Show me the money

S2N spotlight

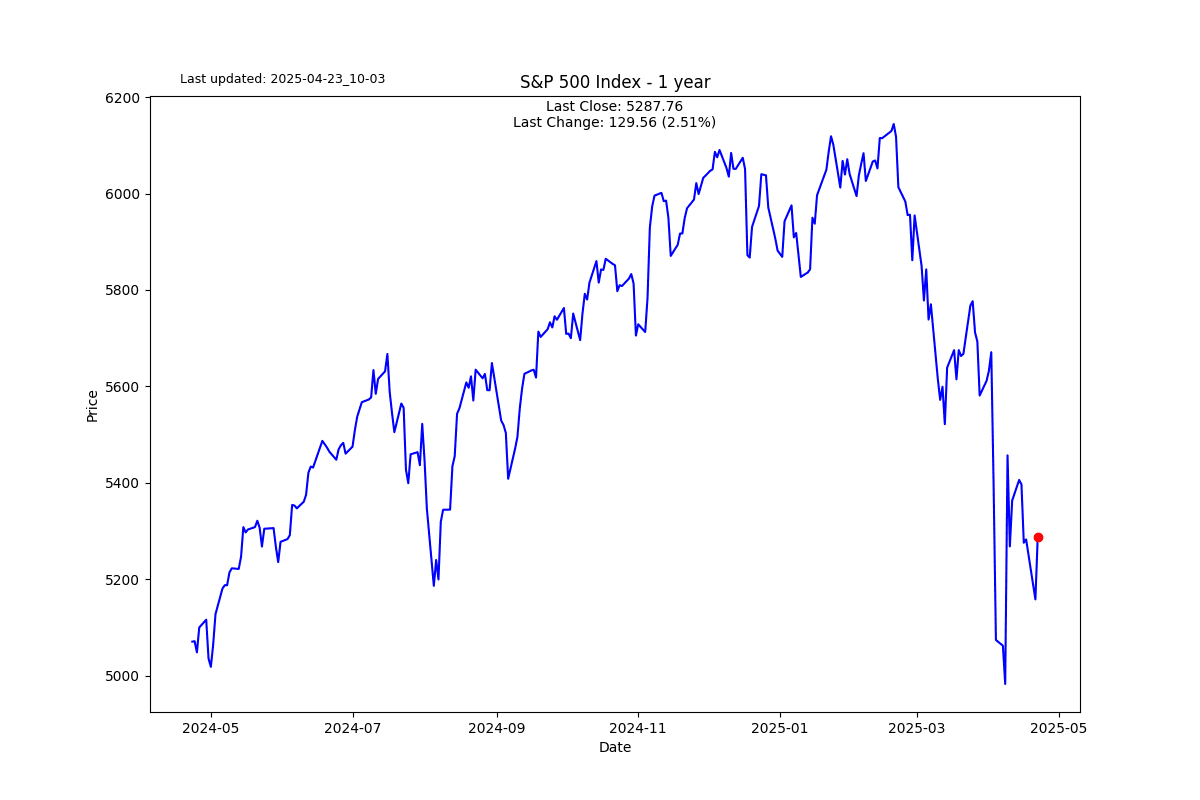

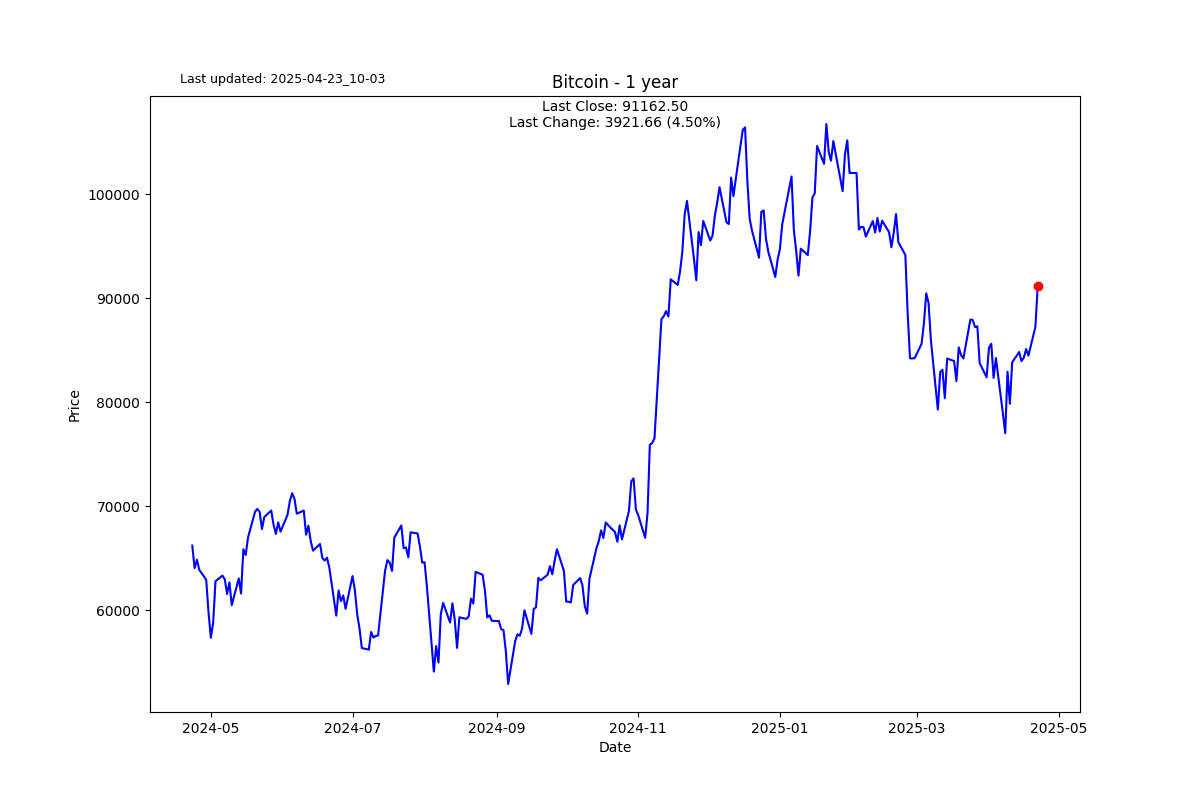

On a day I was short on time, I chose to try and spruce up the charts look and feel and do some data manipulation that would make a chiropractor jealous. I spent hours on this, hence the late delivery.

The positive, which I am super excited about, is I have figured out a way to calculate the flows into an ETF, ok, just GLD for today. Usually these are quite expensive data subscriptions, but I have done it the poor man's way and scraped and manipulated my way to an answer for free. I never get tired of that word.

I need to double-check my calculations for the in- and out-flows to be sure they are correct. Following the money in a major ETF can be useful when researching the probabilities of a trend continuing or reversing for that asset class.

The gold ETF, GLD, has $104 billion in assets; you can trace its growth in assets back to 2004. Yes, another gold record. Yesterday, despite it being a down day, saw the biggest inflow of cash into the ETF of $4 billion, not surprising after another all-time high. In my calculation of the flow of funds, I strip out the effect of the price action in the bottom pane. I focus on the new shares issued or cancelled without actually looking (my little manipulation) so I can show you the money.

S2N observations

I ran out of time.

S2N screener alert

I ran out of time.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.