- Nonfarm Payrolls figures stand out after a steady buildup.

- A speech by Fed Chair Powell stands out as chatter of another 50 bps cut.

- The Middle East may rock Oil and Gold prices after a turbulent weekend.

Winter is coming – that is what happens after the autumn, which has begun with high volatility. With the United States (US) labor market in focus, a dense cluster of such figures is set to rock markets, in addition to hostilities raging in the Middle East..

1) Mid-East tensions may spill into markets

Hassan Nasrallah, leader of Hezbollah and a larger-than-life figure, has been assassinated by Israel over the weekend. This has been a massive escalation to the conflict that has been running for nearly a year. The Lebanese militant group is the strongest of Iran's proxies in the Middle East, and the latest hostilities may turn into a regional conflict. How will markets react?

Oil prices have been stable, pushing aside supply concerns – roughly 30% of global oil trade flows through the Strait of Hormuz, at the tip of the Persian Gulf. Should Iran clash with Israel and the US, crude prices would spike.

Safe-haven assets such as the Swiss Franc (CHF), Gold, and the US Dollar (USD) would also gain if the conflict spreads from the Eastern Mediterranean to the Persian Gulf. In most cases, alarming news results in a short-lived spike, which is quickly reversed – an opportunity to go contrarian.

2) Fed Chair Powell to tilt the debate about the next cut

Monday, 17:55 GMT. Jerome Powell, Chair of the Federal Reserve (Fed) said that he is not behind the curve when it comes to easing the bank's monetary policy, but that the 50 bps in September cut was a sign he doesn't want to be there. Will he opt for a bigger cut next time?

There is still time until early November, the Fed's next gathering, but markets are pricing a 50-50 chance of either another big 50 bps rate reduction in borrowing costs, or a standard 25 bps move. That means every word in the Chair's speech will be scrutinized for clues.

The FXStreet FedTracker provides real-time insights about the speech. Powell has an average score of 5.7 at FXStreet’s FedTracker, which gauges the tone of Fed officials’ speeches on a dovish-to-hawkish scale from 0 to 10 using a custom AI model. Any comments more dovish from Powell could rock the US Dollar.

3) Double-feature ISM Manufacturing PMI and JOLTs to trigger choppy market action

Tuesday, 14:00 GMT. Which release is more important, a forward-looking survey or a labor-related report looking back over a month? Market participants will get an answer when the ISM Manufacturing Purchasing Managers Index (PMI) for September and the JOLTs job openings figures for August are due out.

America's industrial sector has been struggling for many months. According to economists, ISM Manufacturing PMI is expected at 47.2 points in September, the same as in August, and remaining in contraction, below the 50.0 threshold, for the sixth month. While manufacturing is only a small part of the economy, the release serves as the first clue for Friday's Nonfarm Payrolls.

