Silver Elliott Wave technical analysis

Silver Elliott Wave analysis

The current dynamics in the silver market present an intriguing opportunity. Silver is completing the recovery from the pullback that began in late May 2024. This recovery is expected to spark a series of rallies, continuing the year-long bullish impulse cycle. Both long-term and medium-term Elliott Wave forecasts indicate further upward movement for this precious metal.

Daily chart analysis

On the daily chart, the impulse wave sequence that began in January 2024 concluded in May 2024, followed by a corrective pullback. The impulse sequence is labeled as wave A (circled), and the subsequent pullback is labeled as wave B (circled). Following wave B (circled), wave C (circled) is expected to develop into another impulse wave structure similar to wave A (circled), with the potential to reach $38 in the coming weeks.

Alternatively, the anticipated bullish reaction could complete another corrective bounce instead, potentially extending wave B (circled) lower in a double zigzag structure.

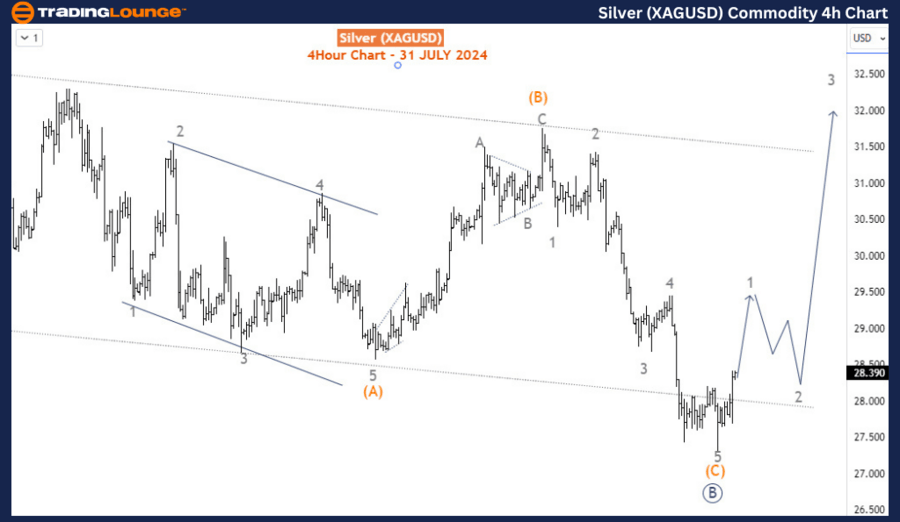

H4 chart analysis

The H4 chart provides a closer examination of the sub-waves within wave B (circled), showing the completion of a zigzag price pattern. The initial rally is expected to form an impulse wave, completing wave 1 of (1) of C (circled). This bullish move should target at least the $30 key level, followed by a pullback, and then a stronger rally for wave 3 of (1). Conversely, if a corrective response occurs, it could lead to a deeper bearish pushback for silver.

Summary

In summary, the Elliott Wave analysis for silver suggests that the current recovery phase is setting the stage for significant rallies. Key levels to monitor include the $30 level and the potential high of $38. Traders should be prepared for the completion of wave B (circled) and the subsequent bullish wave C (circled). By keeping an eye on wave patterns and critical price levels, traders can anticipate future movements in the silver market and make informed decisions to capitalize on the expected uptrend.

Technical analyst: Sanmi Adeagbo.

Silver Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.