Rise in Czech headline and core inflation suggest a cautious policy stance

Headline and core inflation picked up in October, with the price dynamics in the service sector unbroken. We see an ambiguous situation, with the economy operating below its potential, while inflation remains above the target. There is space for further easing to support growth, but the path towards a more neutral rate will be paved with caution.

CPI accelerates for third month in a row

Czech annual inflation increased to 2.8% in October, coming in 0.2 percentage points higher than in the previous reading and matching market expectations. Consumer prices rose by 0.3% from the preceding month, with higher prices in the housing section being the main driver of the overall price increase. Prices of goods added 0.2% and prices of services 0.5% in monthly terms.

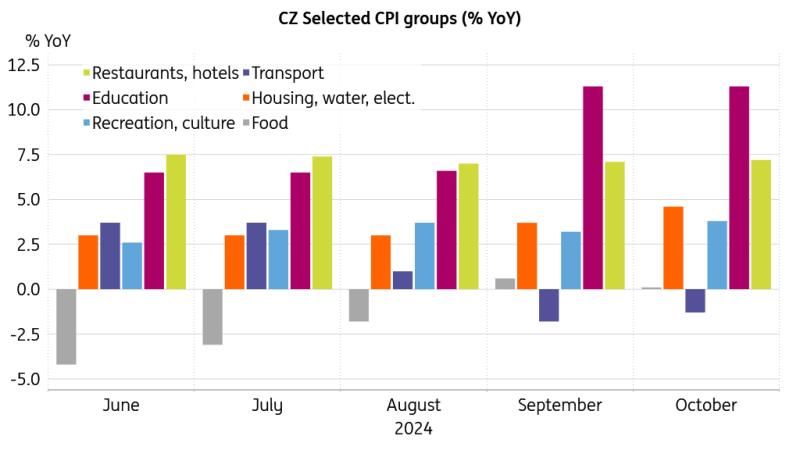

October’s consumer prices continued to accelerate in annual terms despite the overall dynamic being mitigated by declining fuel prices, which have been falling for three months in a row. The main contributors to the annual increase in October were prices in the housing section, where electricity prices were up 10.5%, rents rose by 6.2%, and water charges added 10.9%. In the food section, price tags were higher for butter by some 40.6% and for chocolate products by 14.4%. Substantial price increases in mandatory items such as food and housing will put pressure on household budgets, leaving less for discretionary spending. Prices of goods rose by 1.3% and prices of services by 5.3% from a year earlier, so the upward trend in services prices continues uninterrupted. Core inflation increased to 2.4% in October, reflecting the quickening annual price growth in non-tradable items.

Inflation flies above the target

Source: CZSO, Macrobond

The three consecutive months of accelerating headline CPI do not seem to be great news for policymakers, though it is in line with the Autumn Czech National Bank forecast. The continued robust price increases in segments such as food, housing, and services are likely to carry on, while the dampening effect of declining fuel prices is about to fade out early next year. The continued lofty price dynamics in the service sector will likely prompt caution in any further easing of monetary policy. The situation is ambiguous, with the economy operating below its potential and ready to receive some boost in the form of lower borrowing costs, while both headline and core inflation are set to remain above the target for quite some time.

Structurally higher inflation requires caution

Headline inflation was tempered by falling food prices up until August, and was dampened by a renewed decline in transportation from September onward due to a double-digit decline in fuel prices. However, food price growth has returned and is expected to gain traction, reflecting an observed increase in global agricultural commodities as well as the recent weakening of the domestic currency vis-à-vis the dollar. The decline in fuel prices is also assumed to moderate in the coming months, with Brent crude prices hovering around three-year lows while being subject to geopolitical tensions. Meanwhile, the other items of the consumer basket, such as rent, housing, and services, tend to be more persistent and will likely continue to propel consumer prices throughout the following year.

Price growth is still upbeat in sections with higher inertia

Source: CZSO, Macrobond

Overall inflation seems to be structurally higher, as it is forecasted to remain above target over the next year, while economic growth is only mediocre. With the economy operating below its potential, price pressures should be rather muted, which is not really the case. One plausible explanation is that a negative supply shock is suffocating the economy, so less output is produced for higher prices on the aggregate level. Helping the economy via lower borrowing costs would lift domestic growth performance but would also propel consumer prices. It might be challenging to estimate the magnitude of such a structurally-based supply shock and to navigate the rates path adequately.

Hard to disentangle Europe-wide and domestic growth nausea

The situation is complicated due to the fact that such a negative supply shock is Europe-wide and likely of a structural nature, so fighting it with domestic rate cuts might prove an uphill battle. We still see some room for further easing in monetary conditions, yet the broader economic situation in the context of European underperformance, non-existent productivity growth, and deteriorating potential for expansion will require more caution. We expect Czech inflation to peak at 3.4% in December and to remain above the inflation target over the coming year, though not abandoning the CNB tolerance band. Therefore, we see a December cutting cycle pause as the most likely outcome. Anyway, it will be a close call between the pause and another 25bp cut due to the sluggish recovery, with a 3.25% as a terminal rate to be reached by mid-next year.

Read the original analysis: Rise in Czech headline and core inflation suggest a cautious policy stance

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.