Silver primed for surge as renewable energy and electric vehicles drive demand

Silver, a metal of many facets, has illuminated the path to technological advancements and ecological sustainability. Its inherent properties make it indispensable in industries that uphold the highest reliability, precision, and safety standards. Silver’s role becomes increasingly pivotal as the world pivots towards greener energy and innovative technological solutions, profoundly influencing market dynamics. Based on the technical breakout, the silver is primed for surge.

Silver applications in renewable energy and electric vehicles

The pivot to renewable energy sources, particularly photovoltaics, has amplified the demand for silver. The photovoltaic industry relies heavily on silver for producing solar panels and is a significant metal consumer. Thus, the push for renewable energy solutions has become a direct driver of silver consumption, propelling the metal to a position of strategic importance in the global push for clean energy.

In parallel, the automotive industry is undergoing a revolutionary shift from traditional combustion engines to electric vehicles (EVs). This transition is not quiet; it resounds through the silver market, promising increased demand for the metal. EVs rely on silver for their batteries and many electrical applications, cementing silver’s role in the future of transportation.

Market trajectories and technical insights

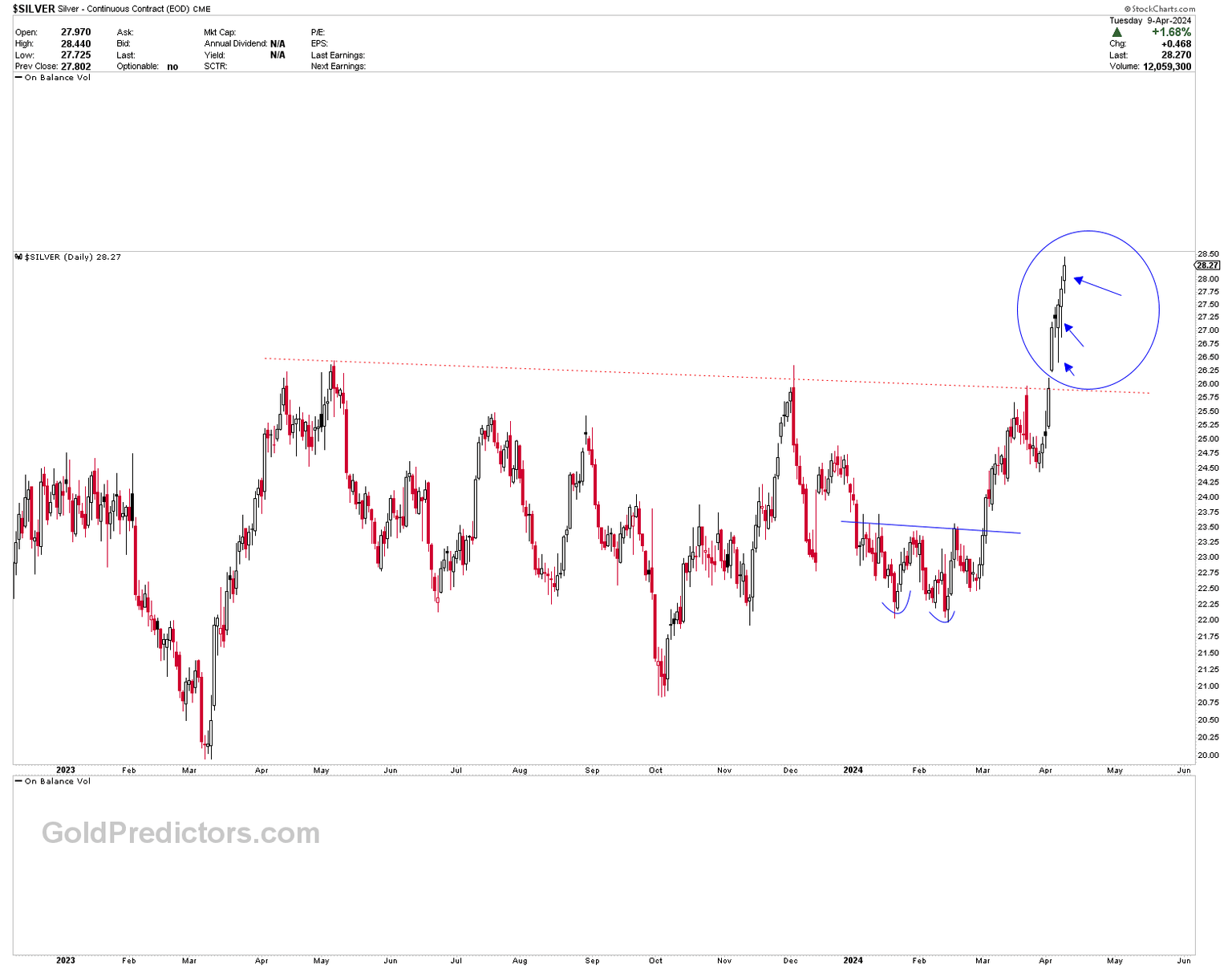

An examination of the weekly silver market chart below reveals a noteworthy development: breaking a long-term trend line following a triple bottom pattern. The significance of this move cannot be overstated, as it follows a fundamental pattern indicative of market confidence and the potential for a bullish future.

The pivotal moment came with the breakout from the $26.50 neckline, suggesting the market is unlocking the potential for higher silver prices. It is not the breakout that holds the market’s attention but the ensuing price action. Consistent higher bottoms on short-term charts suggest an upward trend, reinforcing the notion of silver’s impulsive waves in the market.

The underpinning of this rally can be traced back to a strong foundation—a robust inverted head-and-shoulders pattern identified on the silver chart in 2020. The consequent breakout from this formation propelled silver prices to loftier heights, with a projected uptrend indicated by a conspicuous red arrow on the chart. This projection indicates that silver is primed for surge.

Short-term daily chart observations lend further credence to bullish sentiments. A wick marks each daily candlestick, indicative of prices consistently closing at higher levels—a bullish market behavior underscored by blue arrows on the charts. This suggests an ongoing trend of bullish price action and the prospect of higher prices.

However, it’s crucial to note that silver trades at levels that suggest overbought conditions, which traditionally signal an impending price correction. Far from a cause for alarm, this anticipated correction is viewed by seasoned traders and long-term investors as a strategic buying opportunity—a chance to solidify positions in a market with robust long-term prospects.

Strategic considerations for market participants

The current scenario presents a dual-edged sword for those engaged in the silver market. On one side, bullish trends and technical patterns forecast a bright future, inviting increased investment and holding strategies. On the other hand, the potential for short-term price corrections necessitates a cautious approach primed for opportune buying moments.

While seemingly poised for growth, the market’s trajectory will require careful navigation. Premium members can look forward to receiving exclusive short-term and medium-term trading signals that pinpoint opportune moments based on the market’s ongoing dynamics.

Conclusion

Silver’s entwined destiny with renewable energy and electric vehicles is an unmistakable signal of its ascending market relevance. As the world tilts towards sustainable solutions, the shimmering prospects of silver grow ever brighter, painting a picture of metal not just valuable for its luster but for its potential to catalyze global change.

The silver market stands at a threshold, buoyed by solid applications and technical indicators that herald a bullish future. For those who monitor the pulse of this market, the coming period is one of strategic opportunities as silver is primed for the surge. In this era, the wise leverage the tides of change, and silver shines as a beacon of industrial and ecological progress. Despite the overbought conditions, the market will likely continue higher based on the solid breakout. However, price corrections will only provide buying opportunities.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.