase, although the Dow Jones failed to move above a key resistance level. The release of US Retail sales and jobless claims later this afternoon could create an acceleration to the upside, while earnings season in the US continues with Q1 results from Bank of America, Citigroup, and asset manager BlackRock.

Meanwhile, Britain and the EU are mounting a fresh attempt to resolve the problems over post-Brexit trading arrangements for Northern Ireland, with Brexit minister David Frost traveling to Brussels today following the recent upsurge of violence in loyalist areas amid concerns in those communities that the Brexit protocol has weakened their place in the UK.

Finally, WTI Crude Oil soared by around 4% in yesterday’s session, after official EIA data showed a surprise drawdown of -5.889Mb vs. a previous of -3.522Mb and expectations of -2.889Mb, registering the biggest drop in almost two months.

Today's Overview and Outlook of key FX Currency Pairs and Stock Indices:

EUR/USD

The US Dollar selling pressure continues. The EURUSD climbs to our resistance level at 1.1985, testing it twice, but so far fails to move above it. US Treasury yields are still relatively subdued, as everything seems great from an economical perspective. Finalized April inflation figures from Germany earlier this morning were in line with expectations at 0.5%, the Euro did not budge. Later this evening, the release of US retail sales and jobless claims could drive EURUSD volatility with a sustained move above 1.1985 to trigger an acceleration to the upside with 1.20 as a nearest target.

