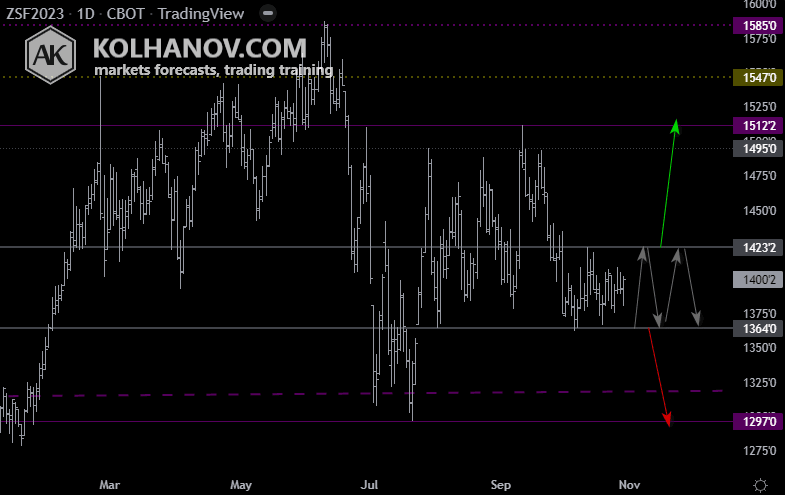

Soybean: The downtrend will start soon

Weekly forecast (November 28 – December 2, 2022)

Uptrend scenario

An uptrend may be expected to continue, while market is trading above support level 1420,4, which will be followed by reaching resistance level 1469 and if it keeps on moving up above that level, we may expect the market to reach resistance level *1512,2.

Downtrend scenario

The downtrend will start as soon, as the market drops below support level 1420,4, which will be followed by moving down to support level 1362,2.

Monthly forecast, November 2022

Uptrend scenario

An uptrend will start as soon, as the market rises above resistance level 1423.2, which will be followed by moving up to resistance level 1512.2.

Downtrend scenario

A downtrend will start as soon, as the market drops below support level 1364, which will be followed by moving down to support level 1297.

Author

Anton Kolhanov

Anton Kolhanov

Anton Kolhanov is a trader and an analyst. He started to study the Forex market in 2003.