Roadmap for fine gains

S&P 500 delivered on my Thanksgiving and Friday‘s expectations by holding up and rising, with Russell 2000 joining in – another great day for clients swing and intraday too. As Bitcoin is making another push through $95K, remember my right after elections crucial call on what was to outperform then. Pay special attention to KRE vs. (a great leader otherwise) XLF, and to the crypto realm Ellin is focusing on. Within my domain, clients across equities and real assets with plain just Bitcoin had been prepared finely for this fine weekend too. was good enough for slow extension of clients‘ swing gains, and for quick intraday ones too.

As for macro drivers, I‘m bringing you another call that turned out great, and that‘s the one regarding yields retreat. My macroeconomic views about no recession, slowly increasing productivity, resilient consumer and Fed rate cuts expectations being slowly dialed back as we get ready to enter 1H 2025, are well known, so enjoy the VIX chart with bond market volatility message as well.

I hope you had a great Thanksgiving, let‘s enter the Santa Claus rally time on as upbeat note as always – we have plenty of reasons to looking backwards at successes delivered, and ahead too.

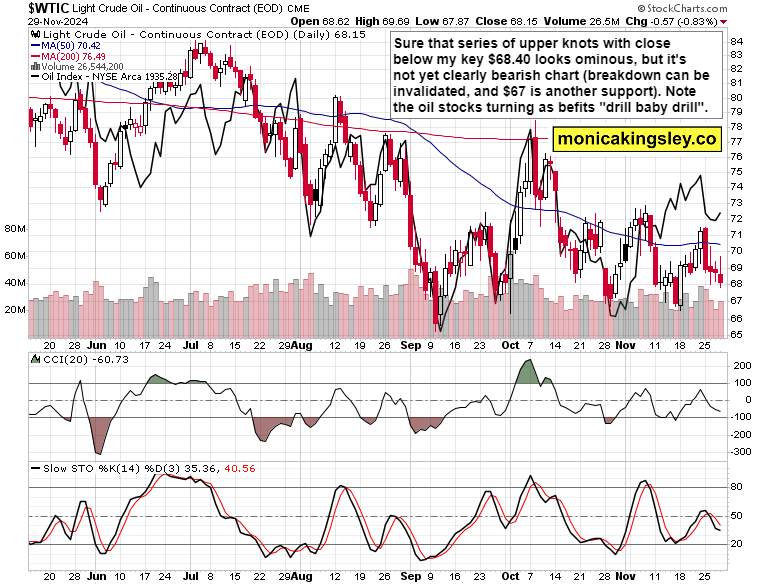

Crude Oil

This is at crossroads, and I mean rather the oil itself than oil stocks. While the cornerstone for rising prices was laid a week ago, now it‘s back to the lower border of the range, with bullish momentum lacking, and only lower volume giving some hint of maybe sellers‘ conviction waning. The last three days of no upside progress have been undeniably underwhelming.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.