Snapback rally and bouncing Dollar

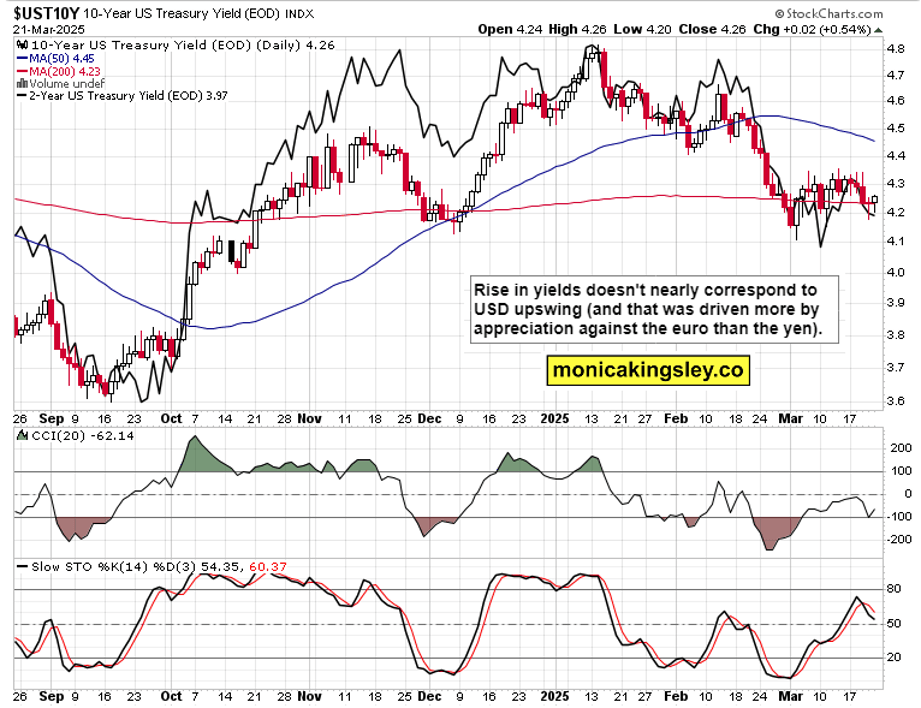

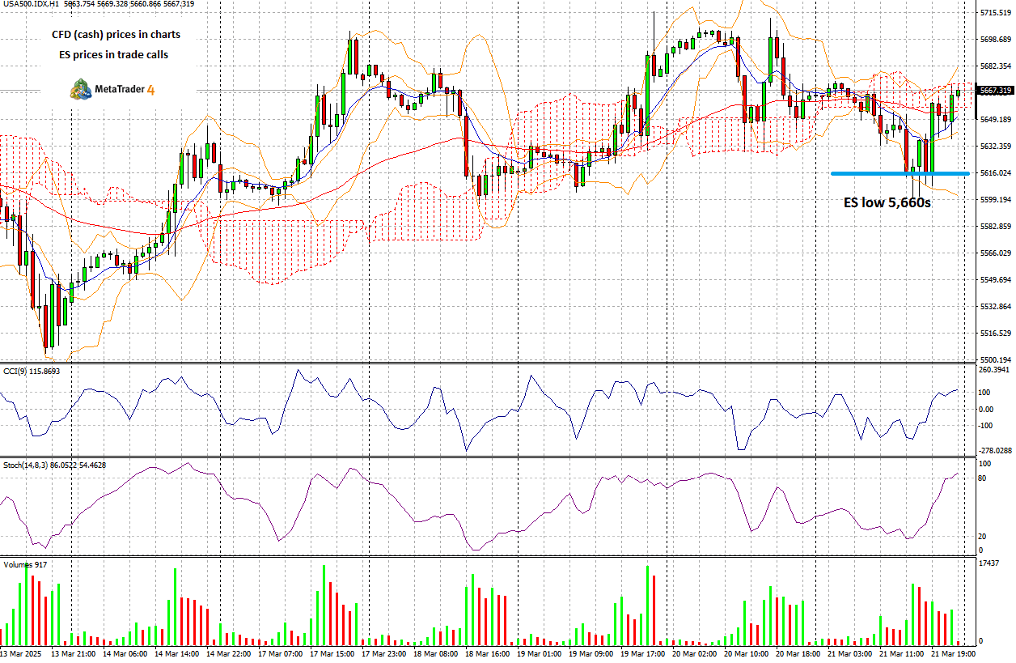

S&P 500 went for the second support of 5,660s given, and gradually worked its way higher as befits my solid progress of ES bottoming call, reiterated throughout the week while taking advantage of pretty technical setups such as 5,760s resistance holding. The defining factor of this week had been Fed taking down QT to $5bn only coupled with greater certainty on rate cuts ahead – but it can be argued that a more easy money policy would be in place. Still, it allowed for stock market run all the way through Wednesday‘s conference, and folowing the retracing all of that move Thursday, very constructive bottoming price action on Friday‘s triple witching.

Especially the buying into the close had been very constructive, together with the sectors that have led – all talked within your extensive weekend video, I‘m covering volatility and USD signs for risk-taking and money flows pointing again back into the US. Gold, silver and copper with Bitcoin are also discussed at length – but the real crux to chime in is whether stocks are consolidating here before grinding up (even snapping back higher), or carving out a bearish chart pattern. As I have said many times already, if stocks wanted to tank, they would do so on stagflationary, record bad UoM consumer data or continued tariff news barrage – and that isn‘t happening, 5,660s are tellingly holding, and weekend action in cryptos is also encouraging.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.