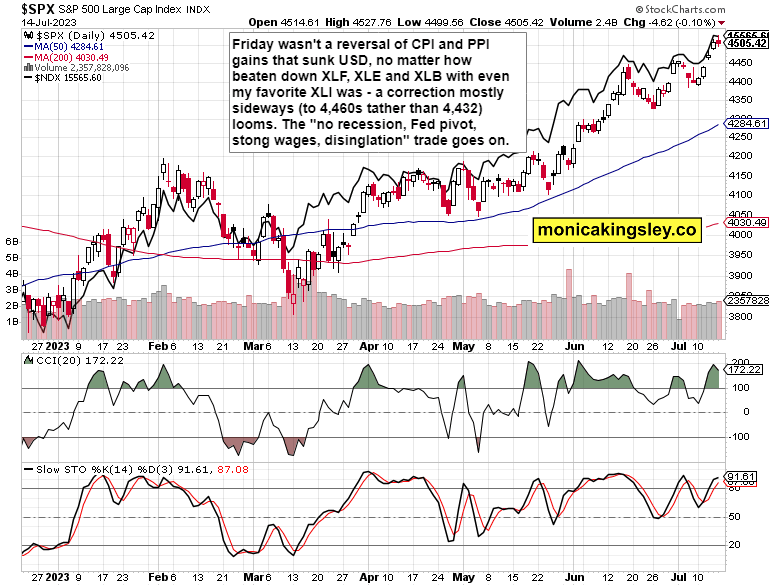

S&P 500 correction ahead

Good Jun inflation data weren‘t really sold into – not even following Fed‘s Friday pronouncements. Markets are acting as if inflation were to stay low and the Fed pivots, as if Jul were to be the last hike.

On that one, I think they have it wrong, and Nov (probably not Sep) would bring another 25bp hike as inflation would make a return in autumn. Crude oil prices are likely to rise into year end, into the $90s while wage growth wouldn‘t get hammered into negative even if unemployment were to exceed high 4%, and reshoring & friendshoring doesn‘t work to bring down costs either.

The still very expansionary fiscal policy is to also to contribute to the resilient consumer, and nominal retail sales wouldn‘t do poorly – discretionaries would see internal rotation while staples would come to the fore as inflation returns – it‘s a question of when, not if.

For now, even banks are starting to look bright – JPM and other earnings weren‘t at all bad. And even if Q4 earnings estimated for the whole of S&P 500 are too optimistic in my view, the improving market breadth and solid rotations both into non-tech and inside tech when Fed hawkishness is disregarded, doesn‘t provide the necessary ingredients for a steep or lasting selloff over the nearest weeks – these are to bring rather good XLI showing after industrials didn‘t break lower in May (and this applies to non-US manufacturing too), XLB and XLE are to keep improving together with XLF that didn‘t break lower following the Mar banking troubles.

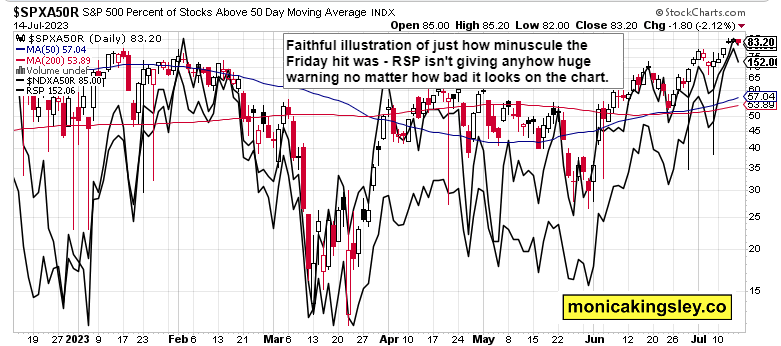

This S&P 500 rally is becoming a rally of more than Top 7 stocks, and it‘s getting entrenched as the disinflationary data aftermath showed. Sure, it‘s on the very optimistic side, coupled with key breakdown in USD below 101-102 without really looking back.

I‘ve discussed much more in Sunday‘s extended video taking 17min, just check it for fiscal policy prospects meeting still tight Fed and earnings projections especialy as regards Q4 – Fed that won‘t cut rates any time soon, and will have to face returing inflation in autumn. Review also my expectations from Empire State manufacturing and retail sales – together with discussion of stock market levels to enter this week.

Finally, I got a question whether I could comment on upcoming NFLX, TSLA and GS earnings. I‘m not looking for the profits and revenue incl. guidance to trigger a downfall. TSLA and NFLX charts look strongest, and if JPM is any guide, GS isn‘t to disappoint. In the aftermath, I see TSLA being bought maybe faster than NFLX, and success for GS would be to start rising from the base, which is also doable.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 5 of them.

S&P 500 and Nasdaq outlook

Friday marks start of a correction at best – and one that would go rather sideways than too much down. I‘m not looking for rotations to really disappoint, or for tech to tank no matter how overvalued AI themed stocks are in the short-term. Not until USD catches breath and rises again, which isn‘t really likely unless Powell talks a good game shortly and Jackson Hole confirms that.

4,460s are the most the sellers can reach in one go, lower targets would need a serious catalyst too – which we aren‘t getting over the days ahead.

Nothing here to show a dramatic drop is knocking on the door – the lasting reaction to inflation data made that clear. If need be, stocks would rather correct in time over price – this broadening breadth is becoming entrenched.

Gold, Silver and Miners

I had been talking increasingly positively precious metals lately, and the reason why is obvious. Comparison of gold to silver miners also speaks about improving sentiment within the sector, a sharply improving sentiment.

Crude Oil

Crude oil is likely to recover from Friday‘s setback in relatively short order – China buying and no recession market narrative together with OPEC+ and overall supply (US shale) situation, warrant that. As $71 didn‘t come into jeopardy, a little squeeze on macro data developed – and sellers aren‘t willing to step in - $73.50 - $74 is likely to hold. The long wait in commodities for upswing resumption, is drawing to an end.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.