Market Overview

Today is Friday the 13th, not a great day for the superstitious. But can the horror show be any worse than Thursday the 12th after some of the worst selling in history and a car crash of a press conference from ECB President Christine Lagarde? Hot on the heels of a broadly terrible address from Donald Trump the night before, Lagarde’s inexperience did little to calm market fears. Her predecessor, Mario Draghi, seemed to be so adept at setting the nerves, but Lagarde compounded a damp squib of a monetary policy announcement by spooking traders. Her comments that the ECB’s role is not to close sovereign debt spreads caused yields on Italian BTPs to spike higher and the euro to dump. The fears of Coronavirus creating economic crisis turned into a liquidity scare yesterday as overnight funding swaps prices soared, with the dollar jumping. The US Federal Reserve has looked to calm markets and it will offer trillions of dollars in liquidity operations through its repos. This is an attempt to stem what it sees as “temporary disruptions” which caused a huge jump in overnight swaps pricing. At least, coming into the European session this morning, there is an element of relative calm and recovery. Risk assets are rebounding. Is this like putting a sticking plaster on a burst dam? Let’s hope that this can begin to provide stability that the markets so badly need right now.

Across the board, yesterday’s moves on equity indices were some of the worst falls since 1987, with the S&P 500 -9.5% to 2480. However, US futures are on the rebound today with a gain of 4.0%. Asian indices played catch up with the Nikkei -6.1%, whilst the relative outperformance of the Shanghai Composite continues (-1.2% last night). European markets look set for a rebound with DAX futures +1% currently. In forex, there is a pick up in risk appetite, with JPY being the big underperformer, whilst AUD and NZD along with CAD are on the comeback. In commodities, gold is trading over +1% higher with oil almost +4% higher.

Although volatility remains immense, the economic calendar shows the Prelim Michigan Sentiment at 1400GMT is data that could be telling. The impact of Coronavirus is expected to begin to hit the US consumer, with the headline Michigan Sentiment expected to drop back to 95.0 in February (from 101.0 in March). The deterioration is expected to be driven by the Current Conditions component falling to 112.0 (from 114.8) whilst Michigan Expectations are expected to reduce to 88.2 (from 92.1).

Once more, there are no central bankers due slated to speak today, and FOMC members remain in their blackout period until next Wednesday’s FOMC announcement.

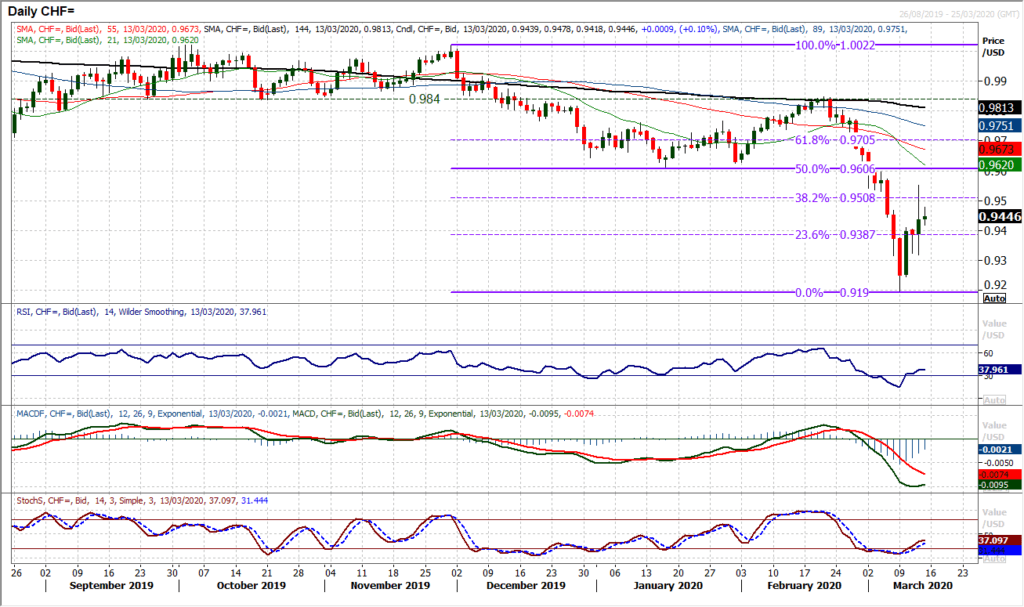

Chart of the Day – USD/CHF

When the Swiss franc sells off as the bottom is fallout out of risk markets, there is a real signal that something is going badly wrong. As such the dollar is strengthening across major forex and unless the Fed’s funding operations calm markets down, the momentum of the dollar move could be like a steam train. Technically, a recovery of the big sell-off on USD/CHF is gathering pace. Yesterday’s positive close came with a lot of volatility throughout the session. In calmer markets, trading decisively through 23.6% Fibonacci retracement (of 1.0022/0.9190 decline) at 0.9387 implies a continued recovery to test 38.2% Fib around 0.9510. Momentum buy signals are coming through fast with crossover buy signals on Stochastics, and the RSI back above 40. Posting another positive candlestick today would suggest the dollar bulls remain on track and recovery back towards the 50% Fib at 0.9605 which is also an old floor of the January low and a basis of overhead supply could be seen. The hourly chart shows good near term support now 0.9325/0.9410.