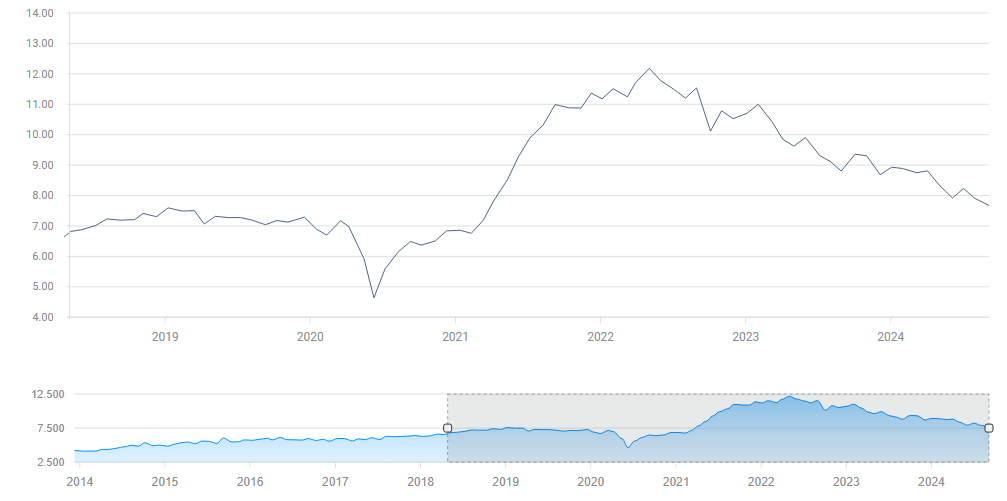

The JOLTs data pointed to a cooling labor market in July, with a drop to 7.67 million annualized hirings. The upcoming report for August lags the NFP, which is for September, but is closely watched by the Fed.

JOLTs job openings. Source: FXStreet.

The impact depends on the combined impression they leave. If both miss or beat estimates, markets would move more significantly than in case they offset each other.

In case the data point in different directions, I expect JOLTs to have the upper hand, given the dominance of labor data on the Fed.

4) ADP jobs data needs to shock to leave a lasting impact

Wednesday, 12:15 GMT. ADP manages one in six US payslips, giving its jobs report clout in moving markets as an early indicator of the official Nonfarm Payrolls. The firm's print of 99K jobs in August disappointed investors and proved correct in projecting the NFP. However, ADP's often fails to serve as a leading indicator.

With the Fed's focus on employment, there is a good chance that any surprise in the data for September will shape expectations for Friday's employment report and will also have an immediate, yet short-lived, impact on markets.

The economic calendar points to an improvement, but another miss could trigger a drop in the US Dollar and stocks while buoying Gold. Nevertheless, unless ADP's figures are badly off the mark, the initial knee-jerk reaction could be followed by a reversal, thus serving as an opportunity for fast traders.

5) Weekly jobless claims are set to show strength

Thursday, 12:30 GMT. The "canary in the coalmine" may be an adequate description for this timely report, which could indicate a disaster brewing in job growth. So far, claims for unemployment benefits have been low, showing that the metaphorical canary is flying high – like the labor market.

Last week, claims stood under 220K, a drop from previous levels above 230K. A small increase is expected this time. A jump back above 230K in the report for the week ending September 27 would raise fresh alarms among investors, who remain sensitive to any weakening in hiring.

It is essential to note that contrary to ADP and the ISM reports, this weekly jobless claims report does not serve as a leading indicator of Nonfarm Payrolls – NFP surveys are held on the week including the 12th of the month. Nevertheless, volatile markets are set to react.

6) ISM Services PMI serves as the last pre-NFP indicator

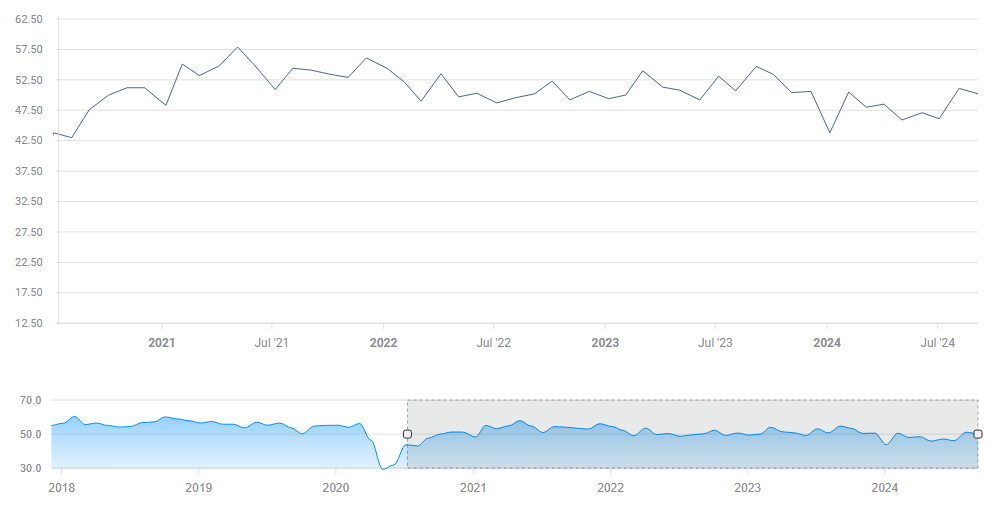

Thursday, 14:00 GMT. The services sector is America's largest, and the ISM's forward-looking measure is a critical gauge of the entire economy. The headline number hit 51.5 points in August, a tad above the 50-point threshold separating expansion and contraction. A similar outcome is on the cards for September.