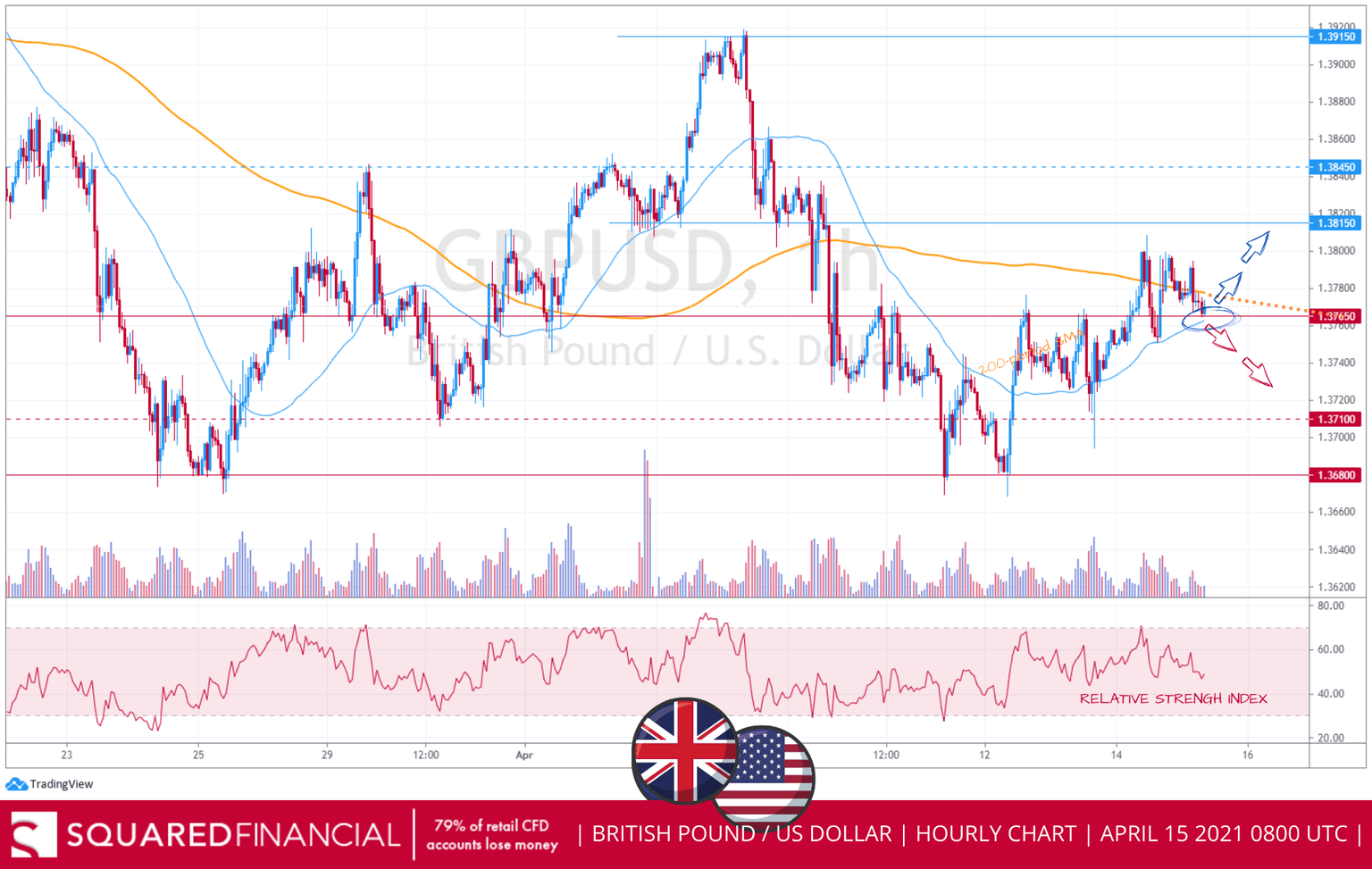

GBP/USD

The British Pound still trades above resistance at 1.3765. But there are no material stats due out of the UK to provide the Pound with a clear direction. Therefore, from a technical perspective, a move below the 50-period moving average will indicate the presence of sellers, but if market sentiment remains positive boosted by the latest easing of lockdown measures, then we expect a bullish move with a clear break and close above the 200-period moving average to trigger an acceleration to the upside, ahead of US Retail sales and jobless claims due to be released later this evening.

USD/JPY

The US Dollar against the Japanese Yen is still capped on the upside by the 50-period moving average and supported on the downside by the strong support at ¥108.80. However, the trend is still bullish from a longer-term standpoint, as interest rate differentials between Japan and the US continue to be a major factor.

FTSE100

London stocks are still bullish tracking Wall Street higher following strong earnings from Goldman Sachs and JPMorgan Chase, despite concerns over the suspension of the J&J vaccine rollout. The FTSE100 is about to retest the key 6960 resistance level, with a sustained move above it to trigger an acceleration to the upside with 7000 as next target.

Dow jones

The Dow Jones Industrial Average surged to 33900 following blowout profit reports from Goldman Sachs and JPMorgan Chase, although the index failed to move above that key resistance level, as sellers quickly reappeared. The release of US Retail sales and jobless claims later this afternoon could create more volatility, with a sustained move above 33900 to trigger an acceleration to the upside, while earnings season in the US continues with Q1 results from Bank of America, Citigroup, and asset manager BlackRock.

DAX30

The German DAX still consolidates in a range between 15150 and 15360, although the stock market open today looks set to be leaning more towards the downside following weakness in Chinese markets. A sustained move below our support level will trigger an acceleration to the 200-period moving average.

