Sell now or later

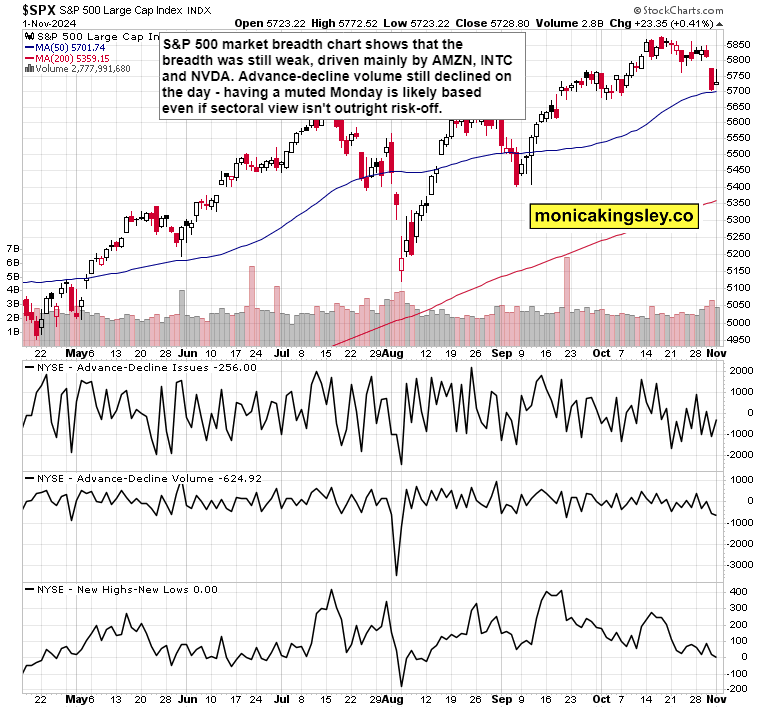

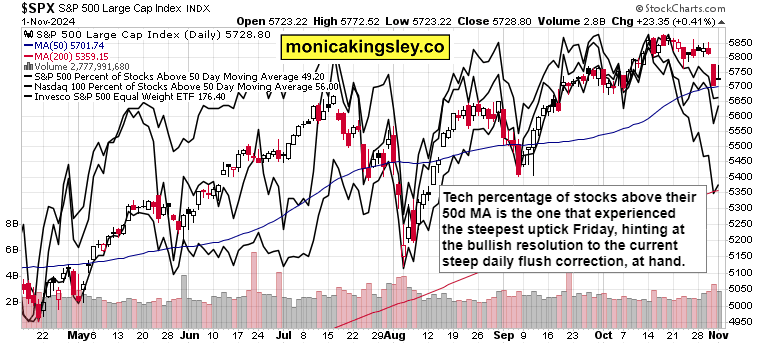

Weak NFPs were explained away by weather and and also strike action, making S&P 500 swing higher in line with my expectations – offering both great intraday long and short gains, Market breadth is nothing to write home about – while not outright risk-off, it relied heavily on AMZN, INTC and NVDA, which bucked SMCI dump, and then poor AMD guidance (company setback in its own right).

Apart from elections uncertainty (notice how precious metals are sold off alongside bonds? A bit weird, but I called for gold and silver turning down before Friday). We‘ll get FOMC (after a panicked Sep 50bp cut that I predicted, now we have by and large positive economic surprises apart from the job market and manufacturing – the latter has low share of US economy that‘s primarily a services one, the former can be used as a fig leaf to not stun the markets and deliver the 25bp that has the added benefit of not saying „oops, we panicked in Sep after falling asleep in Jul“) and SMCI earnings (yeah, no EY around this time).

Cutting when economic policies aren‘t yet set in stone, and e.g. in bonds, the perceived impact of both candidates wildly divergences (Trump is viewed as bearish Treasuries, Harris is taken as bullish Treasuries), which would of course decide as well the USD at crossroads moment of the now.

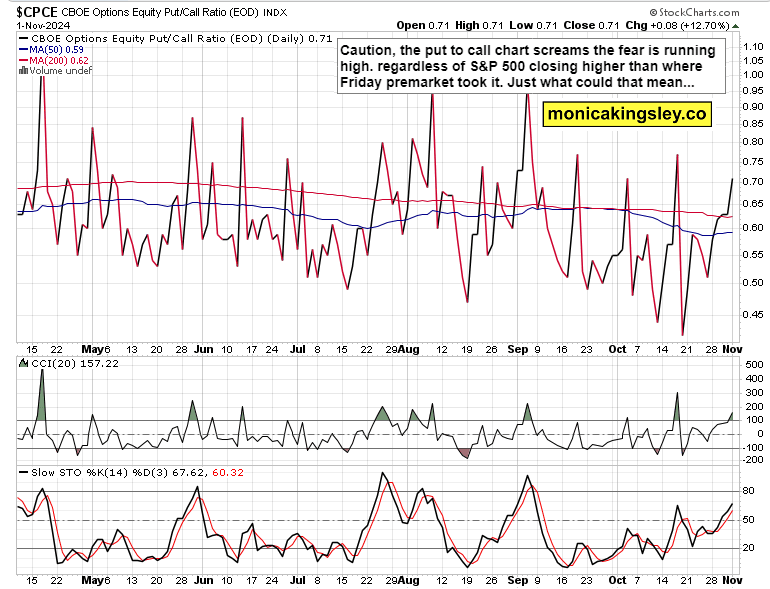

The positioning is a little similar to the one before Sep FOMC – rates are rising while a rate cut is being expected. The current odds of 1% that there is no cut, is wildly underappreciated, inaccurate – that‘s what the bond market is telling us, regardless of the steepening and term premium rising. At the same time, I don‘t think the Fed would like to risk disappointing the market demands.

S&P 500 and Nasdaq

S&P 500 wasn‘t yet fit to keep intraday gains – I looked for the bears to remain the stronger party on a closing basis. And there was really no buying to speak of before the close. Sellers remain in control, and for all the rate cut expectations, XLRE is declining together with XLU. Apart from the three stocks mentioned in the introduction (NVDA strength looks a bit suspect in light of SMCI woes – no hard questions had been raised yet), there is really no leadership, just plenty of vulnerabilities.

This is no time to play play hero for elections resolution with a wildly long bias – way too risky early in the week, better proceed with our short gains being locked in as waning market breadth (bearish divergence, anyone?) while the index had been moving in a tight range without fresh highs, is a clear warning sign.

Gold, Silver and Miners

The pre-elections decline might continue and reach the target given fast – of course, geopolitics can turn that move around very fast, but breaking through $2,730s and going for the horizontal support given, is more probable than latest slide being one and done. If you remember the 2016 gold volatility on elections result catching the mainstream off guard, we have plenty to look forward for in the week ahead. I prefer waiting for a fresh long opportunity than forcing a short here, however probably successful that would be (this is analogical to my equities thinking).

Copper is peeking higher after basing for so long around $4.35, and I favor its move higher to slowly, slowly continue.

Crude Oil

Crude oil is giving conflicting signals – I favored buyers through Friday, and they barely closed up, with a nasty looking reversal candle. This is a lower confidence call than regarding precious metals remaining under pressure for now, but I favor oil to base with a bullish tendency here.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.

-638662728079407231.png&w=1536&q=95)