The United States has seen a significant uptick in initial claims for unemployment, which has resulted in substantial effects on the Dollar Index and gold prices. For the week ending June 3, initial unemployment claims climbed to 261,000, marking an increase from the 233,000 claims from the preceding week. This surge represents the highest level since October 2021, thereby raising concerns among investors and policymakers alike.

In response to this rise in unemployment claims, the Dollar Index has started to decline from its resistance level. The economic logic behind this trend is the reduced pressure on the Federal Reserve to continue hiking interest rates due to increased unemployment claims. With fewer jobs available, there is less incentive for the central bank to keep inflation in check by increasing rates, leading to lower interest rate expectations. As these expectations soften, it causes a relative weakness in the dollar.

A breach of the Dollar Index’s support at 101 could serve as an ominous sign, warning of a strong decline. Such a decline would likely have multiple knock-on effects on the financial markets. Most prominently, this would lead to a bolstering of gold prices, an asset class often inversely correlated with the dollar.

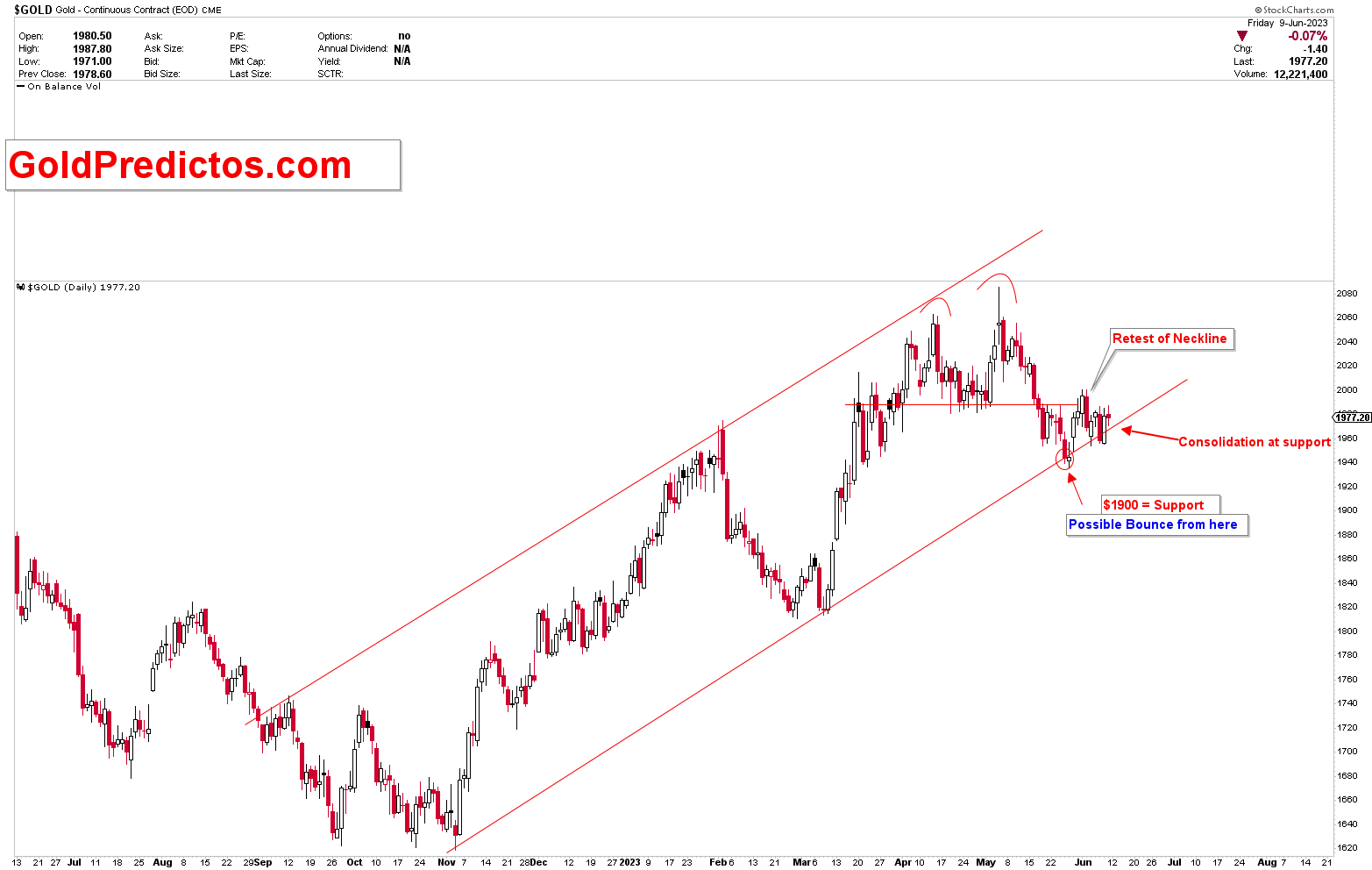

As the dollar weakens, gold prices start to bounce from a strong support region, and they have already begun to show signs of this anticipated behavior. Historically, gold has served as a safe haven for investors during times of economic uncertainty, which includes periods of dollar weakness. As investors anticipate a weaker dollar, gold starts to look increasingly attractive as an investment option. the gold chart below is taken from the previous article. The chart depicts the current situation in the gold market, which is bouncing from the strong support of the channel. Gold prices have found support in the $1900 to $1950 region and are beginning to rise from these low levels.

This shifting landscape presents an opportunity for investors to potentially capitalize on the situation. Buying the dips in the gold market, in anticipation of another shoot higher, could prove beneficial as the expected economic conditions unfold. However, investors should exercise due diligence and consider their risk tolerance before making any investment decisions.

Conclusion

