Silver beats sentiment

S2N spotlight

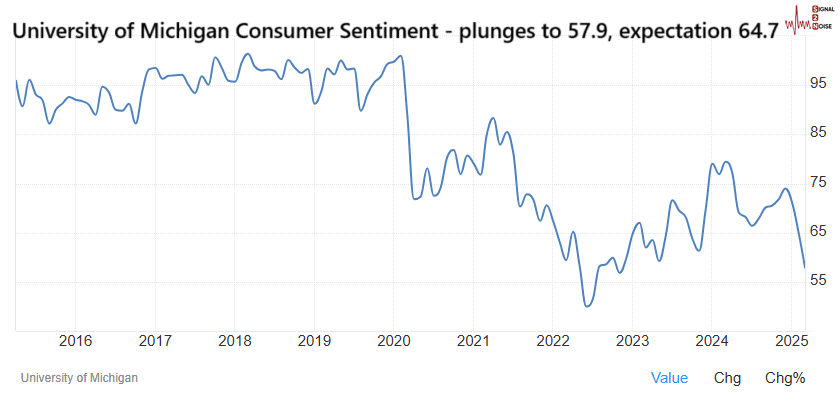

On Friday, the University of Michigan released their preliminary March numbers. Sentiment is so bad it makes my mother-in-law look happy. Things have taken a bad turn.

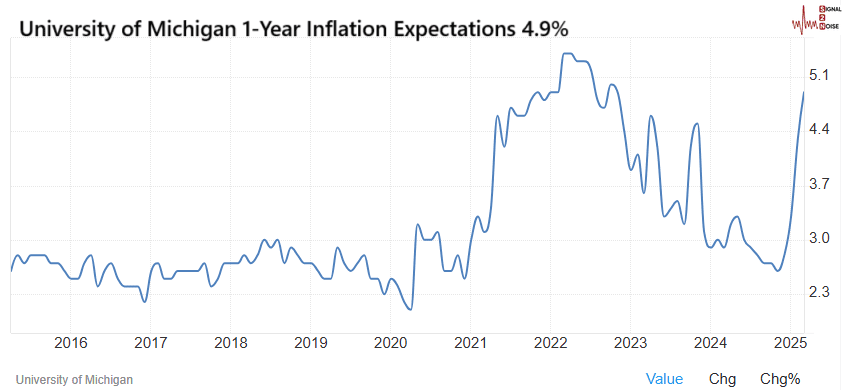

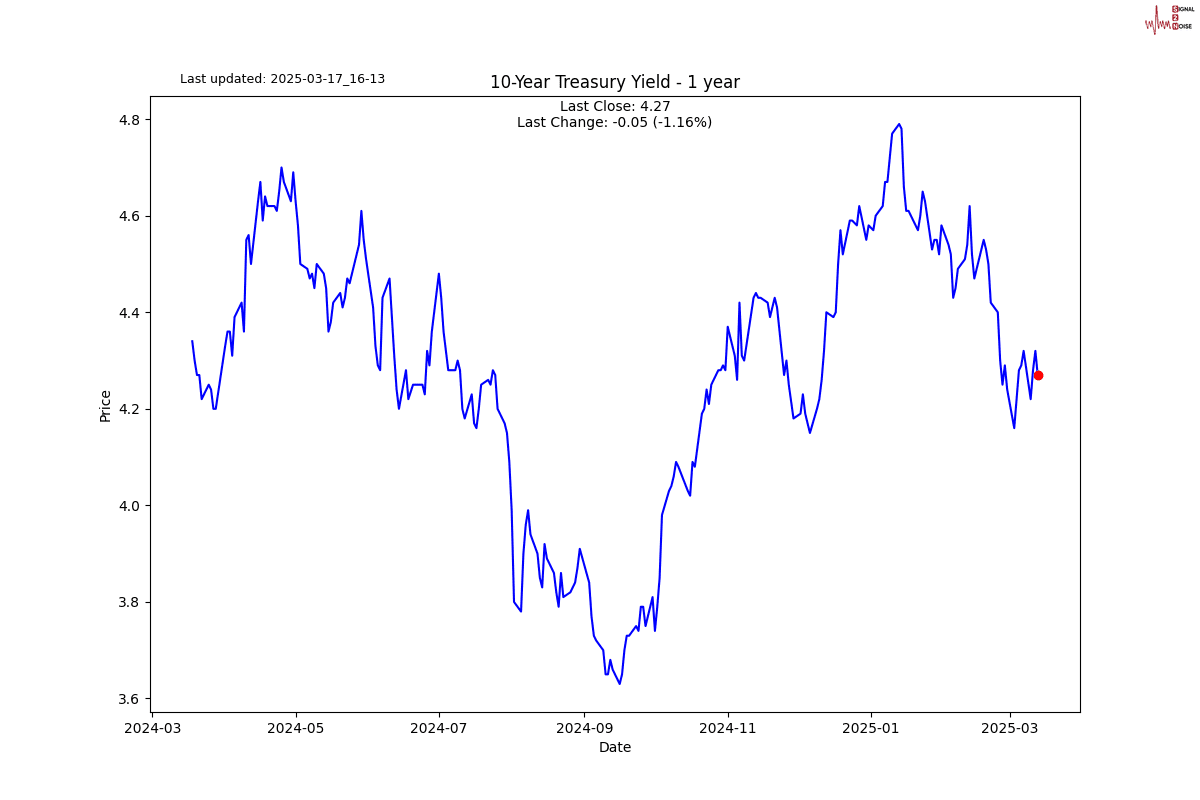

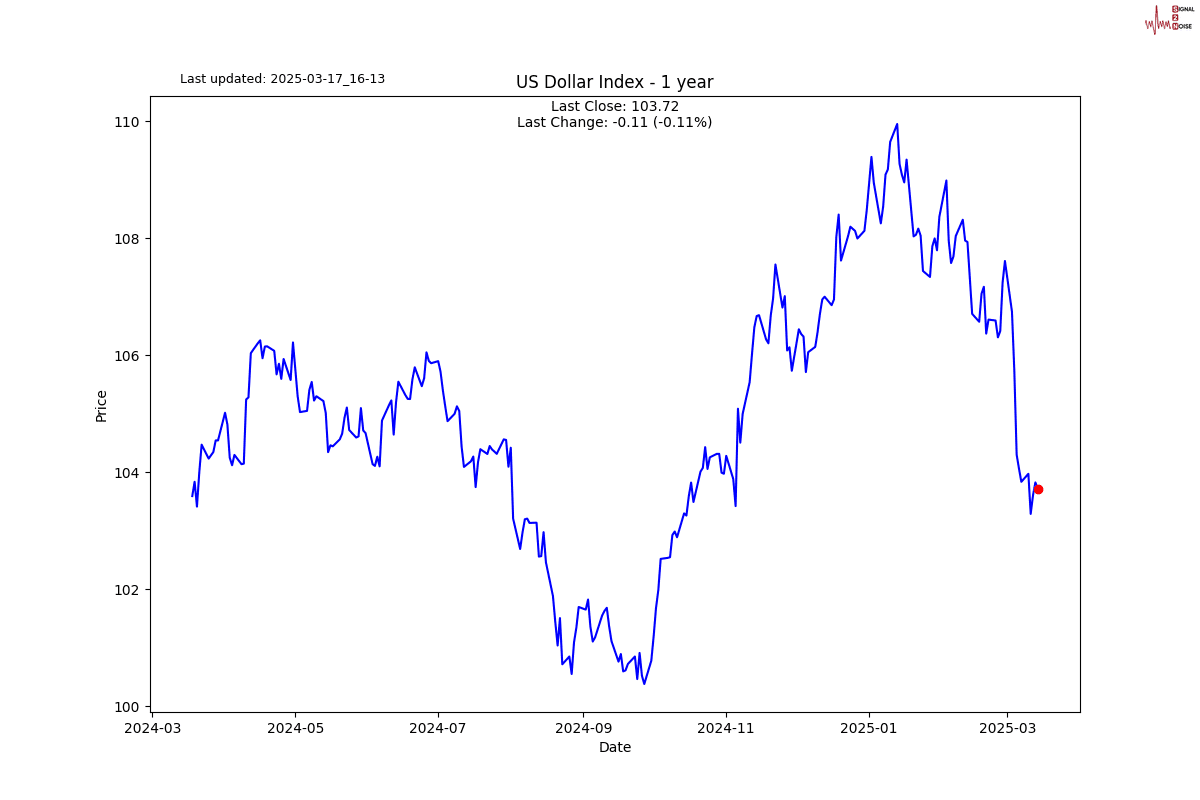

To make matters worse, no doubt driven by tariffs, the 1-year inflation expectation is sitting at 4.9%. The Fed is in a bit of a pickle. Firstly, inflation expectations are self-fulfilling to a large degree. If you are a businessman expecting the cost price of your goods to go up, you are likely to hike your prices. If you are an employee and you believe the cost of living is going up, you are likely to demand higher wages. Then comes the issue for the Fed with their made-up inflation target of 2%. To cut further, when inflation is above and going up from its inflation target, there is very little chance the Fed can cut rates and look itself in the mirror.

