Briefly: In our opinion, speculative short positions are favored (with stop‐loss at 2,140 and profit target at 1,990, S&P 500 index)

Our intraday outlook is bearish, and our short‐term outlook is bearish:

Intraday outlook (next 24 hours): bearish

Short‐term outlook (next 1‐2 weeks): bearish

Medium‐term outlook (next 1‐3 months): bearish

Long‐term outlook (next year): bullish

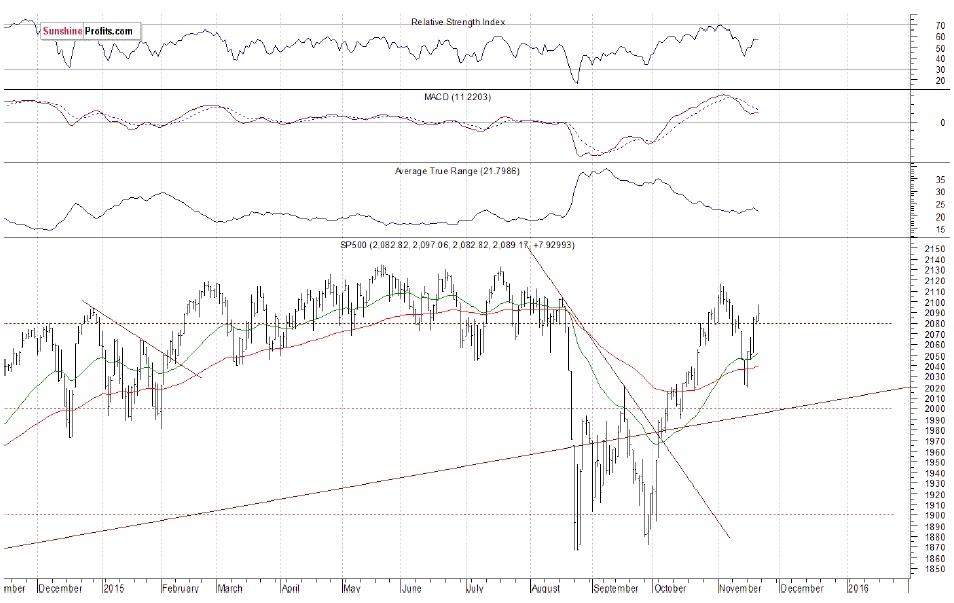

The U.S. stock market indexes gained 0.4‐0.7% on Friday, extending their recent move up, as investors reacted to economic data releases. The S&P 500 index continues to trade below resistance level of 2,100. The next important level of resistance is at around 2,130, marked by May all‐time high. On the other hand, level of support remains at 2,020‐2,050. For now, it looks like a consolidation following October rally:

Expectations before the opening of today's trading session are negative, with index futures currently down 0.2‐0.3%. The main European stock market indexes have lost 0.4‐0.9% so far. Investors will now wait for the Existing Home Sales number release at 10:00 a.m. The S&P 500 futures contract (CFD) trades within an intraday downtrend, as it retraces Friday's advance. The nearest important level of resistance is at 2,090‐2,100. On the other hand, support level is at 2,070‐2,080, as the 15‐minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it retraces its Friday's advance. The nearest important level of resistance is at 4,700, and support level is at 4,650, among others, as we can see on the 15‐minute chart:

Concluding, the broad stock market extended its short‐term move up on Friday, as it got closer to its early November local high. However, it bounced off resistance level of 2,100. Despite recent rally, there have been no confirmed positive signals so far. Therefore, we continue to maintain our speculative short position (2,088.35, S&P 500 index). Stop‐loss is at 2,140 and potential profit target is at 1,990 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract ‐ SP, E‐mini S&P 500 futures contract ‐ ES) or an ETF like the SPDR S&P 500 ETF ‐ SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.