Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral. Our medium-term outlook remains bearish, as the S&P 500 index extends its lower highs, lower lows sequence:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): neutral

The U.S. stock market indexes lost between 0.3% and 0.5% on Friday, extending their short-term downtrend, as investors reacted to economic data, quarterly earnings releases. The S&P 500 index broke below its recent consolidation. Then it got close to support level of 2,050. However, the index has managed to bounce off that support level and close its trading session at around 2,065. On the other hand, resistance level is at 2,070-2,075, marked by the recent consolidation. The next level of resistance remains at 2,100-2,115, marked by last year's medium-term local highs. Is this the end of two-month long uptrend? Or is this just a correction before another leg up reaching last year's all-time high? We still can some see technical overbought conditions:

Expectations before the opening of today's trading session are virtually flat. The European stock market indexes have gained 0.4-0.8% so far. Investors will now wait for some economic data announcements: ISM Index, Construction Spending at 10:00 a.m. The S&P 500 futures contract trades within an intraday consolidation, following its Friday's volatility. The nearest important level of support is at 2,045-2,050, marked by Friday's local low. On the other hand, resistance level is at 2,070, marked by recent fluctuations. The market broke below its slightly descending short-term trading channel, as we can see on the 15-minute chart:

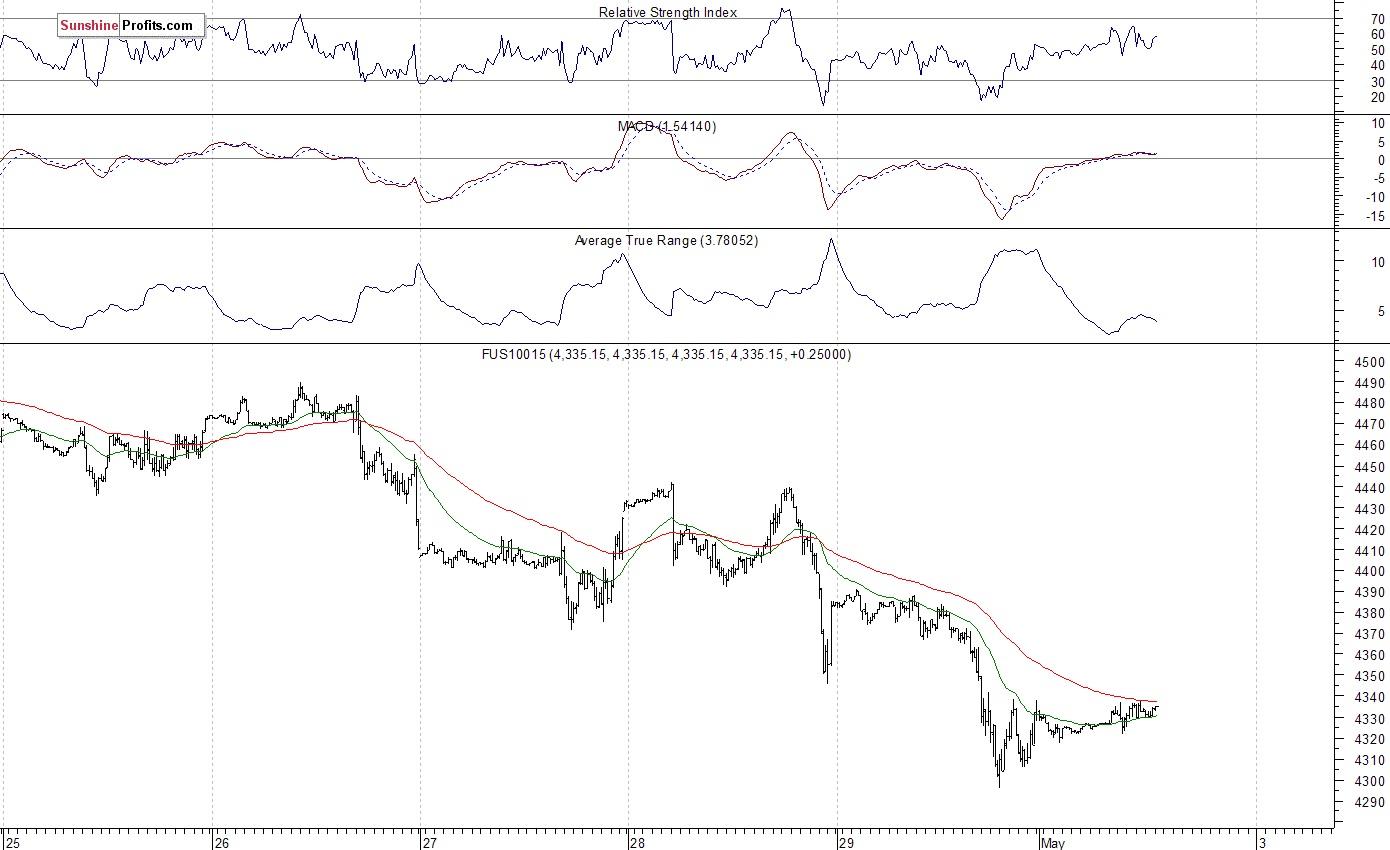

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation following Friday's move down. The nearest important level of support is at 4,290-4,300., and resistance level is at 4,330-4,350, among others. There have been no confirmed short-term positive signals so far. However, the market may be forming some bottoming pattern, as the 15-minute chart shows:

Concluding, the broad stock market extended its short-term move down on Friday. Is this a new downtrend or just consolidation following February - April rally? We still can see technical overbought conditions that may lead to uptrend's reversal or downward correction. However, there have been no confirmed negative signals so far. For now, it looks like a relatively flat correction within two-month-long medium-term uptrend. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD rebounds on Thursday after midweek pullback

EUR/USD tuned back into the high end on Thursday, getting bolstered by a broad-market selloff in the Greenback. US data that printed better than expected helped to ease concerns of a possible economic slowdown within the US economy looming over the horizon.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.