S2N observations

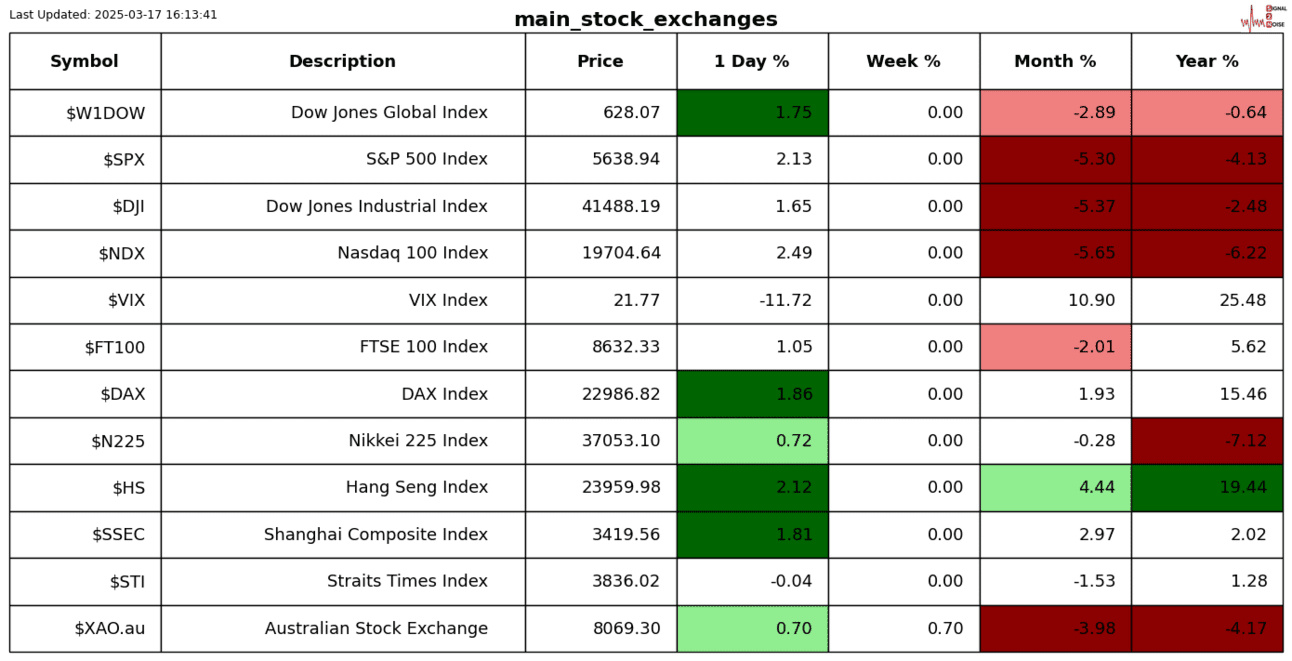

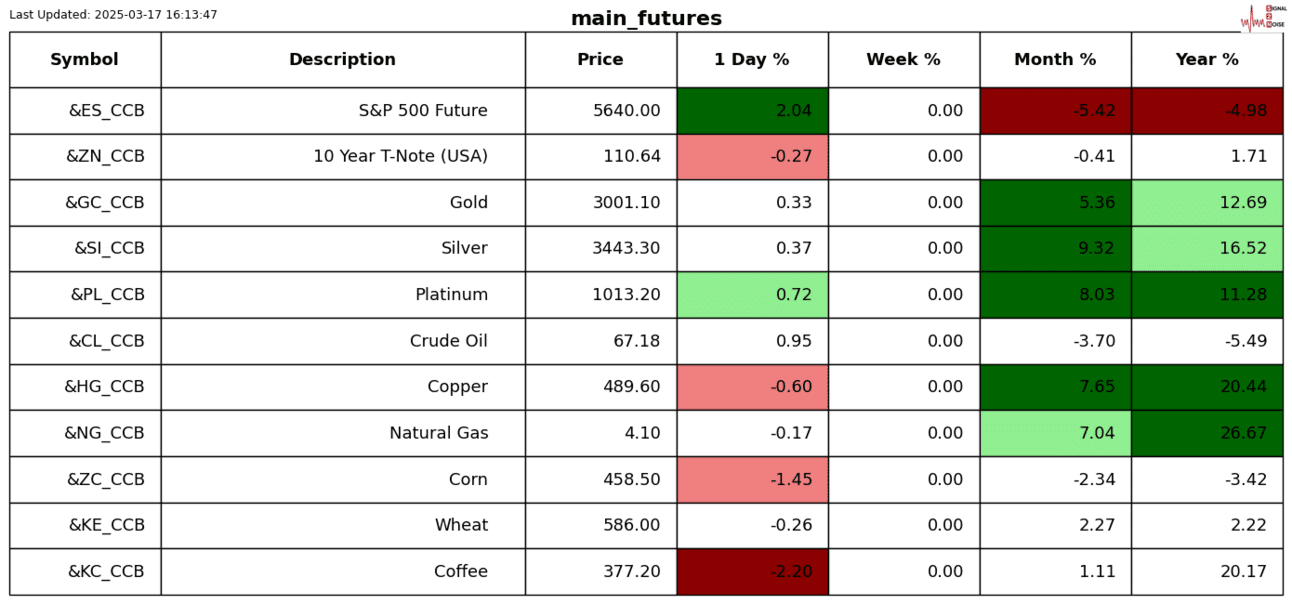

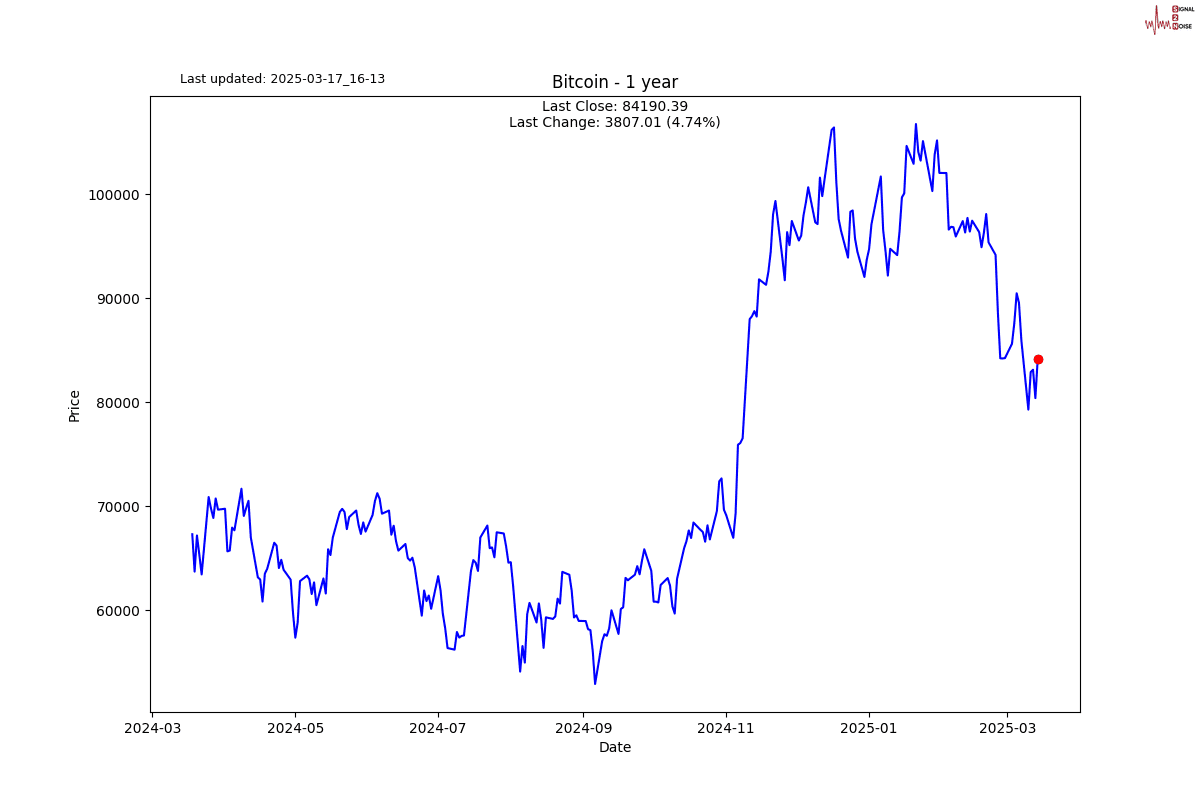

