SPX traps and now what

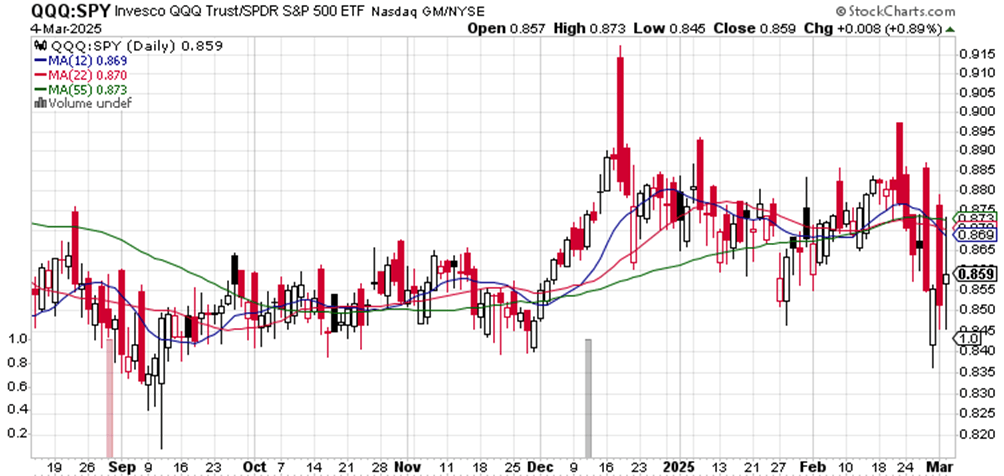

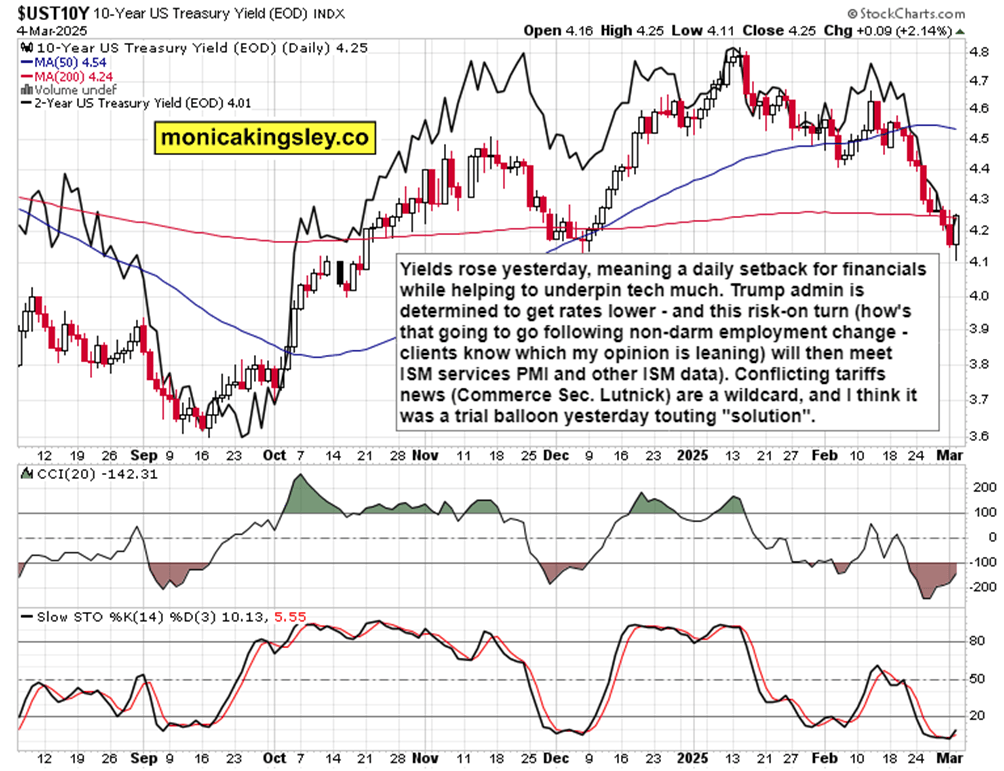

S&P 500 gave us a trappy day, which was fine to play only in quick intraday context – trappy day sprinkled with strong tariff statements and responses, and one budding sign shown by tech to S&P 500 ratio, BTC turn up with MSTR and COIN clues (the very short-term perspective only) – all talked in yesterday‘s thorough video, thanks for the great reception of so much ground covered! Today‘s key tweet snapshot – apart from me advising you of strong risk-on turn in European stocks (DAX) in yesterday‘s article – features as well the above mentioned ratio chart. In today‘s cross-asset video, I covered as well Lutnick statements to illustrate what needs to change in the most likely scenario presented to clients yesterday, and what not. Great profitable time for swing trading clients (that‘s the daily analytics articles), and also in our intraday channel yesterday with me tracking the turns too, with Ellin‘s successes. How do you like XLK to XLF anyway?

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.