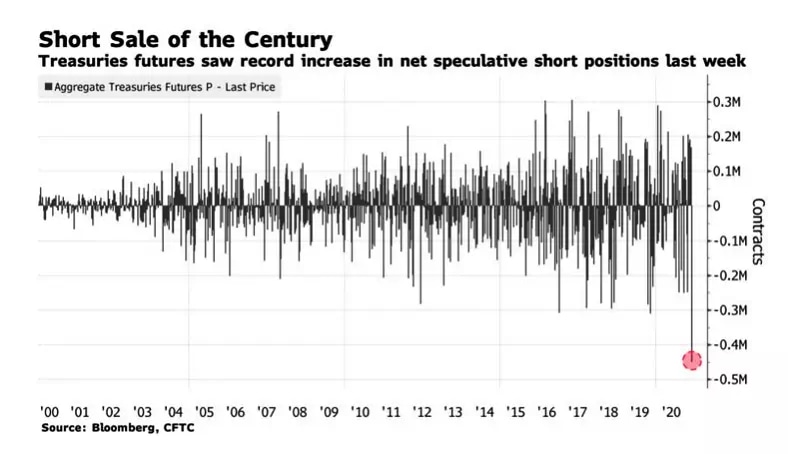

Small speculators pile into treasury shorts, is a short squeeze coming?

Across the yield curve, small speculators have plowed into Treasury short positions.

Treasury Bear Frenzy

Bloomberg reports Treasuries Bear Frenzy Was the Biggest on Record Last Week.

Bond bearishness hit a record level last week as investors piled into short bets on Treasuries.

An aggregate gauge of the change in net non-commercial positions across the Treasuries futures curve dropped by the most on in record, according to the latest Commodity Futures Trading Commission data. The change was equivalent to $45 billion in benchmark Treasuries net short positions, according to TD Securities strategist Penglu Zhao.

“Specs piled into shorts across the curve last week as the market became agitated on Fed tapering and early hiking risks,” Zhao wrote Friday. “Dealers and levered funds were net buyers, while asset managers and other investors are net sellers.”

Barchart 10-Year Treasury COT

That is a chart of 10-Year Treasuries courtesy of Barchart.

On the surface the above chart looks extremely ordinary.

Shorts are nowhere near record levels as you can by looking at the red line (commercials) who take the opposite side of the speculators.

Closer inspection of the data is more interesting.

The commercial traders are only net long 278,002 contracts now vs. 852,899 on August 20. We are not close to a record now.

But look who is leading the way. Small speculators are net short a whopping 182,391 contracts.

CotBase 10-Year Note Futures

CotBase has a subscription but it does provide one year for free. It plots small speculators on a different scale.

It's the small specs who are plowing into the shorts on 10-Year Treasuries.

I went back 5 years on Barchart and I do not spot a larger short position by the small specks on this contract.

CotBase 5-Year Note Futures

CotBase 30-Year Bond Futures CotBase Interest Rate Complex 2021-03-04

CotBase Interest Rate Complex

Small Specs Lead the Shorting

It's pretty clear who is leading the way on interest rate futures and it is also clear why.

- Powell Confirms Easy Money Until the Cows Come Home

- Deficits are rising as a $1.9 Trillion Covid Spending Compromise Just Passed the Senate

- Fed Hubris: Housing Prices Show the Fed is Making the Same Inflation Mistake

The concern is easy to see, too easy in fact. Futures trades so "obvious" that small specs pile on in record numbers don't get rewarded for long.

I suspect a strong rally in bonds will soon wipe out the latecomers into these trades.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc