Soybean Elliott Wave technical analysis [Video]

![Soybean Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Agriculture/soybean3-637443204454550091_XtraLarge.jpg)

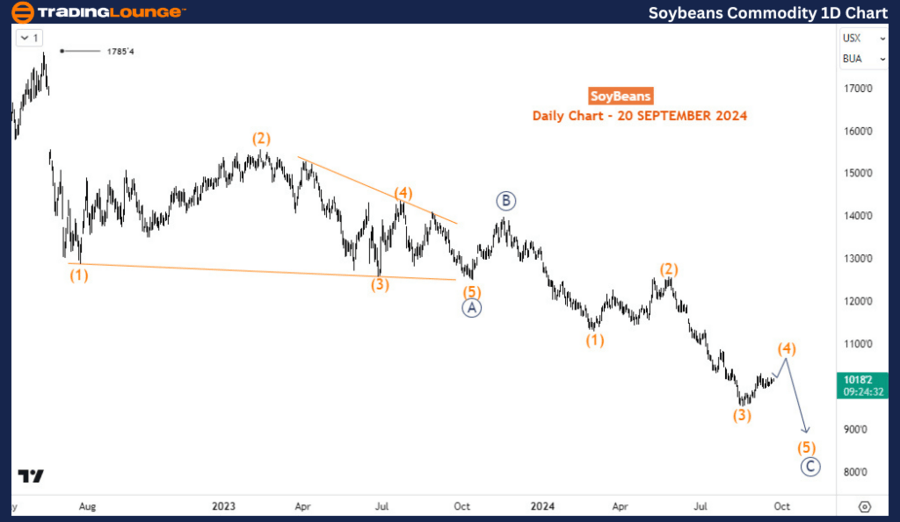

Soybean Elliott Wave analysis

The soybean market is currently retracing within a long-term corrective structure that has developed since the peak in June 2022. While short-term upside potential appears likely, the overarching trend suggests that a significant sell-off is poised to resume, potentially driving prices toward the lows seen in 2020.

Long-term perspective

Before the decline that began in June 2022, soybeans experienced a robust bullish impulse wave starting in May 2019, which propelled prices from approximately $806 to significant highs. However, over the past 26 months, the market has surrendered more than two-thirds of those gains. From an Elliott Wave standpoint, the current corrective phase is forming a three-swing pattern, a typical structure within corrective waves that indicates a complex retracement.

Daily chart analysis

On the daily chart, we observe this corrective structure unfolding at the primary wave degree. Wave A reached its conclusion at $1,249 in October 2023, followed by Wave B, which peaked at $1,398 in November 2023. Presently, we are witnessing the formation of Wave C to the downside. Within this unfolding Wave C, sub-waves (1), (2), and (2) of 5 have already been completed. The market is now experiencing a retracement in Wave (4), currently trading above the significant level of $1,000. A key question arises: how high can this Wave (4) rally extend?

Four-hour chart analysis

Zooming into the H4 chart, we find that Wave (4) has completed its first sub-wave, denoted as Wave A. The bullish reaction observed since September 11, 2024, suggests that Wave B may have concluded. For confirmation that Wave B has indeed ended and that we are transitioning into Wave C, the price must break above the high of Wave A. Should this scenario play out, we could expect Wave C to advance toward the $1,070 level. Alternatively, if the price fails to surpass the high of Wave A, it may indicate that Wave B is set to make another minor leg down, dipping slightly below $1,000 before establishing a solid support base to initiate Wave C.

Soybean Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.