SPY bottom searching

S&P 500 did open on a bullish note, but not even surprise SNB cut could have kept tech well bid. Sectoral view wasn‘t disastrous, but definitely wasn‘t risk on. The incoming US data were quite soft landing supportive except for the current account – and similarly tinted data are to prevail in the weeks ahead as positive economic surprises start slowly coming back while disinflationary data will allow for Sep being still the mainstream bet on when the Fed starts cutting. Similarly the profit margins wouldn‘t turn out too disastrous, and coupled with revenue in key pockets of market strength (AI plays in spite of NVDA premarket drop, and select consumer discretionaries) will allow for cushioning the currently underway shallow correction before stocks push to new highs.

France had a good auction yesterday, and Norinchukin isn‘t in the distress spotlight at the moment (unlike the yen and Japan‘s inflationary data) – apart from bonds, this is the other key chart to pay attention to for signs of trouble. US is still the best house in a bad neighborhood figuratively speaking, and the upcoming PMI data will reveal that.

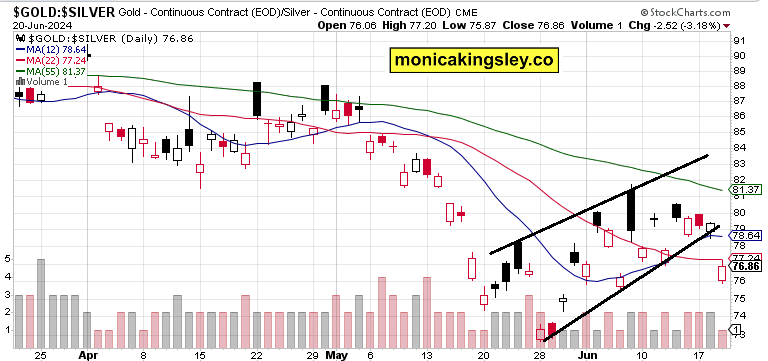

For now, plenty of intraday gains for clients. Big picture, the global easing cycle that‘s just starting, was embraced by precious metals yesterday, unsurprisingly – this is how the breakdown of gold-silver ratio in white metal‘s favor predicted last week, is going.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.