Market Overview

This recovery in risk has a remarkable ability to pull ever higher. The US has now faced a week of protests and rioting, and yet Wall Street continues to rally. Whilst the riots could still be an issue (if they continue for much longer), right now it seems to be secondary as an issue. Investors and traders of risk assets are focused far more on the massive monetary and fiscal support, re-openings from lockdown and potential economic recovery. Reports that China was potentially breaching its Phase One trade agreement obligations seem to have been wide of the mark (at least they have been officially denied) and so the risk rally has been released once more. This has been driven further overnight with the China Caixin services PMI which have climbed to 55.0 and shows an expansion level of almost decade highs. This all continues to fuel the recovery in equities, which bounds on this morning. Even Treasury yields (which have seen volatility dampened by the actions of the Fed) are ticking higher. The outlook on forex is decisively risk positive, with the Aussie and Kiwi again bursting higher today, whilst the dollar and the yen (both seen as key safe haven plays) are underperforming badly. This relentless run in risk appetite is also hampering the move higher on gold too, which is down in recent days despite the dollar weakness. The services PMIs will give an indication of how the major western economies are faring today. With the ECB also expected to add to its own support programme tomorrow, this risk rally looks set to continue.

Wall Street closed in positive territory once more, with the SP 500 +0.8% at 3080. US futures are showing further gains today too, with the E-mini SPs +0.4% higher. Asian markets were broadly positive again (Nikkei +1.3% and Shanghai Composite +0.1%) whilst European indices are also set for good early gains (FTSE futures +1.1%, DAX futures +1.4%). In forex, the risk positive bias continues to show through as AUD and NZD pull ever decisively higher. USD and more pertinently now, JPY, are the underperformers. EUR continues to strengthen ahead of the ECB and GBP is also positive. In commodities, the bull run on oil is the big story, with Brent Crude and WTI around 2% to 3% higher once more. Gold is struggling on the strong risk environment, with silver also weaker today.

The economic calendar is packed today with services PMIs, US employment and the BoC rates decision. The morning will be dominated by the European PMIs, with the Eurozone final Services PMI at 0900BST which is expected to be confirmed at 28.7 (28.7 flash May, 12.0 final April). This would mean the Eurozone final Composite PMI coming in at 30.5 (30.5 flash, 13.6 final April). The UK final Services PMI is at 0930BST and is expected to see a mild upward revision to 28.0 (from 27.8 flash, and up from the 13.4 final April). This would leave the UK final Composite PMI at 28.9 (28.9 flash, 13.8 final April). At 1000BST, the Eurozone Unemployment for April is expected to increase to 8.2% (from 7.2% in March). Into the US session, the early data is dominated by the ADP Employment change at 1315BST which is expected to show a decline of -9.000m in May (after the -20.236m in April). This will likely set expectations for Friday’s Non-farm Payrolls. The US ISM Non-manufacturing is at 1500BST and is expected to improve slightly to 44.0 in May (from 41.8 in April). US Factory Orders at 1500BST are expected to show a month on month decline of -14.0% in April. The Bank of Canada monetary policy decision at 1500BST is not expected to make any changes to the rate of +0.25%. Finally the EIA Crude Oil Inventories at 1530BST are expected to show another solid stock build of +3.3m barrels (after the surprise build of +7.93m barrels last week).

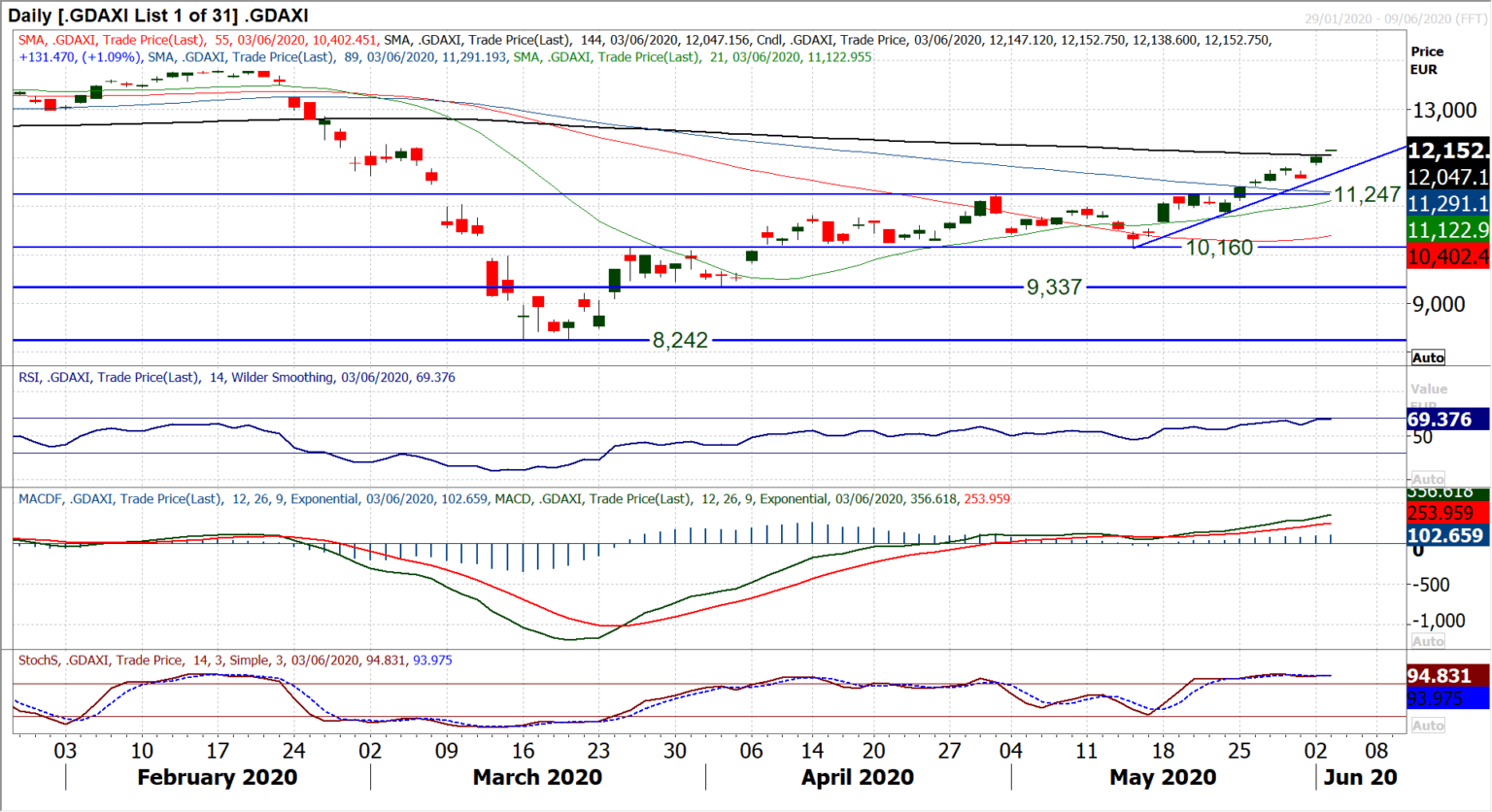

Chart of the Day – German DAX

It has been a breakout that has barely looked back for the DAX. Throughout much of May, the DAX bulls were looking towards the next breakout, but it was a struggle in coming. However, since clearing the resistance at 11,247 the DAX has taken a huge leap forward in its recovery. The breakout implied around 1100 ticks of additional recovery towards 12,350 and the market is well on its way towards hitting this next target. The next resistance is around the early March high of 12,270. Momentum indicators are impressively strong, with the RSI into the high 60s (and the strongest since November), whilst MACD lines rise strongly. They all suggest buying into weakness and so the good uptrend of the past two and a half weeks (comes in as a basis of support around 11,660 today) is the key near term gauge. The question is whether there will be another opportunity? Gaps are commonplace on the DAX but are often unfilled. Yesterday’s gap at 11,730 is yet to be filled, but with futures looking strong again today, there could be a further acceleration higher of the move. That said, the extended nature of this move will likely induce an unwinding intraday move at some stage which would be the opportunity on support. There is a good band of support around 11,570/11,810, with yesterday’s traded low at 11,850.