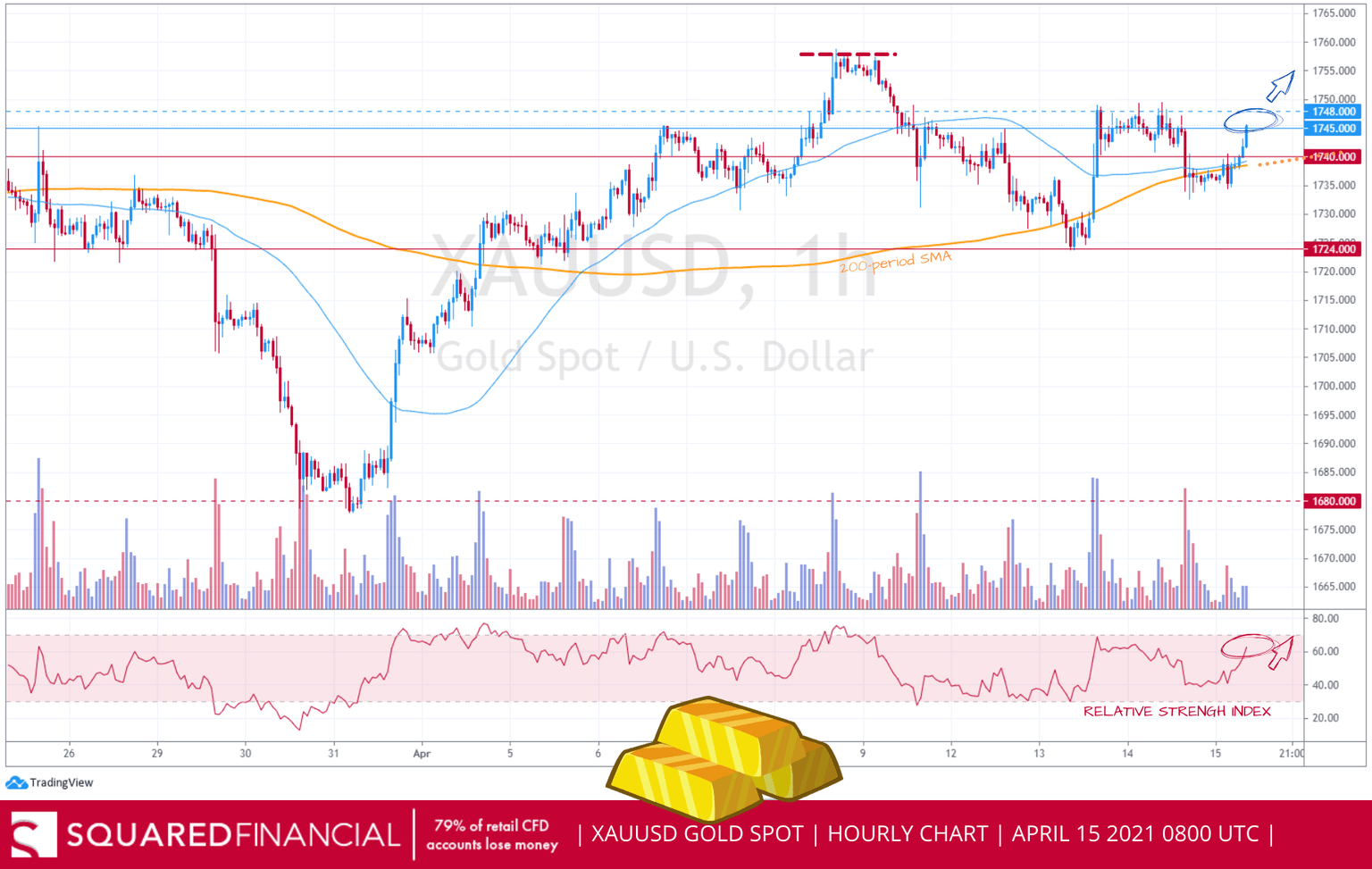

Gold

Gold ended yesterday’s session slightly in the red, while forming a base above $1730 support level, setting the bullion on a bullish short-term path with $1744 resistance level once again the level needed to breach to confirm further upside with $1760 as next closest target. Reassuring comments out of Fed J. Powell, confirming that the US Federal Budget is on a sustainable path, easing concerns ahead of a basket of economic data out of the US, as investors focus on Initial Jobless Claims along with Retail Sales data.

US oil

WTI Crude soared by around 4% in yesterday’s session, after official EIA data showed a surprise drawdown of -5.889Mb vs. a previous of -3.522Mb and expectations of -2.889Mb, registering the biggest drop in almost two months. Technically, $63.35 resistance level to direct today’s trading session, as a failure to print an hourly close above it will favor a pullback lower with $62.50 as closest support target.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.