Sneaky sellers

S&P 500 had the opening upswing sold into heavily, Nasdaq kept underperforming – and we have key tech earnings with CB consumer confidence and JOLTs data. Equally worryingly, good bond auctions saw their upswings sold into, and S&P 500 market breadth was nothing to call home about.

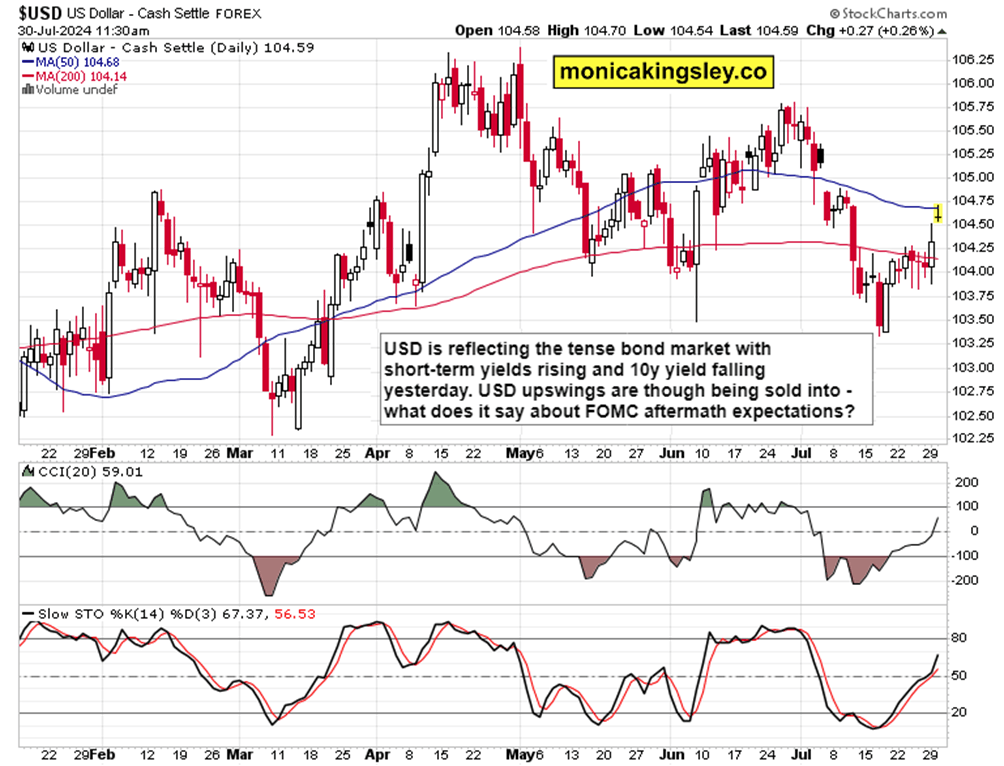

It seems that FOMC turbulence is being pulled forward a bit, and what I had foreseen as regards Russell 200 (bout of underperformance of Nasdaq), also came true. I doubt that Powell would bring too much relief to equities (too much is the key phrase here), and instead we might see VIX and defensive posture finish its job (its larger move underway) – more details and expectations as usual reserved for clients, I‘ll just say that S&P 500 sectoral view lacked clear thematic leaders (XLC itself doesn‘t cut it).

Let‘s mve right into the charts.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.