Risk-on profits into CPI

S&P 500 buyers stepped in relatively fast, yesterday already, confirming what I had written on Sunday in premium stocks analysis, quoting:

(…) 4,432 holding Friday isn‘t enough – the table was set up in a much better way. The crawl through 4,460s up to 4,490 would be tough, and much depends upon whether Monday brings further weakness or not. Volume though wasn‘t typical of a stark reversal, so I‘m looking for the buyers to come back within a couple of days latest.

Not only that bonds turned decidedly risk-on yesterday, but crucially market breadth and sectoral posture (at relative expense of tech, which I also told you about) including the speed with which gold downswing was rejected, provided more confirmatory clues as to the CPI positioning – the market expects disinflation to continue, and is willing to yet again front run Powell in its Fed pause bets, which I had covered at length for you in yesterday‘s video.

Additionally, this has allowed for some good calls in the Intraday Signals, where especially today‘s move is working well.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram - benefit and find out why I'm the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts – today‘s full scale article contains 4 of them.

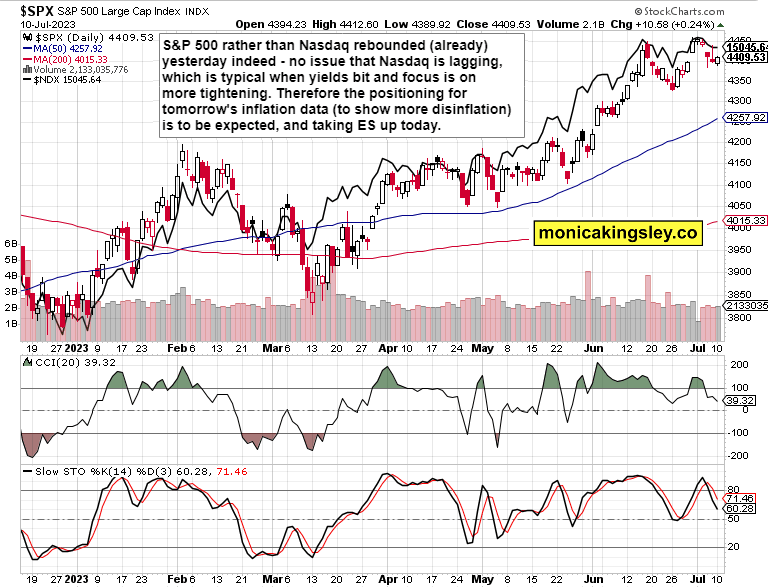

S&P 500 and Nasdaq outlook

4,432 held yesterday on a closing basis, and the table is set for upswing continuation, which is what the early European session intraday call counted with. 4,455 is to give way to 4,460s before the closing bell today, and tech would play catch up on yields calming down more (10y is back below 4%) while I don‘t see star non-tech runners such as industrials, energy, today including materials, and not standing in the way financials, to interfere with by declining really.

The spike into 4,490 / even 4,500 – 4,510s discussed in another video, is still very much possible, and I‘m not looking for CPI kneejerk reaction to sink this scenario. The ES bias for today is still bullish, following initial selling pressure in the opening hours.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.