Silver sinks below 30.00

-

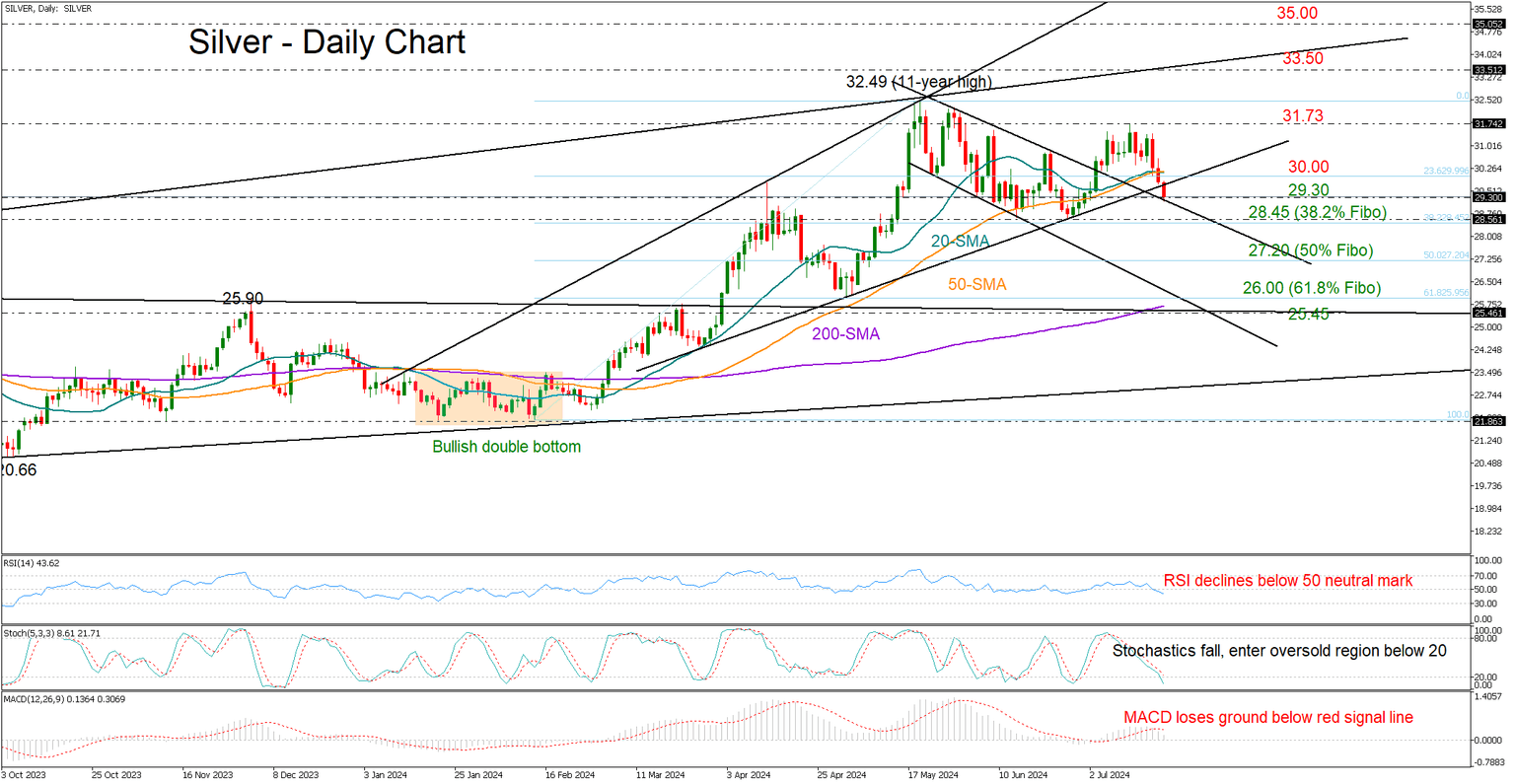

Silver erases June’s gains; eyes on 28.50.

-

Technical signals favor the bears.

Silver’s performance took a hit, marking its worst week in 2024 as the US dollar switched to recovery mode and investors questioned China’s economic outlook. As a result, the metal swiftly reversed a substantial part of its June upswing in just three days and is currently trading near 29.24, correcting by around 10% from May’s 11-year high of 32.49.

The former resistance trendline drawn from May’s peak is currently under examination at 29.30 and a break below it could immediately squeeze the price towards June’s base of 28.55. The inclusion of the 38.2% Fibonacci retracement of the February-May upleg at 28.45 strengthens the region’s significance. Hence, failure to pivot there could prompt a faster decline towards the 50% Fibonacci mark of 27.20. Should the 27.00 round-level prove fragile too, the next stop could be around the 61.8% Fibonacci of 26.00.

With the 20- and 50-day SMAs posting a negative cross and technical indicators falling, a substantial rebound seems unlikely at the moment. Nonetheless, with the stochastic oscillator dipping below 20 into the oversold territory, downward pressures might not endure for long.

For the outlook to improve, the price must reclaim the 30.00 mark, where the 20-day SMA and the 23.6% Fibonacci number are placed. If bullish efforts prove successful, the recovery phase could expand towards July’s high of 31.73, and then up to the top of 32.49. Even higher, the bulls might peak around the ascending trendline drawn from December 2022 at 33.50 or near 35.00.

To summarize, silver may face a negative situation in the near future, but bulls will have start to worry more if the price drops below 28.45.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.