In conclusion, the recent rise in unemployment claims has set off a cascade of events, leading to a weakening dollar and a strengthening of gold prices. This presents a compelling investment opportunity in the gold market for the cautious yet opportunistic investor. As always, the dynamics of the financial markets can shift rapidly, and what appears to be a sure thing today may change tomorrow. Therefore, it’s crucial for investors to stay informed and adaptable.

Articles/Trading signals/Newsletters distributed by GoldPredictors.com have no regard to the specific investment objectives, financial situation, or the particular needs of any visitor or subscriber. Any material distributed or published by GoldPredictors.com or its affiliates is solely for informational and educational purposes and is not to be construed as a solicitation or an offer to buy or sell any financial instrument, commodity, or related securities. Plan the strategy that is most suitable for your investment. No one knows tomorrow’s price or circumstance. The intention of the writer is only to mention his thoughts and ideas that may be used as a tool for the reader. Trading Options and futures have large potential rewards, but also large potential risks.

Recommended Content

Editors’ Picks

AUD/USD: The loss of 0.6700 could spark extra weakness

The selling pressure in the risk-linked universe gathered extra pace on the back of the firmer tone in the greenback, motivating AUD/USD to retreat for yet another session and challenge the key support around 0.6700.

EUR/USD: Next on the downside comes the 200-day SMA

EUR/USD partially reversed the recent two-day advance on Thursday, breaking below the key support at 1.0900 the figure amidst the increasing upside impetus in the US Dollar and the dovish hold by the ECB.

Gold approaches $2,450 as US Dollar corrects

Gold holds steady above $2,460 on Thursday after posting small losses on Wednesday. The rebound seen in the US Dollar amid risk aversion and the US Treasury bond yields' resilience, however, limits XAU/USD's upside in the American session.

Shiba Inu crushed by 5 trillion SHIB transfer, $230 million WazirX hack

Shiba Inu (SHIB), one of the largest meme coins in the crypto ecosystem suffered a steep correction early on Thursday, following a hack on an Indian crypto exchange. Data from on-chain intelligence tracker Arkham shows that WazirX exchange was exploited for over $102 million in SHIB tokens.

ECB review: A ‘wide open’ September meeting

Today, the ECB held its policy rates unchanged, as unanimously expected by markets and analysts. The central bank did not send any signals for the September decision, where it repeated its call for a data-dependent and meeting-by-meeting approach.