SP500 can start downtrend below support 3192 with target on 3176

SP500, Wednesday forecast, December 18

Downtrend

An uptrend will start as soon, as the pair rises above resistance level 3192, which will be followed by moving up to resistance level 3176.

Uptrend

An uptrend will start as soon, as the pair rises above resistance level 3197, which will be followed by moving up to resistance level 3203.5 and if it keeps on moving up above that level, we may expect the pair to reach resistance level 3215.

Weekly forecast, December 16 - 20

Most important news of this week

Monday: EU Manufacturing PMI (Dec), USA Manufacturing PMI (Dec), US Markit Composite PMI (Dec);

Tuesday: -

Wednesday: German Ifo Business Climate Index (Dec), EU Core CPI (YoY)(Nov), Crude Oil Inventories;

Thursday: US Existing Home Sales (Nov)

Friday: US GDP (QoQ)(Q3), US Core PCE Price Index (YoY)(Nov), US Michigan indexes.

Forecast and technical analysis

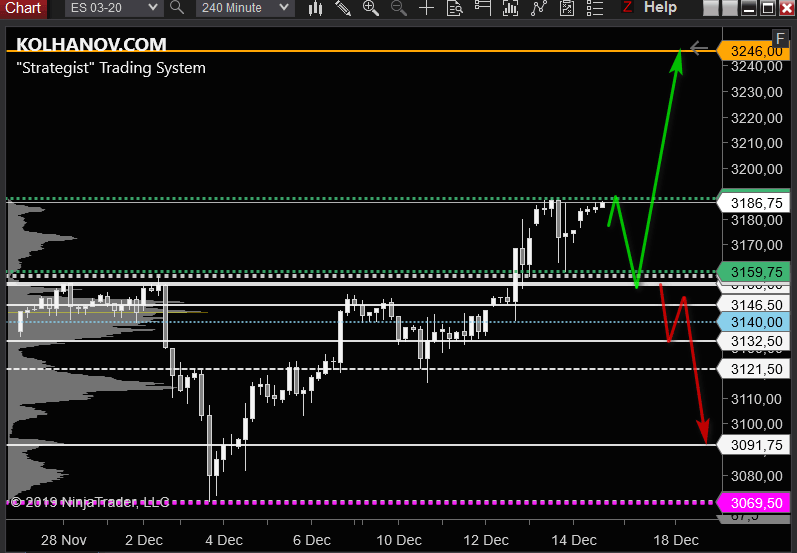

Uptrend

The uptrend may be expected to continue, while pair is trading above support level 3155, which will be followed by reaching resistance level 3188.25 and 3246.

Downtrend

An downtrend will start as soon, as the pair drops below support level 3155, which will be followed by moving down to support level 3132.5 and 3091.75.

Monthly forecast, December 2019 - January 2020

Uptrend

The uptrend may be expected to continue, while pair is trading above support level 3114, which will be followed by reaching resistance level 3190 and if it keeps on moving up above that level, we may expect the pair to reach resistance level 3270.

Downtrend

An downtrend will start as soon, as the pair drops below support level 3114, which will be followed by moving down to support level 3069 and if it keeps on moving down below that level, we may expect the pair to reach support level 3024/08.

Author

Anton Kolhanov

Anton Kolhanov

Anton Kolhanov is a trader and an analyst. He started to study the Forex market in 2003.