Short Dollar trade ideas [Video]

![Short Dollar trade ideas [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-1178148633_XtraLarge.jpg)

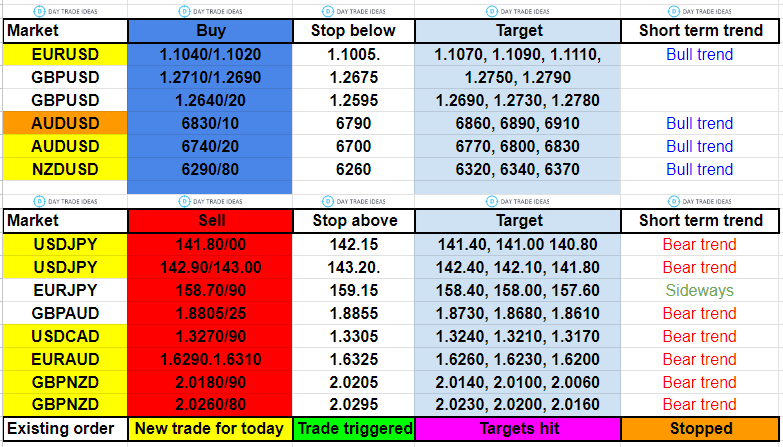

Starting with the EURUSD, he emphasizes the absence of a clear trend on the daily chart and focuses on the four-hour chart with the aid of Fibonacci levels and Bollinger Bands. Moving on to GBPUSD, Jason discusses his bearish outlook on the US dollar, identifying short-term opportunities around key support levels.

The bullish trend in AUDUSD, highlighting support levels and emphasizing the potential for long positions. The video also covers NZDUSD, where Jason identifies a support level and expresses confidence in a developing bull trend. Lastly, USDCAD is analyzed with a bearish perspective, focusing on resistance levels and the early signs of a sustained bear trend.

The dollar was steady on the first trading day of the year as traders weighed the prospect of steep interest rate cuts from the Federal Reserve in 2024 and looked to economic data this week for clues on the central bank's next moves.

The focus now switches to a slew of economic data due this week, including the data on job openings and nonfarm payrolls. Minutes from the last Fed meeting in December are scheduled for release on Thursday and will provide insight into the central bankers' thinking around rate cuts this year.

At its December policy meeting, the Fed adopted an unexpectedly dovish tone and forecast 75 basis points in rate reductions for 2024.

That contrasted with other major central banks, including the European Central Bank (ECB) and Bank of England (BoE), which reiterated they will hold rates higher for longer.

Still, traders are pricing in 158 bps of cuts by the ECB this year, while the BoE is also expected to cut rates by 144 bps in 2024.

Meanwhile, the Japanese yen weakened 0.24% to 141.20 per dollar to start the year on the back foot, having slid 7% against the dollar in 2023.

The spotlight is squarely on whether the Bank of Japan will exit negative interest rates in 2024, even as the central bank continues to stand by its dovish line. Tokyo markets are closed for a holiday, keeping volumes light on the day.

Author

Jason Sen

DayTradeIdeas.co.uk