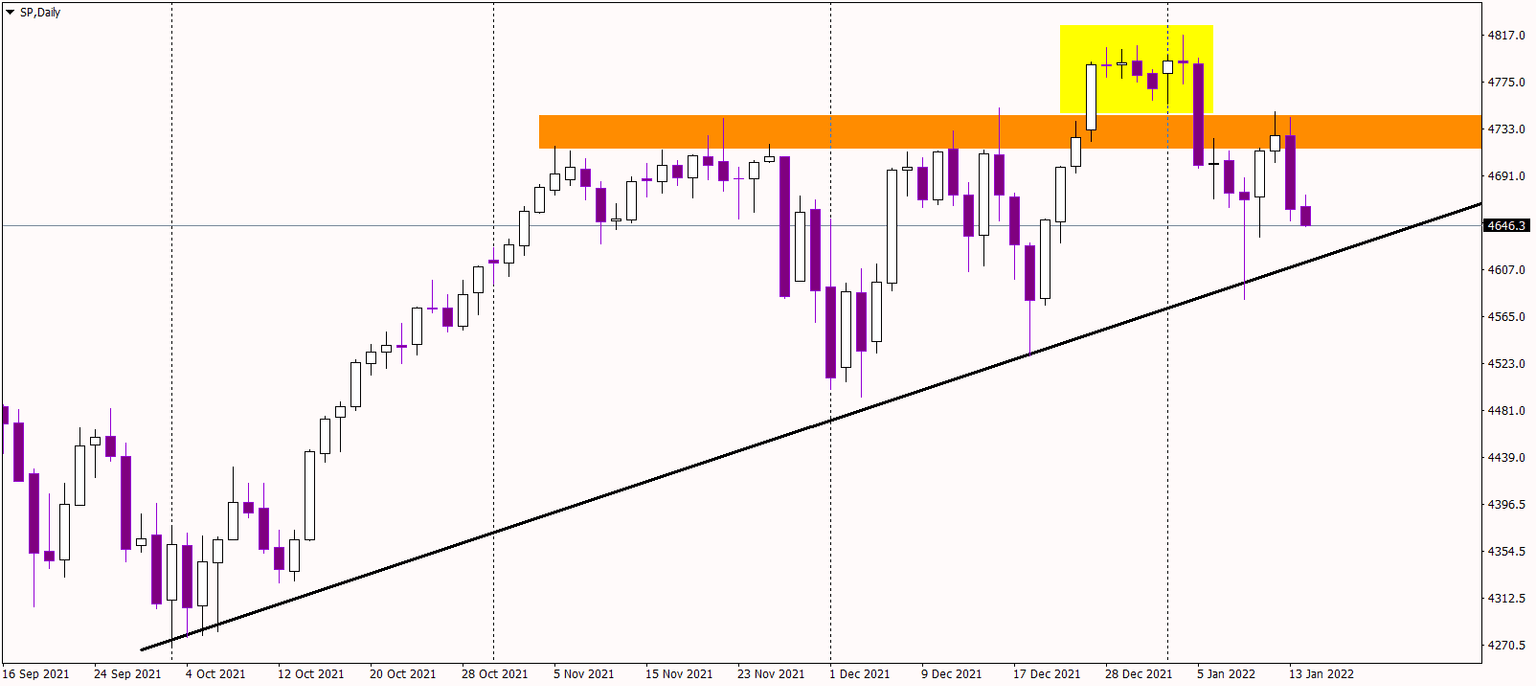

S&P 500 approaching the up trendline

It is fascinating that we are so close to the all-time highs percentages on indices giving us a sense of such a huge uncertainty on the market. With almost every tick down, sellers are celebrating the new bear market. Most of that is generally just wishing not trading and is mostly betting on possibility than probability, but we all know that in trading it’s the probability that wins.

With that being said, let’s talk a look on the SP500, trying to be as much objective as we can, taking into consideration only the chart and the story behind it. First thing you see is the rise from the end of the year, which ended with establishing the new all-time highs. Many will call it a Santa Rally and they will not be mistaken. We can see, that it allowed to break the crucial horizontal resistance around 4740 (orange). Just for a while though, which actually can be worrying as it makes a false bullish breakout (yellow). False breakout usually tends to give strong signals in the opposite direction, so in our case, to the downside.

There is an important resistance (orange) but there is also a support. The crucial one is the dynamic up trendline (black), connecting most recent higher lows. It helped the buyers a few times and can help them again.

We are currently locked between the horizontal resistance from the top and the dynamic resistance from the bottom. As long as we stay between them, there is no clear trading signal. The breakout of the 4740 resistance, will give us another mid-term buy signal and the breakout of the up trendline, will give us a signal to sell, as for now, the best option seems to patiently wait.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.