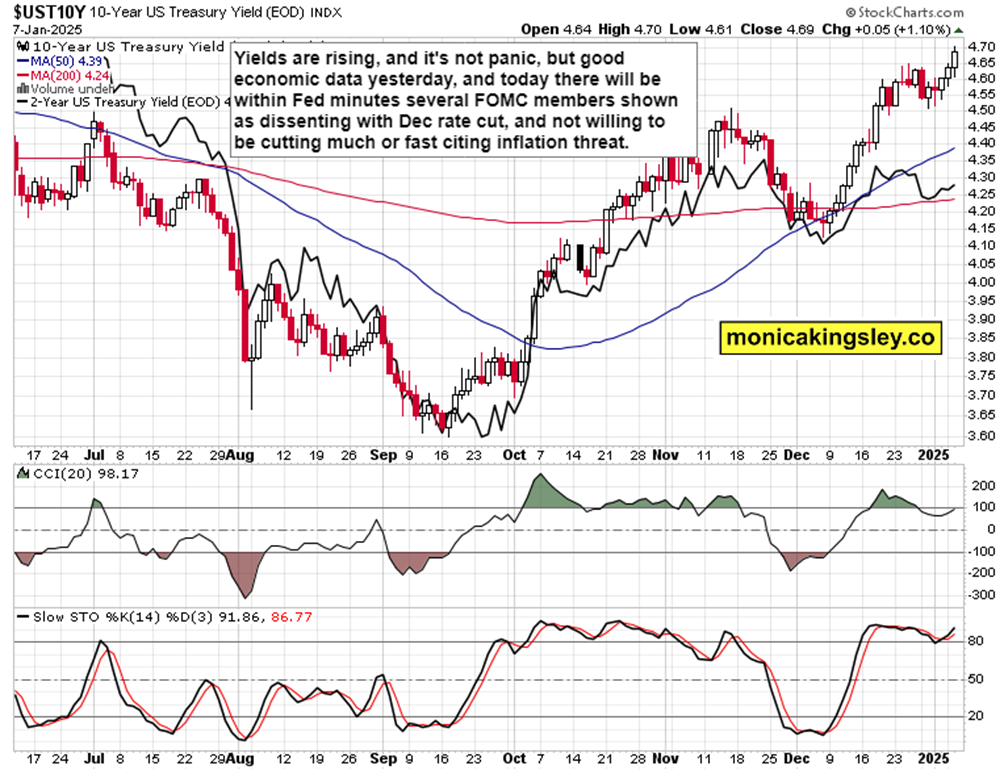

S&P 500 early session upswing was rejected, and neither 6,010 or low 5,990s stopped the sellers. It‘s that services PMI and JOLTs data were so good that they dialed back yet further rate cut or dovish Fed policy expectations (March).

All explained in this highly practical video – what were the macroeconomic and chart clues that allowed me to call for a dip on the data, check it out on Youtube and thanks for yet another great video reception.

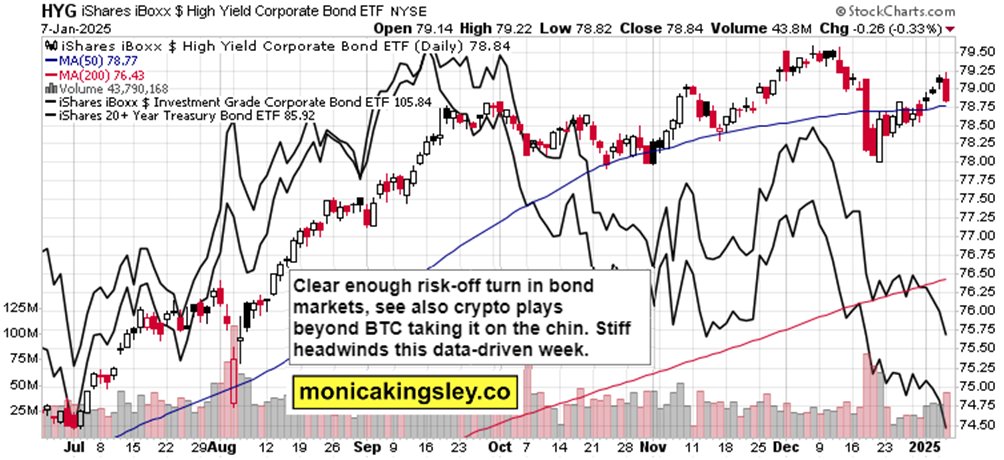

What‘s ahead today? ADP employment change (focus is on small companies, before the big figure arrives Friday), and one has to seriously ask (considering sharp NVDA reversal and crypto pressures while yields gapped up), who is ready to put fresh capital to work before Friday‘s NFPs and today‘s Fed minutes?

Pretty volatile session ahead, yet yesterday‘s price action in the power hour was rather clear as well, and today I already delivered some IWM short gains to fast intraday clients acting premarket..

Let‘s dive into the bond market charts for more insights – review today‘s stocks and gold video for extra preps preview.

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD holds losses near 1.0300 ahead of Eurozone Retail Sales data

EUR/USD trades with mild losses for the third consecutive day at around 1.0300 in the European session on Thursday. Encouraging German Industrial Production data for November fail to lift the Euro amid a sustained US Dollar demand. Eurozone Retail Sales and Fedspeak are next in focus.

GBP/USD flirts with nine-month lows near 1.2300

GBP/USD remains under pressure and sits at nine-month lows near 1.2300 in Thursday's European trading hours. The pair remains undermined by the extended US Dollar strength and a bearish daily technical setup ahead of speeches from BoE and Fed policymakers.

Gold price sticks to modest intraday losses amid bullish USD; downside seems limited

Gold price snaps a two-day winning to a multi-week top amid the Fed’s hawkish stance. Retreating US bond yields undermine the USD and lend some support to the XAU/USD pair. Traders look to Fed speakers for some impetus ahead of the US NFP report on Friday.

BNB poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.