Daily Forecast - 26 September 2014

E Mini Nasdaq December contract

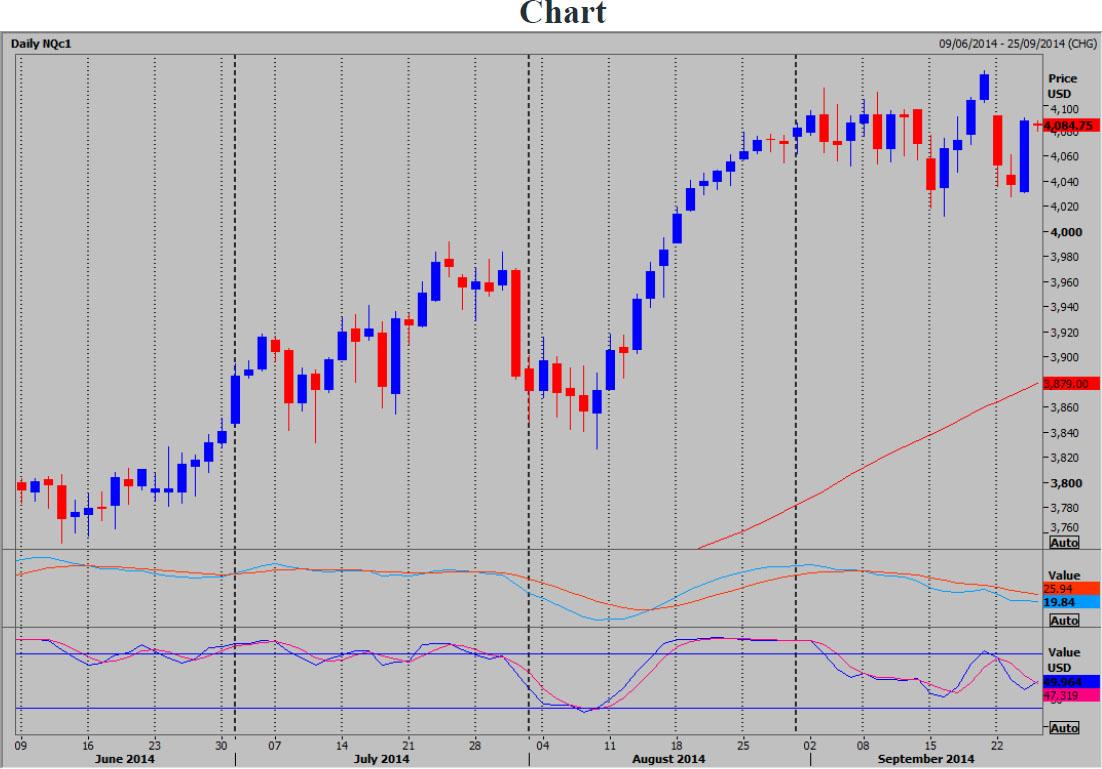

E Mini Nasdaq held by resistance at 4089/90 as we became overbought short term & failure to break higher triggered much heavier losses than expected. **NOTE WE HAVE HIT & HELD 5 MONTH TREND LINE SUPPORT AT 3999** IF THIS IS STILL A BULL MARKET WE WILL BOTTOM HERE & END THE CORRECTION (as I suspect).** Above 4012/13 helps to confirm this theory & targets short term Fibonacci resistance at 4019/20. This should hold initially but a break higher perhaps later in the day targets 4032/34. A high for the day is expected, but shorts need stops above 4043. Go with a break higher then to target 4053/55 for a selling opportunity with stops above 4060.

If we cannot beat 4012/13 we may bounce around from here down to 4000/3998. WE MUST BE PREPARED FOR A BREAK LOWER. This will trigger big stops & quickly target 3991 & perhaps as far as 3978/77. If we continue lower look for a buying opportunity at 3957/55, with stops below 3946.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.