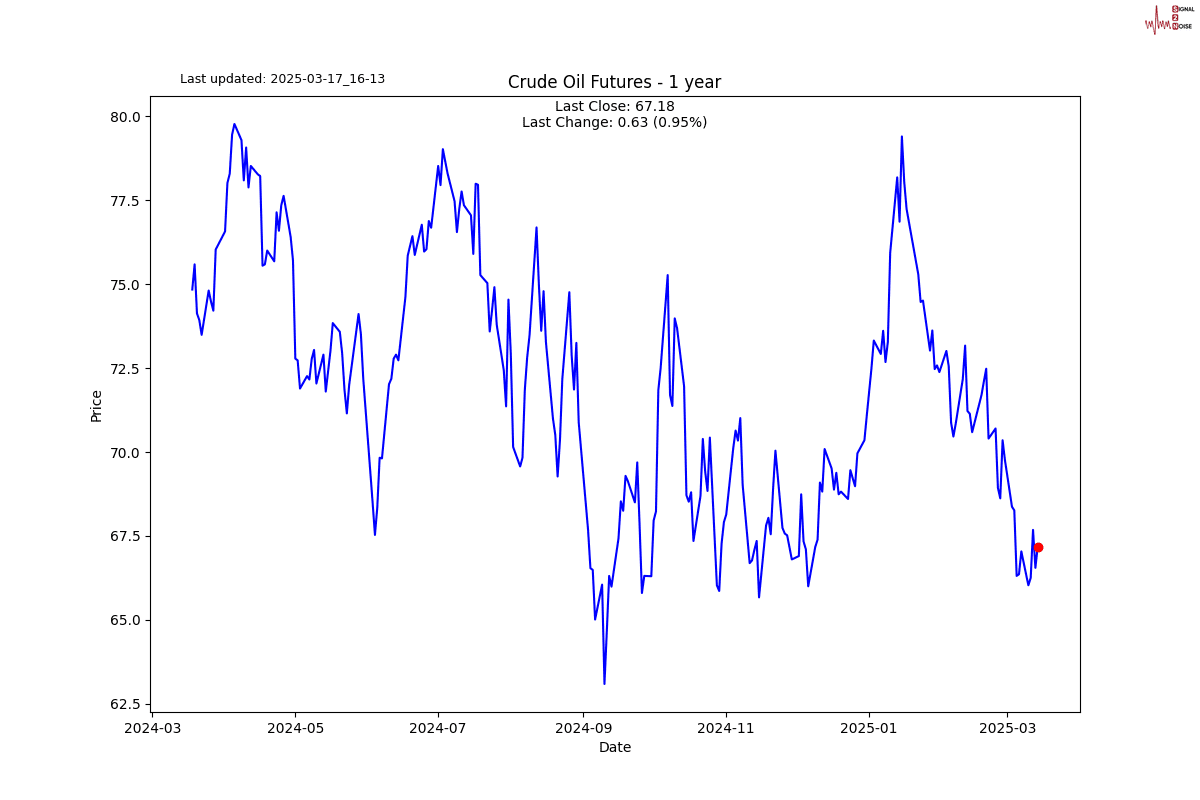

Against the backdrop of the inflation picture we are facing, I am expecting gold to continue to outperform equities.

