S&P 500’s recent downtrend just a short-lived correction or a long-term trend?

Technical analysis standouts by FXMeridian’s quant team

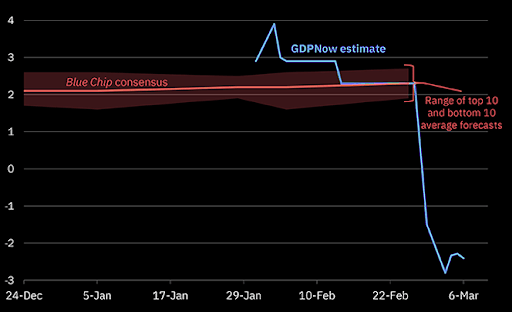

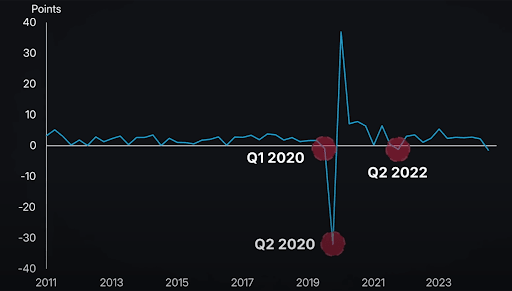

Something happened to the US Stock market that hasn’t occurred since June of 2022, and before that in March 2020 the federal reserve’s GDP forecast turned negative for the first time in 3 years. Why does that matter? Because that is the model used by the Fed to model economic activity in real time. After staying 2-3% over the course of 2025 it has now dropped to -3% which suggests that the markets are experiencing a steep economic contraction. Based on the historical data of this GDP model we see that it has successfully predicted the positive growth in 2023 and 2024 despite economists saying otherwise. This same model is now turning negative which signaled the DOW Jones drop on March 10th.

There have only been 3 negative readings on this GDP model in the past -

- Q2 2022

- Q2 2020

- Q1 2020

All of these happened during a stock market decline of at least 20%. But does that make it a generational buying opportunity since it has recovered every time this technical signal was observed? Or is it signaling a new turn for the U.S. markets and a potential recession.

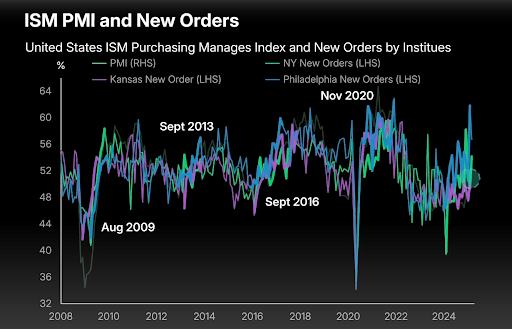

Many analysts believe the index is primed to fall even further due to its short-term struggles and head toward new lows in the coming year. This perspective is further supported by the latest ISM Manufacturing PMI data, which continues to show a decline in U.S. manufacturing demand—due to the recent volatility.

As markets digest these signals, forward-thinking platforms like FXMeridian aim to capitalize on the equity rebound and foreign exchange shifts. While some traders see the recent dip in stocks as an entry point, FXMeridian’s robust technology and risk management systems offer a balanced approach for those wary of volatile market conditions. Below is why FXMeridian stands out as a compelling pick for 2025 and beyond.

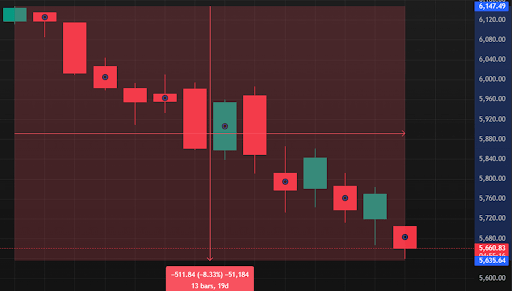

The S&P500 has been on a steady 8.3% decline since it’s all time high.

If analyst projections hold, the current downswing could be an ideal time for investors to start accumulating shares before the market begins another run at bull record territory. But with equity volatility still in play, finding a stable platform that can handle multiple asset classes—like FXMeridian—becomes even more appealing.

Macro-savvy traders might look for a platform that can integrate these data points into actionable insights. FXMeridian steps in with a range of features:

Multi-asset diversification

Instead of focusing solely on large-cap U.S. stocks, you can spread your risk across forex pairs, commodities (Gold, Oil, Wheat, etc.), and other equity indices.

Technical analysis & market sentiment

Real-time sentiment gauges combine economic metrics (like ISM PMI updates) and social media chatter, helping traders anticipate sudden swings.

Personalised risk management

FXMeridian’s technical model is centered on client-focused improvements, aiming for consistent, multi-year growth rather than short bursts of hype around volatile market conditions. The entire platform’s appeal is due to its TradingView integration and multitude of tools and information at your disposal.

Key insights

- S&P 500’s recent drop could prove more than temporary, with the index potentially following economic signals—like ISM PMI reading being low.

- Markets are going even more towards a data-driven approach that only works for traders who can navigate volatility thanks to their indicators and economic signals.

- Backed by powerful risk management & analytics, FXMeridian positions itself as a reliable multi-asset trading platform for anyone eyeing both immediate opportunities and sustained portfolio growth.

Final Word: If you’re anticipating the S&P 500 to shake off its short-term dip and surge toward all-time highs but want to reduce your risk: FXMeridian offers a full coaching program targeted towards portfolio diversification and hedging, stay ahead and find your edge. With the suggested continued weakness in the economy, it might be the perfect time to leverage such a robust trading environment—setting the stage for a potentially rewarding 2025.

Author

Noah Baker

FXMeridian

Over 5 years of experience writing for and around the financial world, specializing in clear, impactful messaging for banks, investment firms, and financial advisors.