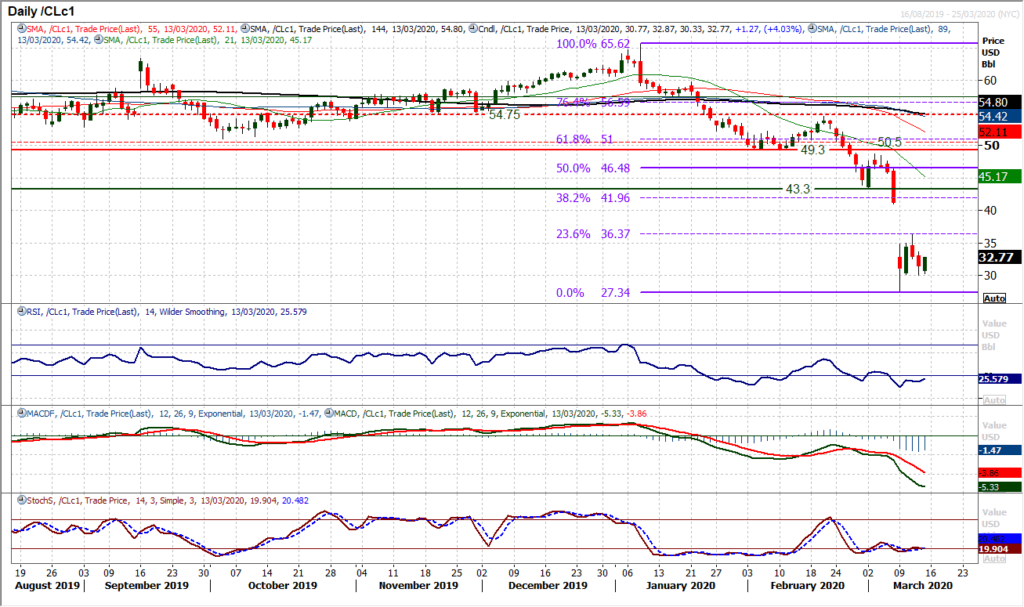

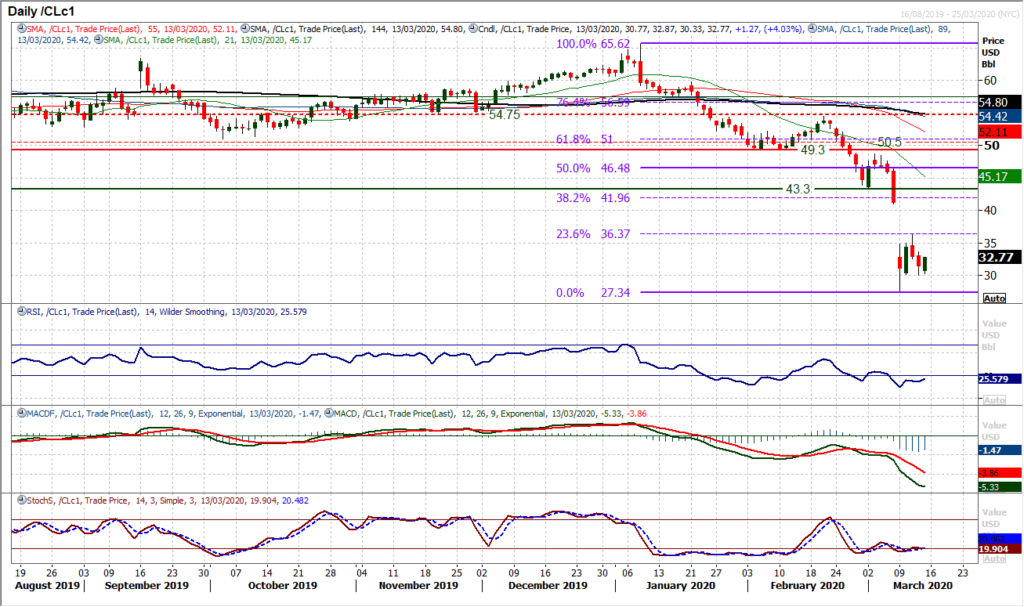

WTI Oil

Given the context of Monday’s oil plunge and the fires that were raging elsewhere across major markets yesterday, a -4.5% decline on WTI was a relatively restrained session. How traders respond today will be key though. It was interesting to see WTI rebounding off $30.00 and a move higher early today suggests that there is an element of settling down of the selling pressure now. However, it is not a good time to be long risk right now, and as such we see rallies on oil fading. A move above initial resistance at $33.75 would begin to shift this sentiment. We still need daily Stochastics and RSI both above 35 (at least) to suggest recovery is building. Until then, we remain broadly negative on oil. Below $30.00 si the key low at $27.35.

Dow Jones Industrial Average

With eye-watering levels of volatility, the bears are absolutely mauling any buyers on the Dow. With a -10% decline on the day, the Dow closed -28% down from its all-time high from exactly one month ago. Technicals do very little in this market, only to say that there is an extremely negative momentum position and that any hint of rally just gets pounced upon by the sellers once more. Yesterday’s intraday rebound after the Fed announced its funding operations, reversed to leave resistance now at 22,838. US futures are higher again this morning, and we can expect another hugely volatilie session. Another massive gap is left gapingly open at 23,328 but once more, gap analysis is struggling in these market conditions. The latest massive support to be broken has left resistance at 21,712 initially. The next key low to come into focus is 20,380.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.