Short squeeze knocking on the door?

S&P 500 held up through deflationary PPI that didn‘t spook the markets – gold and silver kept reading it all correctly, surging. Oil turning lower is another expected development, shared with Trading Signals clients – same goes for today‘s move in real assets (eyeing copper too).

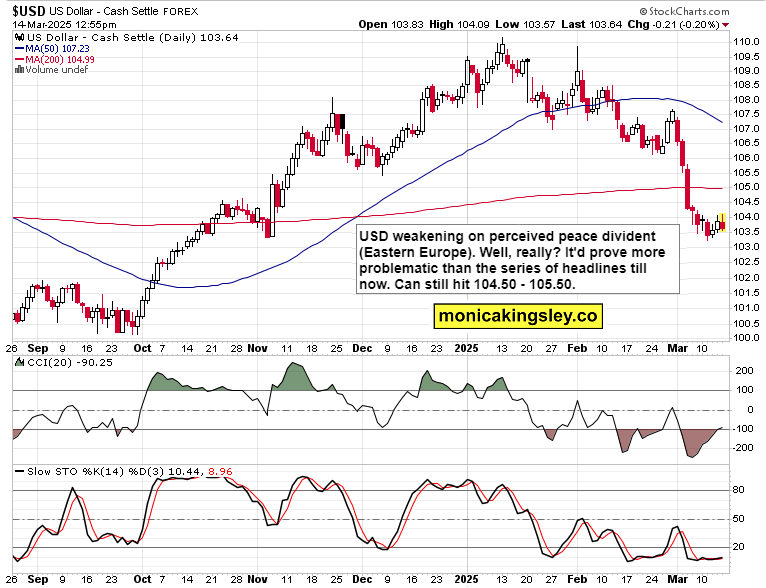

Amid some peculiar strength in select equities (NVDA is a select positive example), S&P 500 is a in a breakdown from the bear flag that I brought up days ago. The question is always about how close a short squeeze is, and whether it can last overnight at least – thus far, the answer had been no, yet remember my last week‘s distrust of bottoms being formed on Fridays – and what about volatility metrics and options positioning? This spells quite some artificial demand today – I covered way more ground in today‘s punchy video, including the peace dividend expectations for Eastern Europe.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.