Selling into NVDA

Stocks rose all the way into NVDA earnings, breaking not only 4,447 but also 4,460 as optimism gripped AI-related stocks – the surprise was considered good enough, but didn‘t result in such a sharp spike as it did a quarter ago. For all the tech breadth improvement and more in the 493 other stocks to be shown today, yields and USD haven‘t said the very last word, but the initiative is on the risk-on side today as well – as in having to prove willing ness to step in while prices consolidate sharp overnight gains (gap filling). The degree to which the daily euphoria spreads elsewhere, would be most telling, and I still think that on the fringes (smallcaps etc), the AI hype and promise driving figure would be sold into as rotations wouldn‘t kick in with veritable strength. Plenty of intraday opportunities both ways before Jackson Hole simply.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 3 of them.

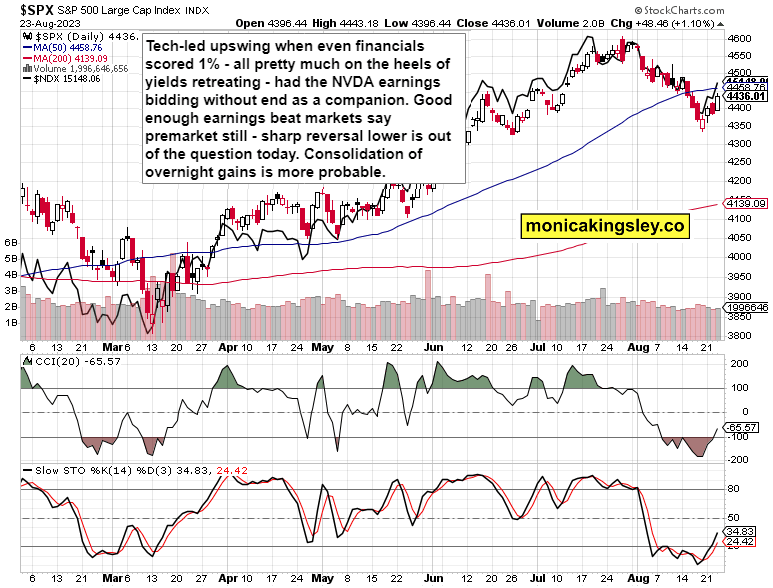

S&P 500 and Nasdaq Outlook

4,425 is a far away support, and also 4,434 is one heck of a journey. 4,447 would probably cushion most of the downside today – yes, a choppy day 4,447 and 4,485, is ahead – buyers would have to prove themselves.

Gold, Silver and Miners

Precious metals upswing is officially underway for everyone to see – made more bullish by silver not really looking back, but that was a function of yields retreating. Similarly post Jackson Hole, I‘m not looking for precious metals to be knocked unconscious in the least.

Crude Oil

Crude oil caught a fine bid, but as per the caption that‘s not definitive. The correction doesn‘t have run its course yet – yesterday‘s lows to be still broken on a closing basis.

Copper would be still inspired by silver, suffering less of a setback – the high $3.70s are my pick for today‘s closing prices.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.