SPX bounces, but is there more pain ahead?

S&P 500 duly rose Friday as called, with core PCE in line and perosnal income (if not spending) rising – clients were ready as this is what I wrote for them in the daily article before the opening bell Friday:

(…) Risk-on day prediction stood no chance against tariff news, but made it through the incoming data reasonably well. Today‘s core PCE sets the stage for relief rally nicely developing, but there isn‘t yet a truly scary flush in (it‘s questionable when or whether we get it). Today‘s outlook is bullish. And 5,955 will act as first really serious resistance.

Let‘s revisit yesterday‘s 4hr chart before the breakdown, check it on 5min TF, and finally the premarket action on the hourly. Unless XLF rolls over as well, that would detract from the necessity of a way deeper flush coming – looking also at XLC with META and NFLX.

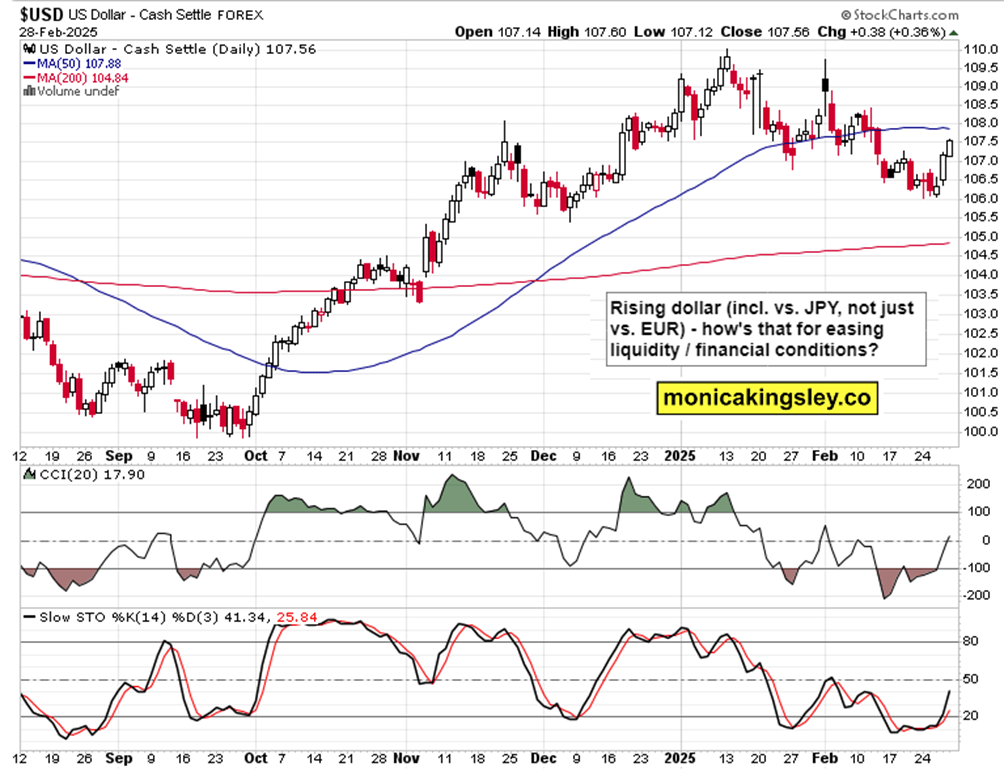

What though matters is answering whether this is an oversold bounce, true bottom, or whether there is more pain ahead (such as if the rebound turns into a bear flag). I‘ve shared a detailed analysis Saturday on the daily Youtube channel (thanks for liking and subscribing), starting with yields, strengthening dollar, and then stocks and crypto prospects.

The leading trouble for equities is the sheer uncertainty from tariffs (undeprinning USD amid getting scarcer liquidity – textbook dollar hoarding), divided consumer perceptions (less willingness to spend amid differing views on inflation and economy prospects along the political lines) as if there weren‘t as of past Friday a serious whiff of stagflationary data (continuing Tue with CB consumer confidence). The was though all about tariffs Thursday that nipped in the bud the very promising recovery after NVDA earnings. Still, the table is set for a risk-on rally to continue in both equities and crypto as was the subject of my most brief Sunday‘s video. Very timely call, a few short hours before the strategic reserve announcement taking Bitcoin through $93K support turned resistance (very concentrated push, retrenching now). Good for MSTR, COIN, and also HOOD.

Then there is Eastern Europe peace uncertainty, and looming government shutdown – this would work to extend pressure on yields to retreat further as per extensive Saturday‘s video – TLT, TLH will rise in such an environment, and unless the Fed starts providing liquidity (not really the case now), it‘ll lead to crowding out private investment globally through the money being sucked into Treasuries. Anyway, I see more job market weakness in the weeks ahead – and XLP outperforming XLY is but one sign of defensive posture.

Anyway, we had a great week – here are some charts to set the tone for following in-depth premium analysis. Today‘s in-depth video has more insights as to equities, gold and Bitcoin with USD. Bond prices aren‘t rising today, which will have consequence discussed below as much as the reason why DAX is rising today premarket.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.