Sheer panic hawkish uncertainty

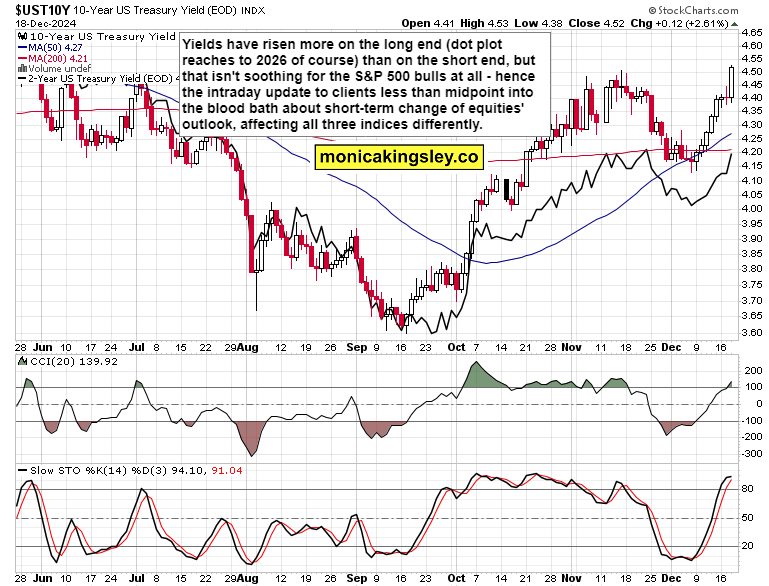

S&P 500 followed the path I foresaw ahead of FOMC – brief dip bought, and then positioning for a relief rally to continue. Hawkish cut delivered as called, the trouble was the dot plot being less generous than expected – only two cuts in 2025 is disappointing, less easy money is what will weigh down especially on all three indices, in the now smallcaps especially. Way fewer FOMC members than before were in favor of rate cutting – the (almost) no cut ahead with much data dependency, strengthened.

Uncertainty about talking tariffs was though what killed the recovery attempt when conference time came. I did dive for you in detail into bonds, select sectors, comparing the before FOMC and thereafter situations, market sentiment in newest video, describing as well scenarios of what lies ahead for stocks (and how reassuring each move scenario would actually be), these sectors and real assets were onto something.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.

-638702163650994231.png&w=1536&q=95)