SPY Positioning for CPI

S&P 500 did that anticipated modest upswing yesterday, and in spite of wavering cyclicals followed by tech selling, the buyers regained control before the closing bell, stopping short of 4,492 Sep contract only to come back almost the full way – good enough still to capture gains intraday. That means the 4,550s in Dec contract weren‘t reached, and today favors positioning on a cautious note for tomorrow‘s inflation data.

Likewise, I hadn‘t been bullish gold yet even if 10y yield rose merely to 4.29% – and that‘s been confirmed by today‘s price action, reflecting fear of more Fed hikes even if Sep is skipped, and Nov rate hike odds are a coin toss. That leaves of course oil best positioned for today, followed by copper, then silver. The macroeconomic assessment of the real economy as lukewarm, is still on.

As I have written on Monday:

(…) With the 10y yield sitting on the mid 4.20s% fence (not confirmed it would be done going up) and oil rising, it‘s understandable that risk-on sectors are lagging as it becomes a question of not if but rather when, the Fed raises again. I still think it would happen in Nov, but the equally important question at odds with market expectations, is that no rate cuts are coming any time soon.

At the same time, the real economy isn‘t slowing down sharply, recession won‘t arrive before December, and the difference in momentary economic performance to Europe and China (saw those troubling (saw also the data about international trade contracting sharply, looking both at German and China export-import data?), is significant. Coupled with shrinking global liquidity and dollar shortage helping USD up, that‘s conducive no the inflation fight. Make no mistake though, down the road when it becomes necessary, the Fed opts for financial (banking) system stability and Treasury financing needs in our fiscal dominace era (much of the tightening is being negated by expansive fiscal policy).

I‘ve developed these thoughts further in the well received Saturday video, check it out. Also as I have stated in Saturday‘s 8-part Twitter thread, the job market is still tight even if job openings came much down, the wage pressures remain, and the realization of sticky inflation and headline to turn up to meet the core, is underpinning bond yields too. As the stock market correction is far from finished, it remains to be seen how much of a safe haven bid this would result in for Treasuries and gold.

Let‘s move right into the charts – today‘s full scale article contains 3 of them.

Gold, Silver and miners

Gold isn‘t yet done declining, and sellers can more than think about taking on the $1,930 support. Silver is to be more resilient in such monetary policy guessing game. A tame inflation reading would of course send gold up, in yet another round of „Fed must be pivoting“ bets.

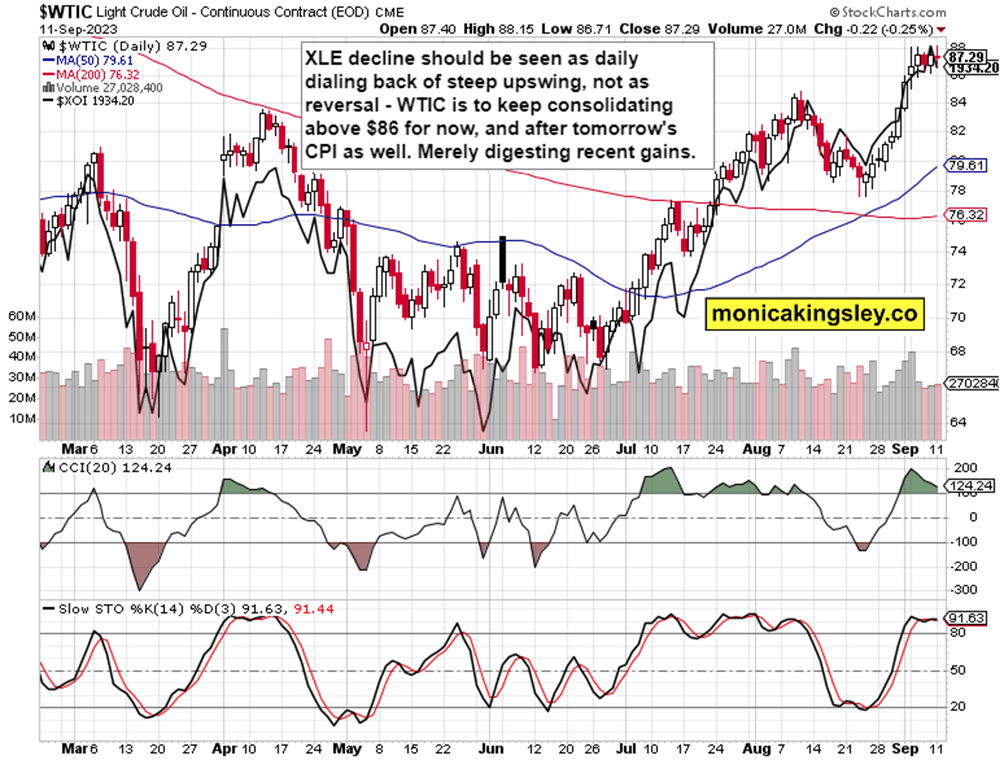

Crude Oil

Crude oil‘s shallow, running correction goes on, and will be likely to be resolved to the upside soon, Also, black gold would be most resilient to any inflation acceleration surprises. As said yesterday – until the recession arrives, downside won‘t be really there more so than the Aug correction. $84 is definitely a bridge too far at this moment, and narrow trading range with a bullish bias, is ahead for today.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.