Apart from the headline, the Employment component will get special attention ahead of Friday's NFP. It stood at 50.2 points, precariously close to contraction territory. Any dip would cause worries and weigh on markets ahead of Friday's report.

ISM Services PMI Employment component. Source: FXStreet.

7) Nonfarm Payrolls set to super-charge price action

Friday, 12:30 GMT. After a full buildup, America's all-important employment report is here. When August's report was released early in September, price action was wild, showing that Nonfarm Payrolls returned to its throne as the No. 1 market mover, outweighing inflation measures.

The previous NFP fell short of estimates with an increase of 142K, the third consecutive shortfall. Moreover, it included downward revisions. Data for May to July was all downgraded in consequent releases, pointing to weaker-than-thought conditions.

A similar increase of 145K is on the cards for September, but these estimates may change during the week.

Gold is set to rally on weak data and fall on strong figures as the precious metal needs lower interest rates to thrive. Stocks will probably rise and fall with the labor market, as investors are more worried about a recession than higher interest rates at this point.

The picture is more complicated for the US Dollar. An outcome roughly within estimates or even within a wide range of 100K-200K would weaken the US Dollar on expectations for a 50 bps rate cut. However, an alarming sub-100K report would send worried investors to the safety of the Greenback, while a super-strong release could trigger worries of a much higher path for interest rates.

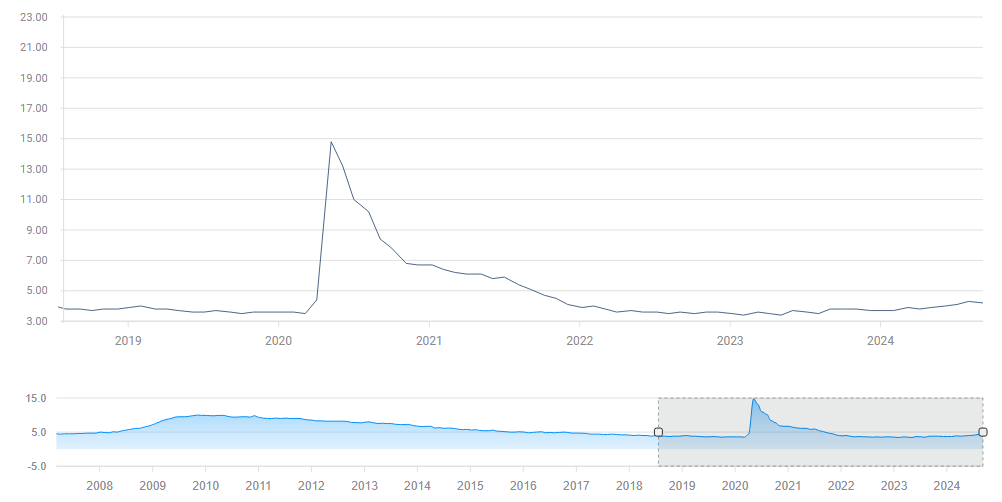

Apart from headline jobs data, the Unemployment Rate is of high importance, both politically and for the Fed. It has been creeping up from the trough of 3.4% in April 2023 to 4.3%, and then dropped to 4.2% in August. The central bank expects it to peak only several tenths high. A fresh increase would also cause worries.

US Unemployment Rate. Source: FXStreet

Final thoughts

This is a consequential week for markets, featuring Nonfarm Payrolls, positioning ahead of the event, and also geopolitics. Trade with care, and stay tuned for an updated preview of Nonfarm Payrolls ahead of the release.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.