Slower labor cost growth continues to help the inflation fight

Summary

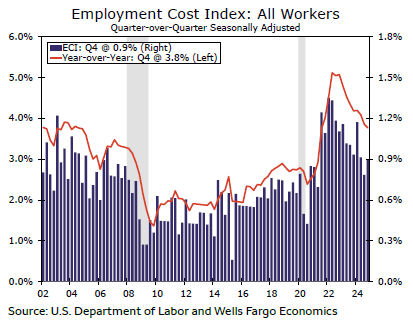

The fourth quarter Employment Cost Index (ECI) gave another indication that the labor market is no longer a major threat to the Fed achieving its 2% inflation goal. The ECI advanced 0.9% in the fourth quarter, boosted in part by further solid increases in private union and public sector pay. Yet the ECI slowed to 3.8% year-over-year, which is near the realm consistent with the Fed's 2% inflation target once accounting for the stronger pace of productivity this cycle.

Compensation costs continue to ease

The fourth quarter reading on the employment cost index (ECI) offered further evidence that the cooler jobs market is reducing upward pressure on inflation. Employment costs rose 0.9% in the fourth quarter, in line with expectations. Over the past year, compensation costs have risen 3.8% (chart). While that remains notably stronger than the past cycle's peak of 3.0%, it has neared the realm consistent with the Fed's 2% inflation target once accounting for the stronger pace of productivity this cycle (productivity growth allows businesses to raise compensation faster than selling prices).

The continued moderation in the ECI, the Fed's preferred barometer of compensation cost growth, looks a little friendlier for the Fed's inflation fight than the most recent readings of average hourly earnings (AHE) from the monthly Employment Situation report. Annual growth in hourly earnings averaged 4.0% in the fourth quarter, up two tenths from the prior quarter. Unlike the more volatile AHE figures, however, the ECI controls for compositional shifts in the employment base along industry and occupational lines. It also includes state and local government workers as well as benefits (about 30% of compensation), making it a more encompassing measure of labor costs.

Author

Wells Fargo Research Team

Wells Fargo