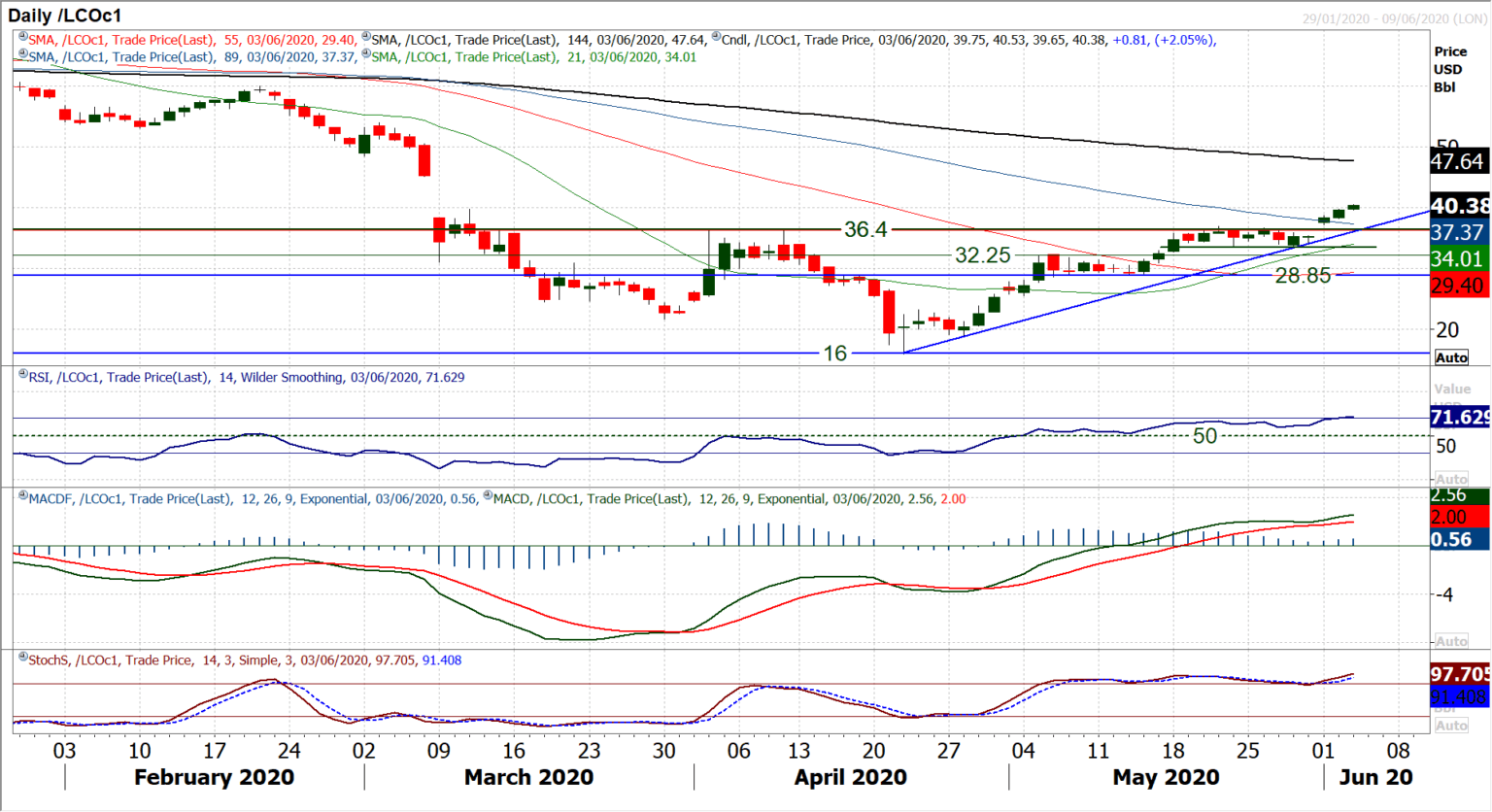

Brent Crude Oil

Oil continues to run higher. Having moves decisively clear of the technical resistance at $36.40, Brent has this morning moved above $39.70 resistance. The more optimistic bulls will be suggesting that this move clear of $36.40 actually completes a big two and a half month base pattern that effectively implies an upside recovery target of around $56 over the coming months. Given that the February high was $60 and there is a March rebound high of $53.90, is this really so unrealistic? For now, Brent is now into gap fill territory, with the big gap down from $45.20 being the next key target. Momentum in recovery is still very strong, with RSI into the 70s, whilst MACD and Stochastics are also strong. The contrarians will look at previous bull failures coming around the 70 mark on RSI (September and December 2019) and this may induce a near term corrective move at least. The recovery uptrend comes in at $36.00 today whilst the breakout at $36.40 is a key area of support now.

