Silver to soar: Not like miners

Silver tends to outperform gold in the final parts of its rally, which means that it might be about to soar.

Market signals and timing

Gold price just moved above $2,800 but both: silver and mining stocks are down – the latter much more visibly. This kind of price action is usually caused by geopolitical turmoil, and this time it seems that it’s the political battle in the U.S. that might be causing concerns triggering safe-haven demand.

If so, then we know when the peak-uncertainty is going to happen – next week, right before the outcome of the U.S. presidential elections is known (at least to a high degree of probability). This means that gold might peak then. And since we have several more days to go, it also means that we have room for further price moves.

This also means that the very final days of this rally are likely still ahead, and thus that silver’s final outperformance is likely also ahead.

Consequently, today’s move down in silver and miners doesn’t necessarily mean that silver’s rally is completely over just yet.

Compared to the beginning of the previous week, gold is up, miners are down (visibly so), and silver is down just a little. Miners are underperforming, just like they have been likely to before or at the top – which tells us that we are close.

In the last day or two of the rally, junior miners might catch up, but it’s not necessary and not as likely as silver’s catch-up. Speaking of miners, please note that they just invalidated the move above their mid-2021 high.

That’s a bearish sign.

The USD Index also suggests that the rally in the precious metals might not be completely done yet.

The USDX encountered resistance at its July high, and since it’s after a sharp, short-term rally, a pullback is due. This is, in turn, likely to lead to higher precious metals prices, at least initially. This fits the U.S.-election-uncertainty-based theory that PMs have several days of higher prices ahead of them.

There’s one more thing regarding the silver market that I’d like to share with you. Namely, there was a margin hike in the silver futures market. CME raised it by 4.3%, effective after Oct. 25.

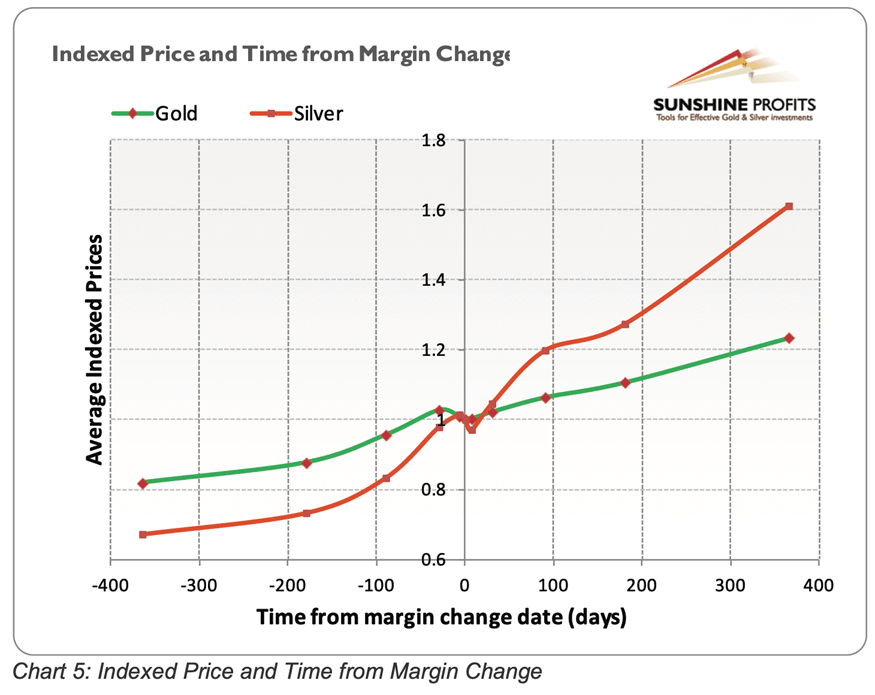

Based on previous research (the dataset is over ten years old, but it’s still useful), margin hikes in silver tend to cause only short-term declines (on average).

