Rising SPY and shoring up treasuries

S&P 500 first rejected 5,240, and got through only on the opening bell buying in the runup to the Bessent speech. Stating the obvious about China tariff unsustainability, and without nay negotiations even having started, markets ran on the news, and didn‘t break back below 5,240 even when it became obvious no negotiations were underway.

India and Japan vibes couldn‘t outweight that caution, and didn‘t provide that much fuel for S&P 500 either. It was though Bessent China remarks and especially Trump turnaround after the close, newly not thinking about firing Powell and being benevolent on China tariffs, that was responsible for the gap as the announcement was made inti the thinniest volume circumstances possible. Hence it worked so great as a pump.

TSLA earnings didn‘t stand a chance – very low quarterly revenue, free cash-flow likewise, but the game goes through robotaxis and Optimus flood statements – the stock is up, mirroring trade deal progress news and calm with the Fed optimism.

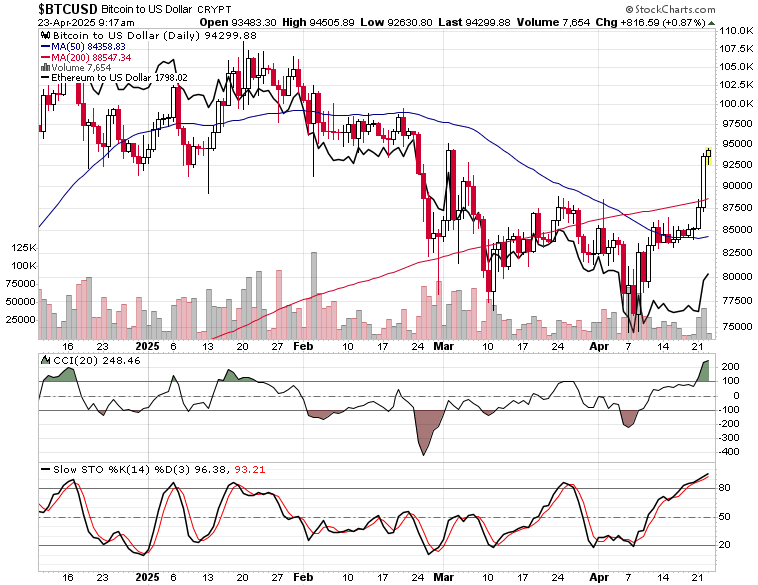

The other consequence that I warned Trading Signals clients about, was gold reversal to come soon, marking perhaps even >5% decline in a day – and gold did reverse to the downside, Treasuries firmed, and USD a bit rose as well – while Bitcoin followed on my bullish Saturday call, and made it to the $95K target after a few days.

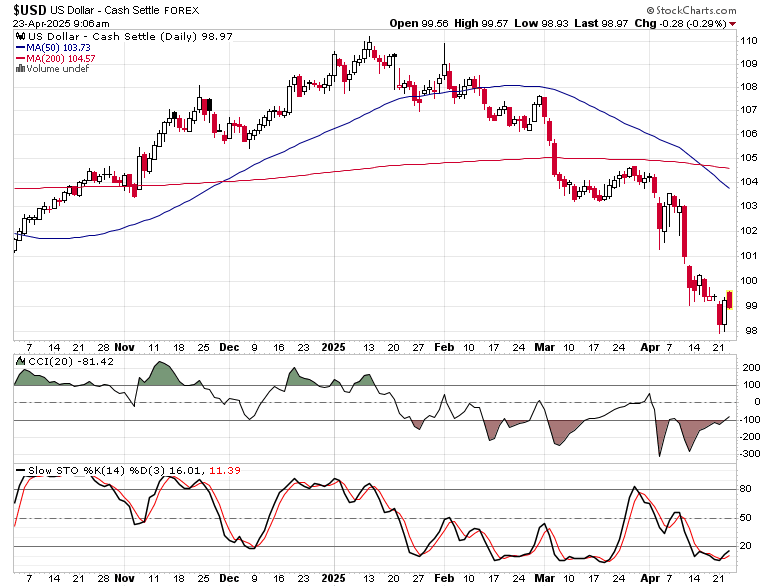

Today‘s extensive video discusses the key cross-asset turns, diving into upcoming Bessent appearance regarding financial system, liquidity and Treasuries – my expectations incl. SPX expectations. USD isn‘t acting at all convincing, so all eyes on whether Bessent lays the ground for more intervention to shore up Treasuries.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.