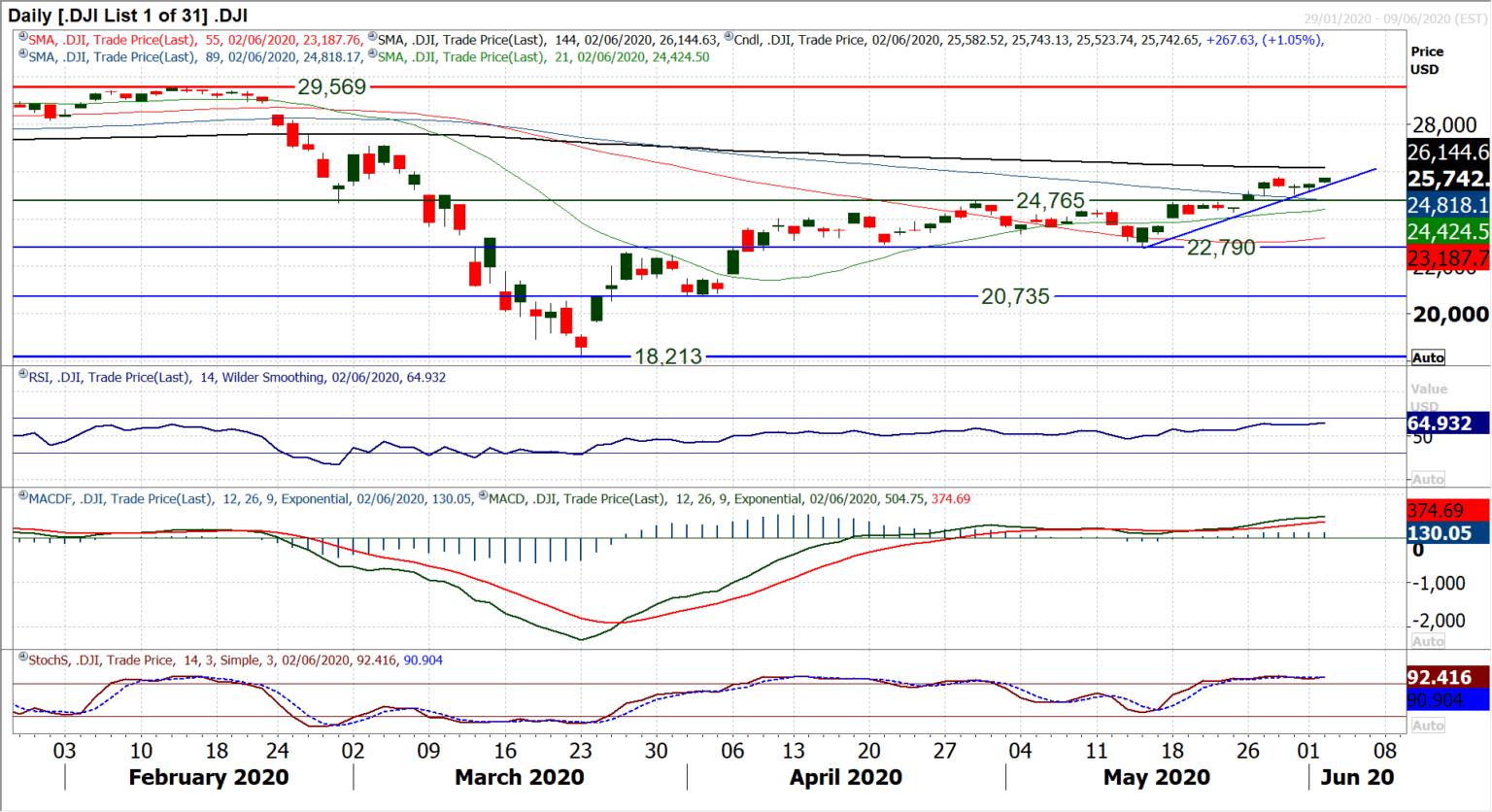

Dow Jones Industrial Average

The Dow just continues to grind higher. Having had a slip back at the end of last week, the bulls seem to have used this pullback towards the key breakout at 24,765 as a chance to buy. The reaction from a low of 25,030 has resulted in three positive candles in a row now. The market has formed an uptrend that is now approaching three weeks in duration (coming in as support at 25,380 today) and is a gauge for the progression of the current bull leg higher. The consolidation rectangle breakout implies a target of around 26,750 and with the next resistance being 27,100 (an old March mini rebound high) the recovery is firmly on track. Momentum indicators confirm the move higher, with RSI into the mid-60s now and at their strongest since January (when the Dow was still pushing all-time highs). MACD and Stochastics also remain bullishly configured. They also suggest using any near term weakness as a chance to buy. The key breakout at 24,765 is the main support area, but any correction to find support above 25,030 would be an opportunity too.

Other assets insights

EUR/USD Analysis: read now

GBP/USD Analysis: read now

USD/JPY Analysis: read now

GOLD Analysis: read now

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to strong daily gains near 1.0900

EUR/USD trades at its strongest level since mid-October near 1.0900 after starting the week with a bullish gap. The uncertainty surrounding the US election outcome weighs on the US Dollar and helps the pair continue to push higher.

GBP/USD holds above 1.2950 as USD stays under pressure

GBP/USD stays in positive territory above 1.2950 after failing to clear 1.3000 earlier in the day. Heading into the US presidential election, the 10-year US Treasury bond yield is down more than 2% on the day, weighing on the USD and allowing the pair to hold its ground.

Gold trades around $2,730

Gold price is on the defensive below $2,750 in European trading on Monday, erasing the early gains. The downside, however, appears elusive amid the US presidential election risks and the ongoing Middle East geopolitical tensions.

Three fundamentals for the week: Toss up US election, BoE and Fed promise a roller coaster week Premium

Harris or Trump? The world is anxious to know the result of the November 5 vote – and may have to wait long hours for the outcome. Markets will also respond to the composition of Congress. The Bank of England and the Federal Reserve will enter the fray afterward.

US presidential election outcome: What could it mean for the US Dollar? Premium

The US Dollar has regained lost momentum against its six major rivals at the beginning of the final quarter of 2024, as tensions mount ahead of the highly anticipated United States Presidential election due on November 5.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.