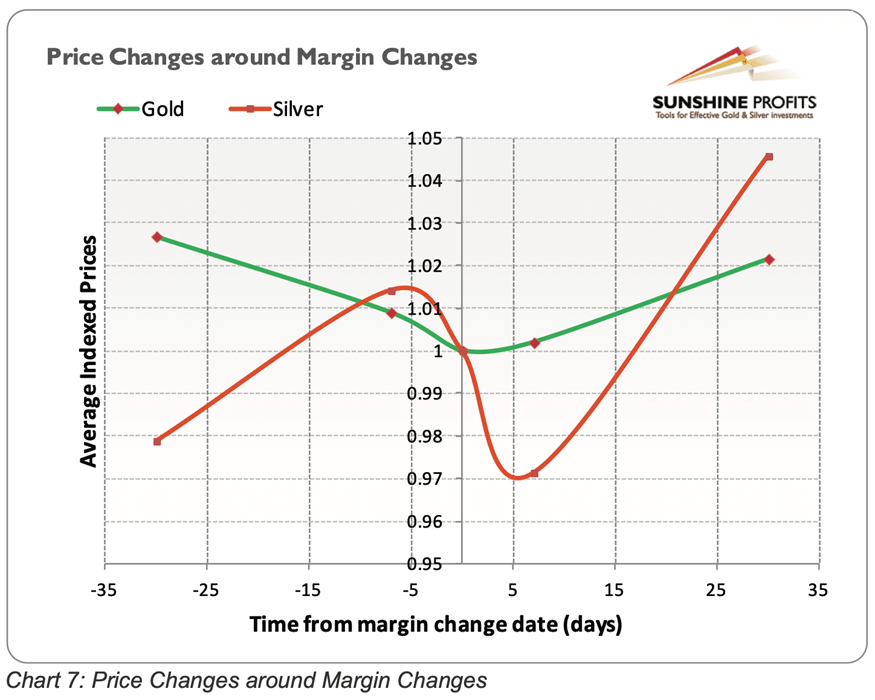

The changes are only seen in the near term. Zooming in allows us to see what’s really going on.

The negative effect of the margin hike tends to extend five days after the hike. This means that the negative effect is about to end.

Consequently, silver price might indeed rally in the next several days before topping in a big way.

This means that our trading positions remain very much up-to-date and likely put us in the optimal risk-to-reward zone.

Also, let’s keep in mind that the upcoming silver top is likely to be of medium-term important, not long-term one. Silver is still likely to soar profoundly in the upcoming years.

Key resistance and potential decline

Silver approximately reached its 61.8% Fibonacci retracement that’s based on the 2011 – 2020 decline. This is a major resistance level, that can – and it likely to – trigger significant declines.

Also, please note that silver is at its long-term cyclical turning point (the vertical lines) and in the last several cases (in the past decade) they were all tops.

Still, both techniques can work on an approximate basis, and silver is known for its fake breakouts. This means that if the precious metals sector is indeed going to rally one final time (I’m talking about days, not weeks or months), then silver could still rally – the above chart doesn’t invalidate that.

What it does show, however, is that a medium-term decline is likely just around the corner.

The long-term potential for silver remains intact, though. Speaking of which, the silver bond offer (silver’s performance plus 12% per year for three years) that we’re featuring in the “investment” part of the portfolio is expiring. I mean the offer is being completed and new applications to it won’t be processed.

And while we’re in the long-term realm, please keep in mind that throughout the years, we’ve been featuring full position in case of our insurance capital in gold. If you joined recently and haven’t looked into the benefits of having some money parked in gold as insurance, I strongly encourage you to do so. Trading is one thing, and I’m writing about the short-term price moves on a daily basis simply because that’s where the action is. However, it doesn’t make keeping some capital employed into gold for security’s sake any less important.

If you’re in the U.S., you might be interested in the additional tax savings that come with having gold as a part of a gold IRA. In fact, you haven’t looked into it, I encourage you to do so, because this might make a big difference over time. One company that handles gold IRAs and has great reviews in multiple rankings is Augusta Precious Metals, so if you’d like to proceed with learning more about gold IRAs or establish one, I suggest that you see what they have.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any