In the chart below, I share the performance of gold, silver, and gold miners over the last 20 years. I want to suggest that silver and the gold mining stocks have underperformed gold dramatically and probably present better investment opportunities on a relative basis. The gold miners have a lot of catching up to do. I think going short gold and long the gold mining stocks (ETF: GDX) offer great risk-adjusted relative value trade. If you are looking to top up your gold holdings I would consider adding some silver if you don’t own any.

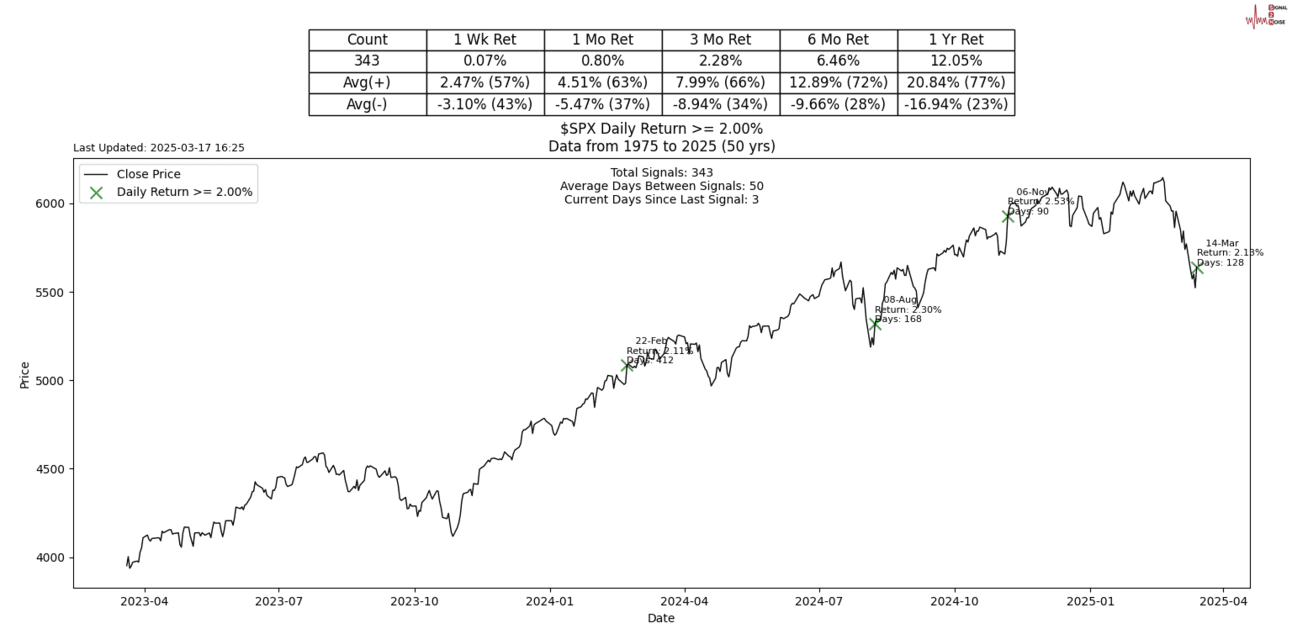

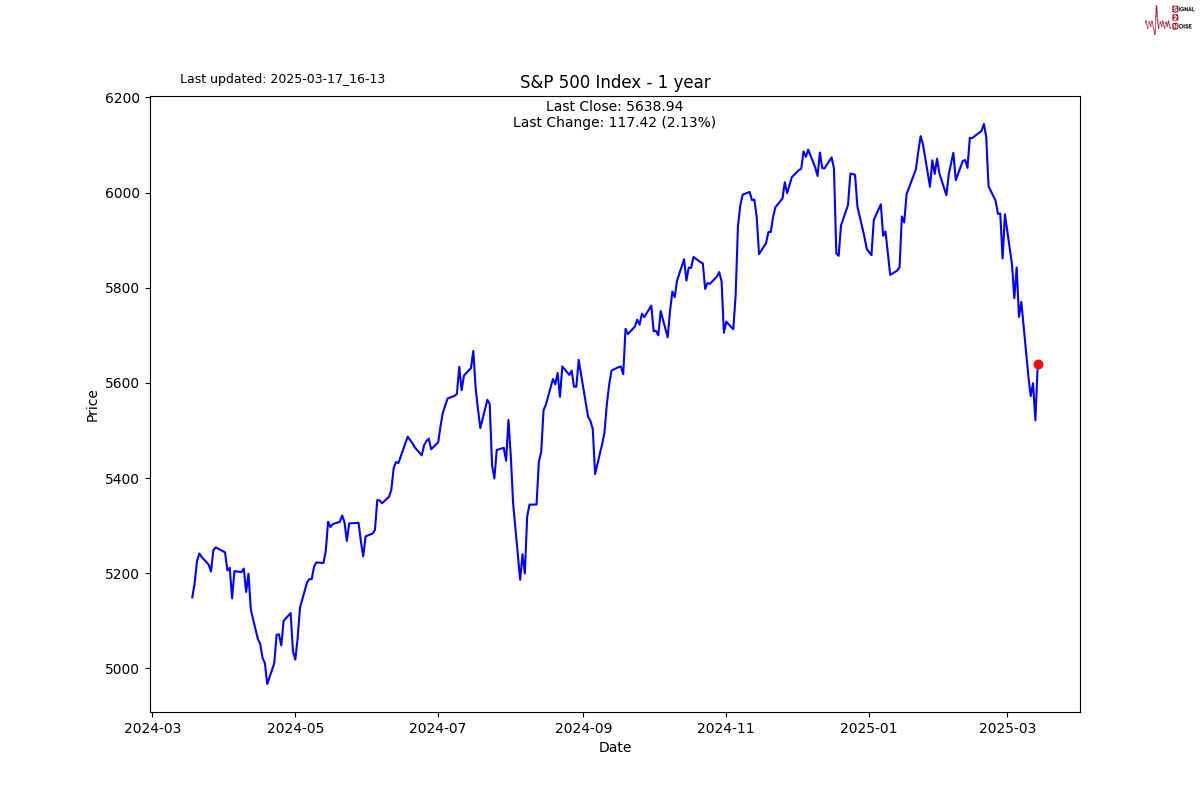

Just in case you think a 2% up day on the S&P 500 is normal, it isn’t. Friday marked only the 343rd time in 50 years that it has happened.

