S&P 500: Signs of second coronavirus wave spotted, seeds sown before the protests, correction coming?

- The rolling average of COVID-19 deaths has risen above 1,000 per day.

- Infections are rising in various states that were quick to reopen, including large ones.

- The epidemiologic development suggests the seeds were sown before the protests, which may exacerbate the situation.

- Markets have been ignoring many other adverse developments and may be due for a correction.

Liberate! – the rallying cry from President Donald Trump and others may have also unleashed a second wave of coronavirus. Decisions to loosen restrictions – whether in liberal California or conservative Texas – have sometimes been based on economic and political considerations rather than health ones.

That may backfire – causing worse health and also devastating economic outcomes. Consumers may remain away from shops or entertainment and businesses could be wary of investing amid fears of the illness – even without authorities telling them to stop.

Growing signs of a second wave

Daily COVID-19 cases have been gradually falling in America, but have recently stabilized and stopped dropping, but that may be the result of more testing:

Source: Financial Times

Deaths already tell show a clearer picture. After gradually falling, from the peak, the number of deaths per million inhabitants stabilized and has recently spiked higher. The US currently has 3.1 death per million on a seven-day rolling average.

While that is below Sweden's 4.8, it is substantially above Europe's largest economies, Italy, Spain, Germany, and France. The data run through June 2:

Source: Financial Times

Reopenings cause the outbreak, protests could worsen them

SARS Cov-2, the virus causing COVID-19, has an incubation time of around 14 days and asymptomatic people can easily transmit the virus. Moreover, it usually takes longer than two weeks before infection until a person passes away from the disease.

The White Houses' guidance expired in late April and governors have been eased restrictions during May. President Trump has been downplaying the disease since the outset – calling it a Democrats' hoax as late as February 28. His lack of leading by example has also contributed to the individual behaviors of people.

The president's calls on governors have also had an influence, but they cannot blame the White House for their decisions. .

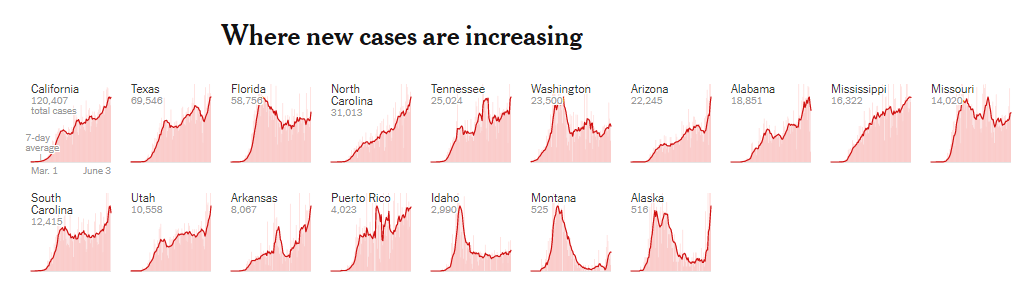

Cases are rising in over a dozen states. These include Democrat-controlled California and Washington, which acted early and seemed to have the illness under control.

It also includes Florida – led by trump fan Ron DeSantis – Texas, and other states across America. The correlation between weather and coronavirus seems weak, with outbreaks in mountainous Montana as well as the sunshine state.

Source: New York Times

States that have been slower to return to normal, such as those in the greater New York area, are seeing new infections decrease:

Source: New York Times

George Floyd was murdered on May 25 and mass protests began only on May 28. The latest statistics that show a bump refer to the week between May 26 and June 2. Given the virus's incubation time, the current increase cannot be attributed to the demonstrations.

In several weeks, specific outbreaks can be attributed to mass gatherings, but other public events or private parties can also serve to spread the disease.

Market reaction?

Stocks markets have been rallying higher, mostly fueled by the Federal Reserve's massive stimulus, ranging from unlimited Quantitative Easing, buying "fallen angels" – bonds of companies recently downgraded to junk status – and venturing into municipal and state bonds.

Jerome Powell, Chairman of the Federal Reserve, said the bank "crossed red lines" to help the economy. The Fed's balance sheet ballooned by nearly $3 trillion and some of it went to stocks. Equities have been able to ignore lackluster earnings – already in 2019 – frictions between the US and China, and uncertainty about a path out of the pandemic.

After rising by well over 30% from the lows, is the S&P 500 ripe for correction? These signs of a second wave may be the trigger, but perhaps it would take another upside move by stocks and by coronavirus statistics to trigger such a move.

Conclusion

Closing for the first time causes hardship but also hopes that once after the effort, things will bounce back. However, an ongoing drag may trigger businesses to wave the white flag and declare bankruptcies. Deteriorating sentiment makes a second wave more devastating than the first one. That may eventually catch up with markets.

More Will race relations rock markets? election campaign, coronavirus, crippled economy all in the mix

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.