Silver Elliott Wave technical analysis [Video]

![Silver Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Silver/silver-coin-and-bullion-bar-21936522_XtraLarge.jpg)

Silver Elliott Wave analysis

Silver breached the August 26, 2024 high to continue the recovery since 6th August. It’s almost inevitable that the commodity will attempt a breach of the 20th May high leading to a fresh high for the year. It’s been a very active year as the commodity rallied from around $24 in a nearly 40% gain since January 2024. Buying the dips is still the best way to go on this commodity.

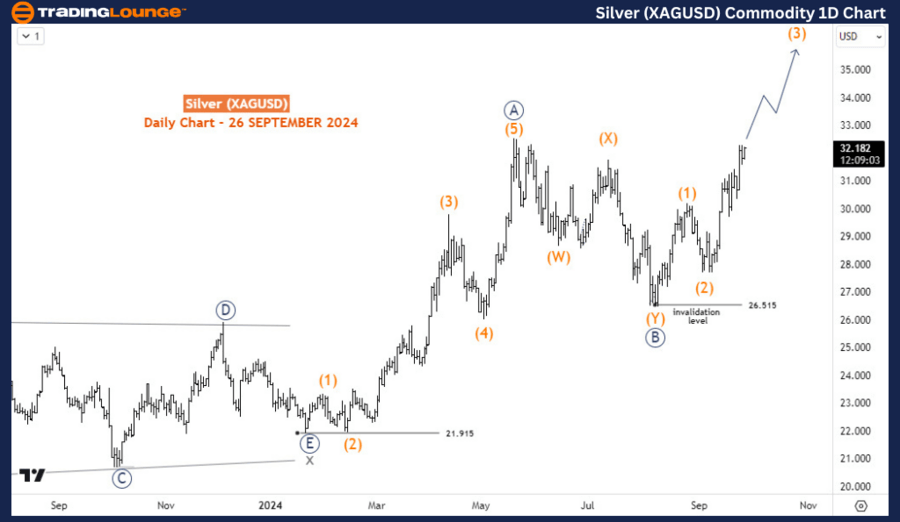

Daily chart analysis

From 22 January, Silver prices started an impulse wave sequence or at least a long-term 2-swing bounce. Wave A or 1 (circled) was completed at 32.5 on 20 May 2024 after an impulse wave structure was completed. A pullback followed in a double zigzag structure to complete wave B or 2 (circled) oat 26.5 on 6th August 2024. From 26.5, wave C or 3 (circled) began and should evolve into a 5-wave structure—Wave (1) and (2) were completed in late August and early September respectively. price is in wave (3) which should extend to prices around $34 (a new 2024 high) or even above before the next pullback in (4) begins. The longer-term target is between 37 and 42. With this potential, buying the pullback is the way to go for traders.

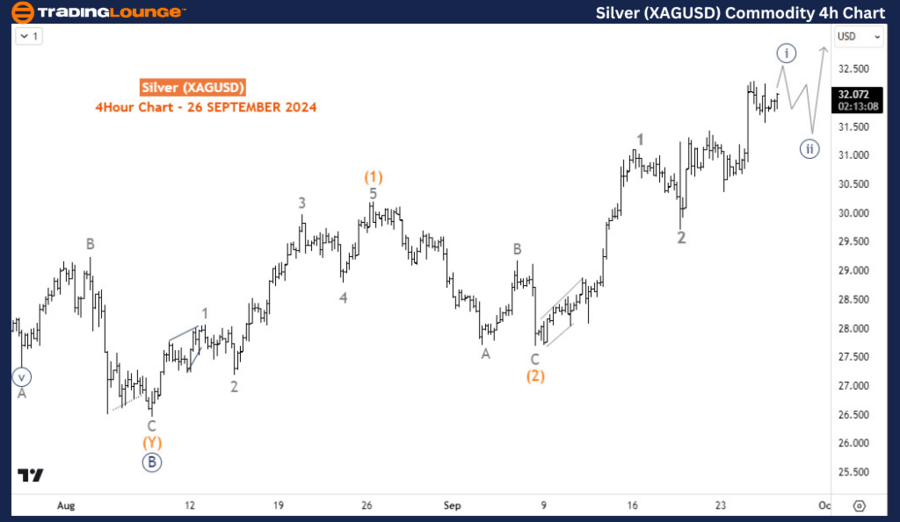

Four-hour chart analysis

The H4 chart shows the sub-waves of wave (3). Price has already completed waves 1 and 2 of (3) and is now in wave 3. Going to the lower degree, it appears the commodity is in an impulse structure for wave i (circled) of 3 and should make a pullback for ii (circled) before returning upside. Thus, traders can find fresh buy entries from waves ii & iv (circled) of 3 and from the wave 4 pullback in the short and medium term.

Silver (XAG/USD) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.