Seizing opportunities in USD/CAD and AUD/USD with strategic long positions [Video]

![Seizing opportunities in USD/CAD and AUD/USD with strategic long positions [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/five-dollar-bills-9087891_XtraLarge.jpg)

Today’s trade ideas

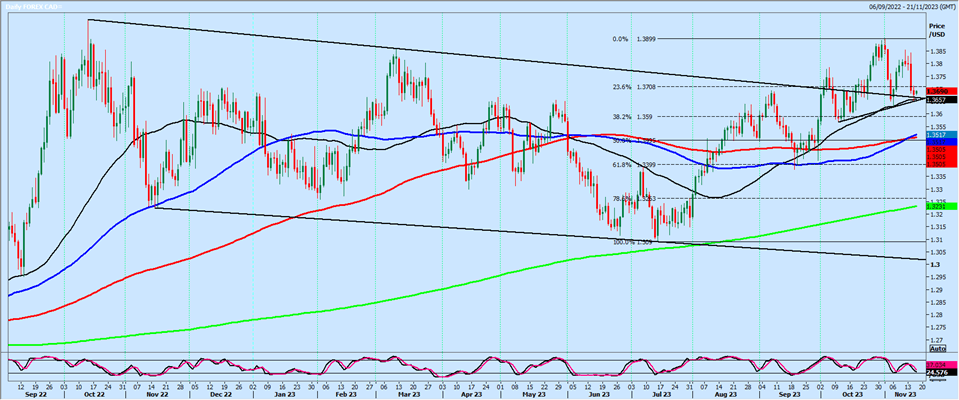

I have sat & watched USDCAD bounce around & retest the break point of the trend line over the past month - I think it is now worth trying a long again at 1.3670/50, with stop below 1.3625.

As a trend follower I have to try an AUDUSD long in the hope that this is bullish breakout of the 3 month consolidation pattern. The break above the trend line, 23.6% Fibonacci & 100 day moving average at 6470/90 should be a buy signal.

AUDJPY breaks above the early November high & more importantly the 5 month high set in June at 9767 for a buy signal. As we retreat for a retest of the break point, I have to try a long at 9775/55.

Author

Jason Sen

DayTradeIdeas.co.uk