Smelling blood

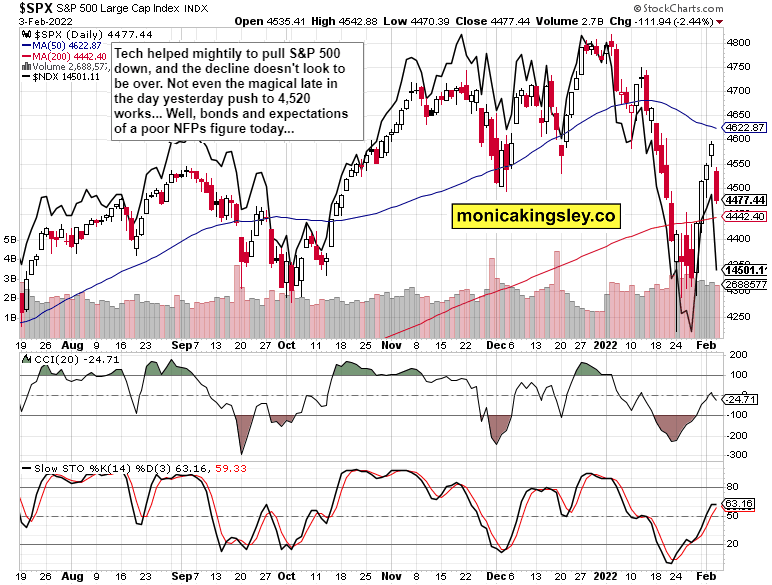

S&P 500 is grinding lower, and bonds concur. Risk-off posture and rising yields aren‘t tech‘s friend really, and the VIX is back to moving up. The odd thing is that the dollar wasn‘t well bid yesterday as could have been expected on rising rates – the sentiment called for a bad non-farm payrolls number today. Understandably so given Wednesday‘s preview, and the figure would just highlight how desperately behind the inflation curve the Fed is, what kind of economy it would be tightening into, and shine more light on its manouevering room for Mar FOMC.

Fun times ahead for the bears, and the S&P 500 short profits can go on growing – the ride isn‘t over: If tech – in spite of the great earnings Amazon move – gets clobbered this way again on the rising yields, then we could very well see even energy stocks feel the initial selling wave. Not that value stocks would be unaffected, to put it more than mildly – just check yesterday‘s poor showing of financials. Something is going to give, and soon.

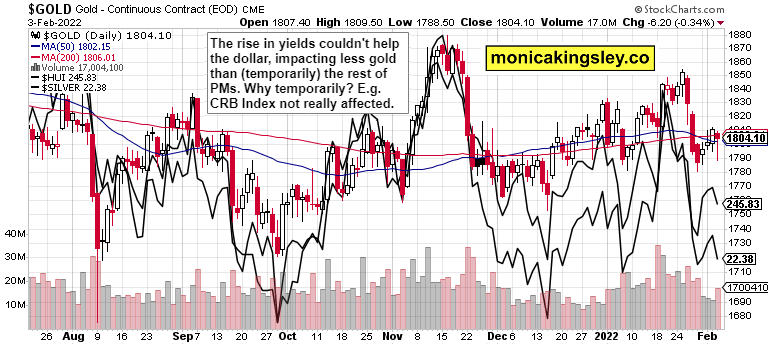

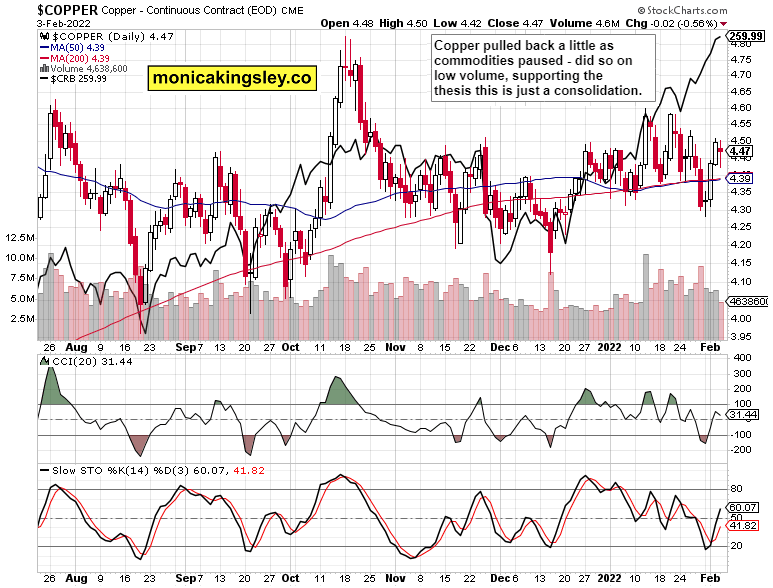

Precious metals are holding up relatively well, regardless of the miners‘ weakness. Commodities can go on enjoying their time in the limelight – crude oil is not even momentarily dipping, and copper stands ready to keep probing higher values within its still sideways range. Even cryptos are benefiting from what could almost be described as a daily flight to safety.

As I wrote in extensive Monday‘s analysis and repeated since, stiff winds are still ahead in spite of the soothing verbal pause in tightening. As the 467K figure just in beats expectations, the Fed gets its justification to withdraw liquidity any way it pleases.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

S&P 500 bulls are getting slaughtered, and the downhill path is likely to continue, thanks to tech. Brace for a volatile day today.

Credit markets

HYG selling pressure made a strong return, predictably. Credit markets are leading stocks to the downside, certainly.

Gold, silver and miners

As written yesterday, all this risk-off already in and still to come, is failing to press gold and silver really down – and that tells you the true direction is up. The downswings are being bought.

Crude oil

Crude oil bulls in the end didn‘t waver, and are pushing higher already – the upside breakout can really stick.

Copper

Copper is back to the middle of its recent range, still positioned for an upside breakout. It would take time, and precede the precious metals one. Rising commodities are sending a clear message as to which way the wind is blowing.

Bitcoin and Ethereum

The crypto bears didn‘t get far, and it looks like we‘re back to some chop ahead.

Summary

S&P 500 bulls are getting rightfully challenged again – the Fed hikes are approaching. See though how little are commodities and precious metals affected. Meanwhile the S&P 500 internals keep deteriorating. Today‘s analytical introduction is special in talking the non- farm payrolls and Fed tightening dynamic, and explains why the pressure in stocks to probe lower values, is still building up, and that 4,450 may not be enough to stop it. For all the pause in Fed hawkish jawboning, the tightening cycle is merely getting started, and today‘s surprisingly strong data gives the Fed as much justification as the quickening wage inflation. I hope you enjoyed today‘s extensive analysis and yesterday‘s risk exposure observations. Have a great day ahead!

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.