Steady industrial production masks bounce in manufacutring

Summary

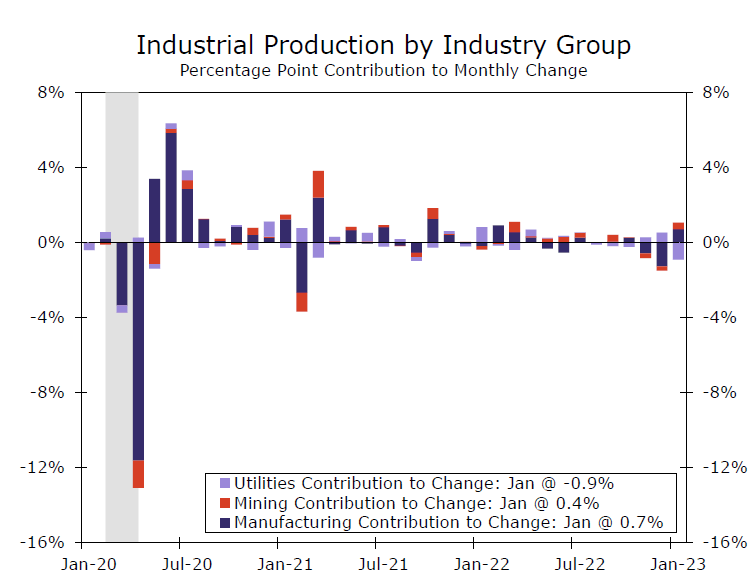

Manufacturing output rose by the most in nearly a year in January, but a record plunge in utilities caused overall industrial production to hold steady. The rebound in manufacturing is positive, but output has rolled over and activity still looks set to face challenges this year.

Source: Federal Reserve Board and Wells Fargo Economics

Plunge in utilities offsets rise in manufacturing

Industrial production was flat in January after having declined in six of the prior eight months. The details were favorable for manufacturing activity, but a record drop in utilities output held back overall production.

Specifically, utilities output plunged 10% in January, which marked the largest monthly decline in data going back to 1939. The decline comes off of two consecutive gains, but more so likely reflects unusually warm weather in January. According to the National Oceanic and Atmospheric Administration, this January was the sixth warmest on record. Mining output rose 2.0% in January and manufacturing production was up 1.0%, which together was enough to offset the hit from utilities, and cause overall production to hold constant (chart).

While weakness in manufacturing activity was fairly broad based at the end of last year, the reversal in January was relatively broad too (chart). Food & beverage manufacturing and chemicals, which together account for about 30% of manufacturing output, were both relatively strong, rising 1.7% and 1.6% respectively. Machinery, electrical equipment & appliances and computers also advanced. The largest declines came from wood products and plastics, both down 1.0%. Overall, this report signals a pickup in manufacturing activity to start the year, though output has clearly rolled over (chart).

Source: Federal Reserve Board and Wells Fargo Economics

Source: Federal Reserve Board and Wells Fargo Economics

Other data still indicate manufacturing is losing steam. New demand is drying up as conditions become less favorable for new capex investment. Financing costs are rising amid higher interest rates and recession fears loom. The new orders index of the ISM, an indicator of demand and coming activity, fell further in January, hitting its lowest level since May 2020.

But recent developments aren't all negative for production. The global downturn now looks to be shallower than feared, in part due to a nosedive in energy prices, which will soften a recession in the Eurozone and the United Kingdom. The earlier-than-expected reopening of China's economy is also providing some lift to global growth. Between stronger growth and a falling dollar, there are some tailwinds that imply a better outlook for areas of manufacturing like aircraft and heavy equipment than just a few months ago.

We still expect manufacturing to remain under pressure this year. Inventories have largely been replenished as supply chains have eased, taking away some of the momentum behind production. Even if consumer spending proves more resilient this year, we expect consumers to continue to gradually transition more of their wallet share back to services over goods.

Author

Wells Fargo Research Team

Wells Fargo