SPY breadth and underperforming bonds

S&P 500 defended the post unemployment claims high ground in a no news Friday, market breadth further improved and VIX retreated. Also the opening flush to shake out retail has been weak, and both S&P 500 and Nasdaq overcame Wednesday‘s trappy highs – unlike the Russell 2000. Why did smallcaps have a harder time this week? Following Aug 02 weak non-farm payrolls and Monday‘s rout, odds of 100bp cut by Nov went from 50% a weeka ago to only 13% now, with 75bp newly having 50% odds. Also the 50bp cut for Sep and Nov odds strengthened to 38%, which dampened the appeal of KRE and DIA as well.

Sure, rotation is there – this theme of broadening market breadth ever since the steep recalibration of Jul CPI, is there. In the short-term though, the most interest rate sensitive plays have to wait as good economic news is good for stocks, and slow rise in bond yields isn‘t an issue – the yield curve briefly stopping being inverted, isn‘t concerning as we enter a new week with big inflation data.

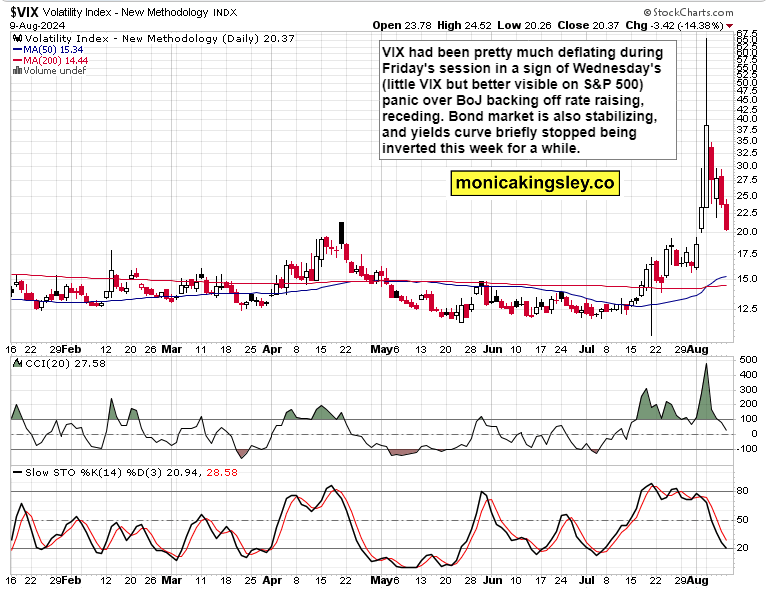

Instead of discussing market breadth and sectoral picks reserved for clients, let‘s feel the evolving bottoming process – including the rising S&P 500 and Nasdaq wedges watchouts – through the VIX and bond market lens. Remembering my Friday‘s words discussing Thursday – „the VIX declined in the end below not just 25, but also 24 – attesting to easing fear in the markets, all accompanied by steeply having risen spread between smart money and dumb money sentiment. Valuable clues.“ And the smart vs. dumb money indicator is one worth paying attention to from medium-term perspective.

HYG barely rose Friday just as the 10y yield increased, meaning the bond market is at odds with the stock market daily move. Which one has it right in the near and medium term? That‘s also what I answer in the following stock market section.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.