Silver has topped [Video]

![Silver has topped [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Silver/silver-coin-and-bullion-bar-21936522_XtraLarge.jpg)

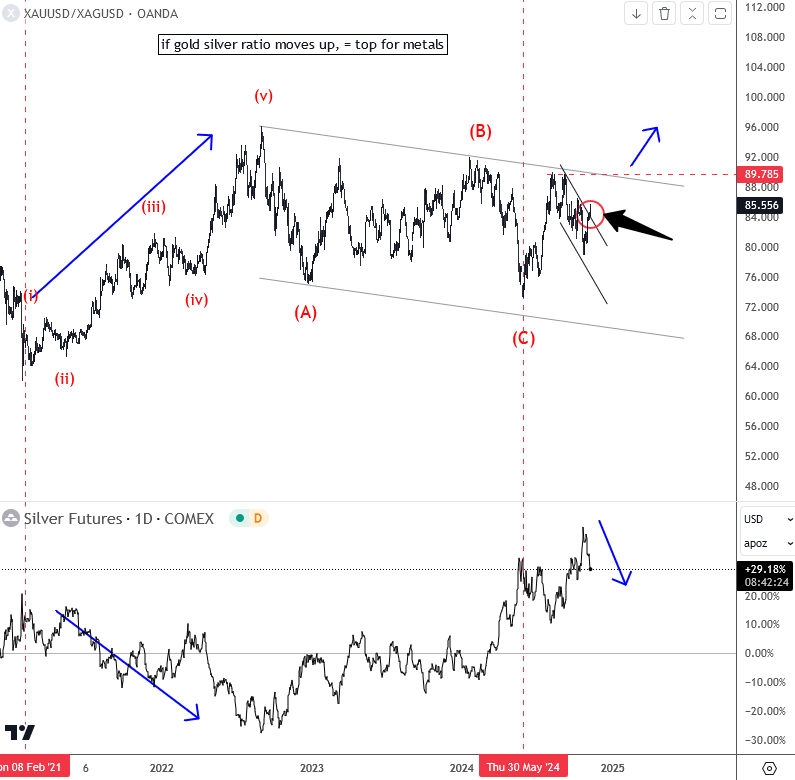

A few weeks back, we saw silver break up toward $34 and $35, marking what looked like the final stages of a larger impulsive recovery. Sentiment was extremely bullish at that time, which led us to consider it might be the end of the cycle. We highlighted this bullish setup and noted a potential peak, even posted some charts on twitter.

Since then, we’ve seen a strong reversal in silver, due to strong dollar rebound following Trump’s election win. The strengthening dollar and rising USD/CNH, have added downside pressure on metals. Keep in mind that CNH and Metals will normally have positive correlation, so if USD/CNH continues to rise, we can expect metals to face further declines (check this video)

It’s notable that silver’s recovery from November 2023 until October this year might have accomplished with an ending diagonal—a classic reversal pattern. This suggests silver could retrace significantly, potentially back to the pattern’s origin. The sharp drop from October’s highs indicates that silver may now be entering a higher-degree correction, with further declines likely after short-term rallies.

For a detailed view and more analysis like this, you may want to watch below our latest video analysis from November 08 2024:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.