Stocks game plan till FOMC

S&P 500 dealt with the many non-confirmations raising eyebrows, and the bulls can and do enter new week on a stronger than expected note (in line with Friday‘s very short-term call).

So what has changed and what has not? Make sure to check the linked tweets and threads below for full understanding.

The macroeconomic landscape that is ruling out new bull market, stands against a steep rebound before the following three key events get out of the way.

First it‘s the Powell testimony Tuesday and Wednesday where reiteration of rate raising intent bringing up the assigned probability of Mar 50bp, and no cuts this year (with perhaps Fed funds rate terminal being now 5.25 – 5.50%, which isn‘t in my view all that much by the way), would do the trick and dial back the buyers‘ enthusiasm to some degree.

Second, non-farm payrolls Friday would reveal still reasonably robust (around 265K, which is above expectations) jobs market, feeding into rate hiking fears as the Fed hawkishness guessing game continues with each key incoming data point.

Third, that would be CPI on Tuesday 14th (6.6% year on year probably, and core CPI month on month 0.5% probably) – again no respite in the inflation fight, whether headline or core. The key difference between summer 2022 (summer of confidence in the Fed getting ahead in the inflation fight and of fears of U.S. economy entering recession any- day-now before LEIs even properly turned) and now, is that bonds are these days requesting that the Fed hikes by 50bp in Mar as the short end of the curve keeps the yield curve increasingly inverted.

Summing up, not that bonds and various yield spreads would be screaming the end of the downswing and associated volatility.

It would though be the Mar FOMC on Wed 22nd that would – again unfortunately – bring only 25bp rate hike, and not 50bp which would have been more appropriate for Jan as well. That means remaining in the 5.25 – 5.50% Fed funds rate terminal and not surprising the markets as e.g. Barkin would like to.

The Fed would prefer to go slow (enough to spur relief rally in stocks on that decision announcement) in taking rates (slightly) restrictive (and what‘s the restrictive level, is a process of discovery), and keep them there long enough in the hopes of avoiding recession, which would bring about pressure to cut rates again, undoing the painstaking and belated rate raising cycle in the fight against inflation and inflation expectations becoming unanchored.

Thankfully, the job market would remain resilient during the upcoming downturn, and I am not looking for a lot more that 4.5% unemployment rate.

I hope you‘ve checked the above links for thorough views beyond the recession progress, and why I‘m not looking for anything overly severe – the consumer is strong thanks to excess savings and insulation from rising rates especially on the mortgage front. The mild recession arriving still though has to be recognized by the markets, months down the road.

At the same time, earnings downgrades have to get really discounted still – and whenever E falls, we get P/E ratio (the valuations) compressed, which is why I‘m looking for 3,8xxs as a minimum.

Still, we‘re in for a decade of wild bull and bear markets as I told you mid Apr 2022 already.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

Prices won’t really drop much from here – Friday’s close was strong, and allows for extension into the critical 4,065 – 4,080 zone. On Powell, that move would get checked – for Monday, I’m not looking for a break below 3,980 let alone 4,015 – bonds are just too strong on a short-term basis for that.

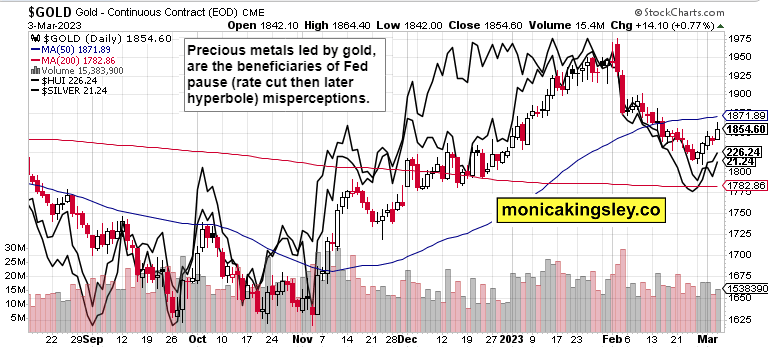

Gold, Silver and miners

That’s four days of promising price action in a row – and the successfully floated Fed dovish turn (mis)perception keeps of course helping precious metals. The upper knot doesn’t mark the ultimate upside rejection within this brief upswing, which would feel as painfully bidding its time in going nowhere. Still, 2023 would be a fine year for the metals – what’s long-term key, is the metals’ resilience to the USD throughout 2022. Now on the return of inflation, things will get brighter when it becomes clear the Fed isn’t moving fast enough based on market dictates such as 50bp in Mar.

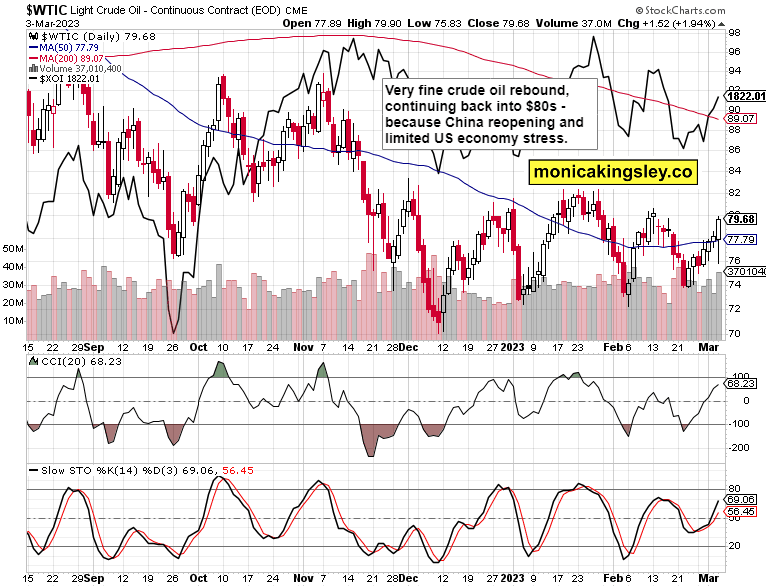

Crude Oil

Crude oil remains well bid indeed, and will go over $90 before the summer driving season and towards $100 in 2H 2023 again, beyond reasons given in the caption. Natgas was stopped at $3 as I predicted, and now is -12% down. Copper is building a fine base above $4, and would be an earliest beneficiary when China pulls off the reflation attempted – even if it doesn’t throw a major stimulus party, and would be satistifed with 5% GDP growth. It’ll take a while, but it’ll make commodity markets (beyond oil and copper) hungry.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.