I know a lot of you are nervous now and want to buy the dip because buying the dip has worked so well in the past. There is a real chance that we bounce a bit more from here, but I think waiting to see if the market can get above its 200-day moving average is more prudent. I can say with more confidence that if it cannot break above the 200-day mark, then there is a real chance that this selloff is going to gain momentum and head towards the -20% bear market territory.

S2N screener alert

Big up week for gold. The 65th time in 47 years that gold was up more than 2.5 sigma in a week.

S2N performance review

S2N chart gallery

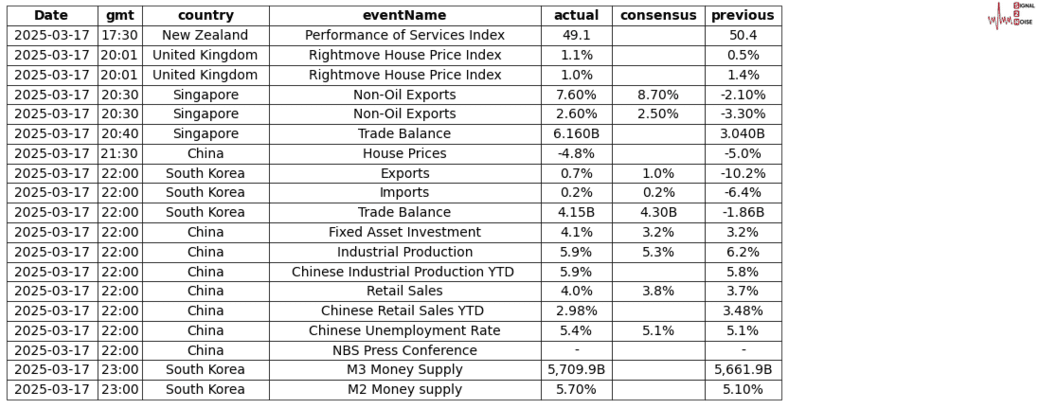

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.